The Three Pillars

Authored by Sven Henrich via NorthmanTrader.com,

New bull market? No. Unproven. New lows to come or a retest? No. Unproven.

Markets are engaged in a key battle between the worst evolving fundamental picture in our lifetimes on the one hand, and the largest set of liquidity injections in history. A looming $3.7 trillion deficit, a Fed balance sheets on a path to $10 trillion, zero rates as far as the eye can see and even calls for negative rates in the US with no plan or vision to ever extract ourselves from this future growth sapping venture. Record deficits, record debt, record unemployment are not a recipe for organic growth. Far from it. But let’s chase record liquidity injections.

The footprints of these liquidity injections can be found in the distortions in asset prices versus the fundamentals.

And this is what this market right now is all about, the three pillars: Fundamentals, liquidity and technicals.

Last week we saw a correction off of the key monthly 2oMA pivot (Just One Chart), this rejection produced a 170 handle correction on $ES, then more liquidity announcements on the side of the Fed on Thursday evening, and a new stimulus package by Congress to the tune of nearly half a trillion dollars and the correction was again saved, but has so far produced lower highs.

This is what it takes. Ever more intervention. But hopes for a structural quick recovery are misplaced. Recovery yes, but back to where we were? Hardly.

For a run down on the macro picture I encourage you to watch these two interviews belie if you haven’t seen them:

Firstly, my own take on things on the macro view via ABC in Australia this week:

Laugh with me at my buzzcut, cry with me at the reality of the situation we’re all confronted with.

Good conversation with @ElysseMorgan, thanks for having me on!

Full interview from this morning:https://t.co/YiJFyhkdfO

— Sven Henrich (@NorthmanTrader) April 22, 2020

And second, this take from Mohammed El-Erian on the cognitive failure that is taking place in markets right now:

Listen closely. @elerianm gets it and he is on it. https://t.co/KoqABYnP0U

— Sven Henrich (@NorthmanTrader) April 23, 2020

The liquidity injections can’t fix the economy, all they can do it goose asset prices above their fundamental worth.

Next week will be an important week in markets: A key new Fed meeting next week, what will they think of now? And of course we have month end with motivation to perhaps mark up stocks right in front of Sell in May? In addition, the big 5 mega cap tech stocks that have carried this entire market on the way up last year (and are again doing so now) will report earnings and speak to outlooks.

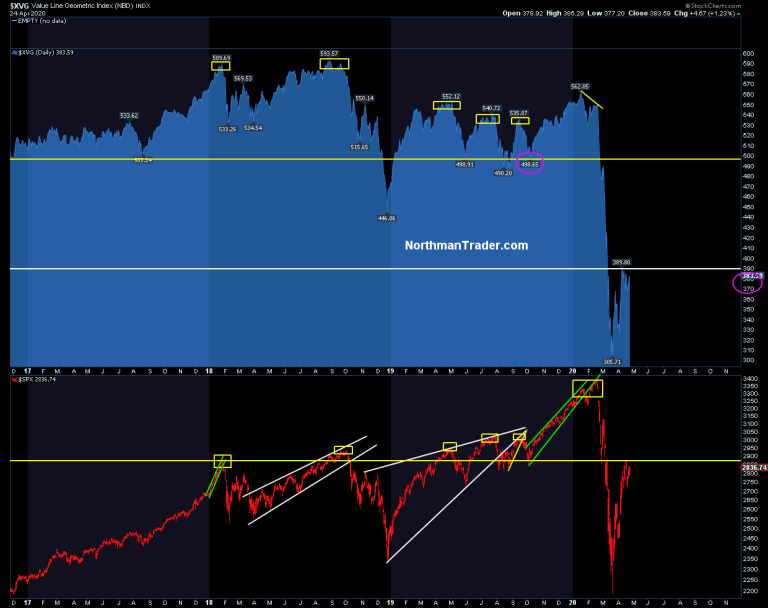

Be clear without these 5 stocks the entire index picture would look far worse than it now appears:

Be the massive divergence in equal weight vis-à-vis $SPX:

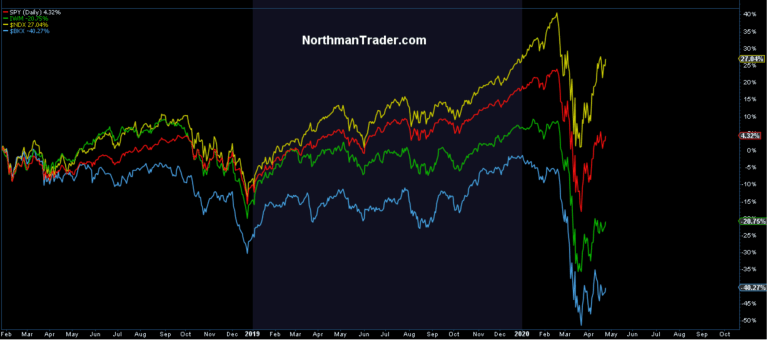

Or be it relative index performance (since the January 2018 highs):

The largest liquidity injections in history and 5 stocks only are masking the extent of the damage inflicted on markets. The bull market remains unproven. Bulls need to prove their case by getting above key resistance levels and then defend these areas as support. Without capturing these levels this rally here looks to follow the historic script of a bear market counter rally.

For the levels and this week’s macro and technical assessment please see the video below:

Please be sure to watch it in HD for clarity. To get notified of future videos feel free to subscribe to our YouTube Channel.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Tyler Durden

Sun, 04/26/2020 – 12:35

via ZeroHedge News https://ift.tt/3cNALL5 Tyler Durden