Here’s Why The Machines Went On A Buying Spree Yesterday As The US Entered A Recession

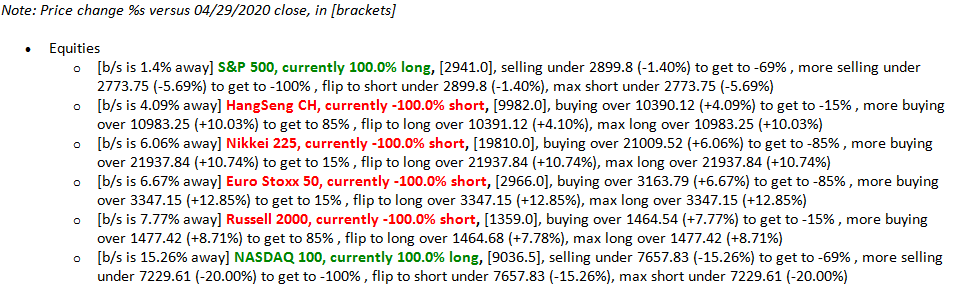

On Tuesday, with stocks already solidly in positive gamma territory – meaning any incremental gains would force dealers to buy even more stocks in a the now infamous gamma feedback loop – we reported that according to Nomura calculations a close in the S&P futs above 2901 would trigger a flip in CTAs from “-69% Short” to a “+100% Long”, with Nomura’s Charlie McElligott not accidentally adding “that anecdotally on these days where the model indicates a “flip” potential, said buying to cover and go long is likely already part of the flow creating the current move (ES1 +1.2%)”

One day later, that’s precisely what happened, because even as yesterday’s dismal GDP print confirmed the US has now entered a recession – the CTA “flip” threshold serving as the bogey for all momentum-chasers to ramp the “pain trade” rally which has seen virtually no hedge fund participation, even higher and the S&P had no problem spiking to new post-crisis highs, just shy of 3,000 in the S&P.

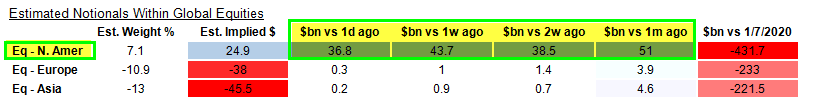

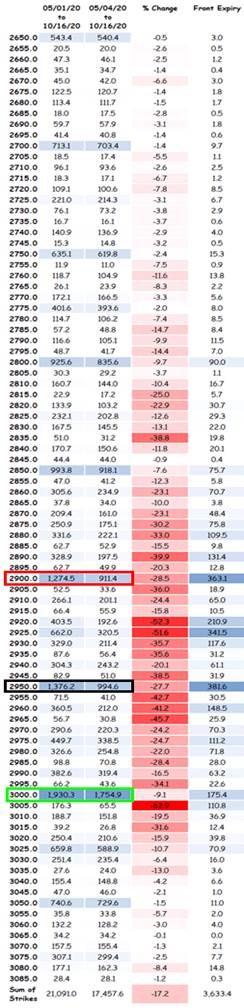

Commenting on this reversal, McElligott today writes that his CTA model’s S&P futures position flipped yesterday, from the recent “-69% Short” signal to the current “+100% Long,” they bought a total of $36.8BN across Emini futures yesterday.

And as stocks seek to recapture 3,000 and the Nasdaq unchanged for the year, McElligott points out that the “buy to cover” triggers are getting closer across various other Global Equities futures legacy “short” positions as well, and worth keeping track of (still “-100% Short” in HSCEI, Nikkei, Estoxx & RTY):

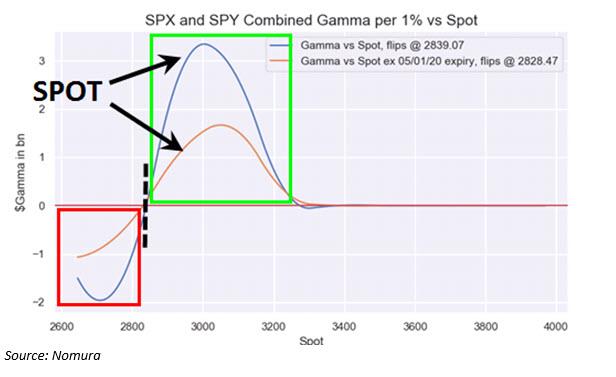

Meanwhile, as pointed out previously, the higher the market rose – start of the recession notwithstanding – the greater the gamma push, and as we have recently seen the aggregate SPX/SPY dealer positioning flip from what had been “short gamma” to then a “neutral gamma” one and now increasingly outright “long gamma” (approaching overwriter strikes), Nomura “sees the benefits of “vol suppressing” dealer hedging behavior with these grinding, less spastic market moves, while the largest Gamma strikes shift higher on the move, with the biggest gamma strike now at the nice, round 3,000.

Incidentally, despite today’s modest drop in stocks, we are still deep in positive gamma territory…

… so don’t be surprised to see another forceful levitation higher, further infuriating purist investors who still care about such market trivia as fundamentals. Here is McElligott explaining in his own unique way why fundamentals are meaningless when one has technicals:

US Equities continue to sit near 2 month highs, to the shock of many who “fundamentally” remain focused on the obviously horrific economic ramifications of the COVID19 shutdown…but without an appreciation of the ability within the Equities market to “pull forward” future inflections, on top of client positioning dynamics, vol dealer positioning / hedging realities and the “sling-shot” that is a market structure built-upon “negative gamma” which creates this seemingly rolling “Crash DOWN, then Crash UP” cycle.

Effectively, in a “VaR” risk management world where volatility is the exposure toggle—the implications of vol resetting LOWER (following a “macro shock” spike) then has a tendency to contribute to sling-shot HIGHER in spot Equities, as vol control & target volatility strategies mechanically need to re-leverage risk exposures, while “expensive vol” / inverted VIX term-structure, per the back-testing model-driven systematic community, signals an “all-clear” to load back into “short vol” behavior…all of which feeds into the risk virtuous cycle

It is precisely this “slingshot” risk we discussed on Tuesday when we said to expect a “Violent “Slingshot” Higher” if “CTAs Flip From -69% Short To +100% Long On Close Above 2901.”

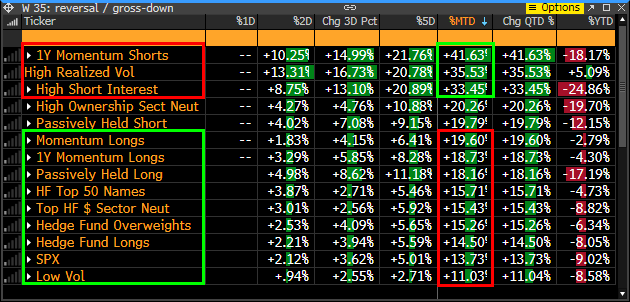

There is another reason for the relentless grind higher in stocks, which is completely disconnected from fundamentals: the continued massive short squeeze which as we discussed earlier this week has been the most furious on record:

“Peak pessimism” in late March (selling into cash, slashing net length exposure, grossing-up of shorts, dynamic hedging in futs / downside in index and ETF options/ upside in VIX futs), historic “Momentum Unwind” seasonality in April, unprecedented CB asset purchases & liquidity on top of government fiscal stimulus, and the tendency for “reflation” sensitives to outperform “as the recession hits” have all created a brutal backdrop for said “shorts” to explode to the upside—all despite being economically sensitive plays into a crashing economy

Tyler Durden

Thu, 04/30/2020 – 10:50

via ZeroHedge News https://ift.tt/3bMOGB0 Tyler Durden