Hedge Fund CIO: “The Oil Price Is A Rare Indicator Of What Is Still Real In This Market”

Authored by Eric Peters, CIO Of One River Asset Management, via LinkedIn.

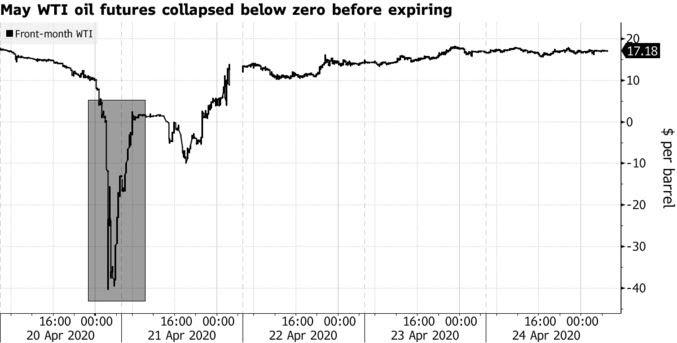

Crude utterly collapsed. 300% in a single trading day. Sellers paid $37.63 to buyers.

Everyone acted shocked, but no one really cared. Not even Powell, who has developed a falling-knife fetish but didn’t lift a finger to catch that one.

Jay gets it. Oil is real. Unlike stocks and bonds, he’d have to store the stuff. So until producers cap the wells, or light up their neighbors fields like Saddam, the price will keep falling until we start driving.

And besides, the Fed and Treasury believe it’s not commodity prices that need support, it’s drillers, frackers, and investors who lent them so much. The refiners need help. The guys who bought their bonds. Airlines that bought back their stock. Car companies too. Boeing. And on, and on. So they bailed out all the really big companies.

In the end, risks their investors took were not risks at all, only rewards.

Absorbing a financial asset glut is easy for a committed central bank. They credit a column, change a ledger, hit a button, hire the Blackrock boys. Add a server, maybe two. That’s the Fed’s storage cost.

Which leaves the oil price as a rare indicator of what’s real. Unemployment claims are real too. They’ve jumped 26mm in the two months since stocks hit all-time highs.

The CBO forecast America’s already extraordinary federal deficit will quadruple to $3.7trln. Q2 GDP will shrink 40% (-5.6% for 2020). They expect unemployment to peak at 16%, but we know it’s already higher than that, so their other forecasts are low too.

That’s real. People are real. You can’t house 26mm unemployed folks in servers.

The United Nations says 265mm face acute food shortages, you can’t feed them with a ledger. Will the real world rebound to meet the paper asset prices artificially set by the Fed and Treasury?

Or has the relationship between paper assets and reality been permanently severed? And if that is so, then what will be the price we pay?

* * *

By targeting asset prices instead of bread lines, we run the risk that in our attempt to prevent another Great Depression, we amplify the inequality that left the hill so unstable to begin with. And this raises the greatest risk of all. You see, today’s politicians, policy makers and investors have only experienced mass hysterias of the wildly optimist type. But in the ebb and flow of history, there are mass hysterias of exactly the opposite sort too. The Great Depression was one.

Tyler Durden

Sun, 04/26/2020 – 17:35

via ZeroHedge News https://ift.tt/3bHhD1g Tyler Durden