Here Is The One Indicator That Convinced BofA Another Market Crash Is Coming

Picking up on a warning it first issued three weeks ago, Bank of America’s derivatives group doubles down this week, cautioning again that “history suggests it would be highly unlikely for the S&P not to re-test its Mar-23rd lows given both the size of its recent drawdown (-34%) and the fact a recession is underway.”

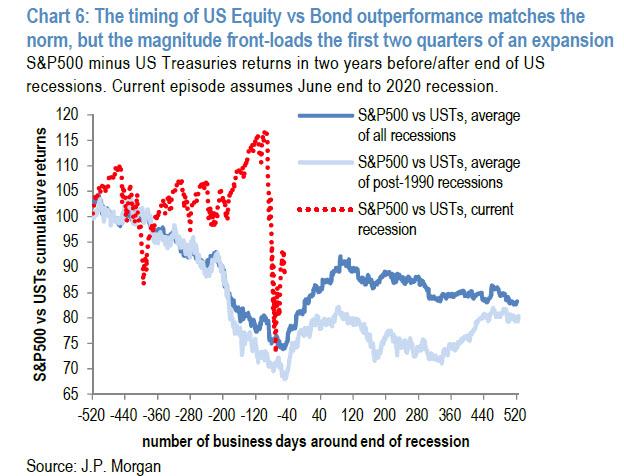

However, the speed of the recent bear rally on the back of record and rapid policy stimulus, shown in the chart below…

… has some wondering if this time is different?

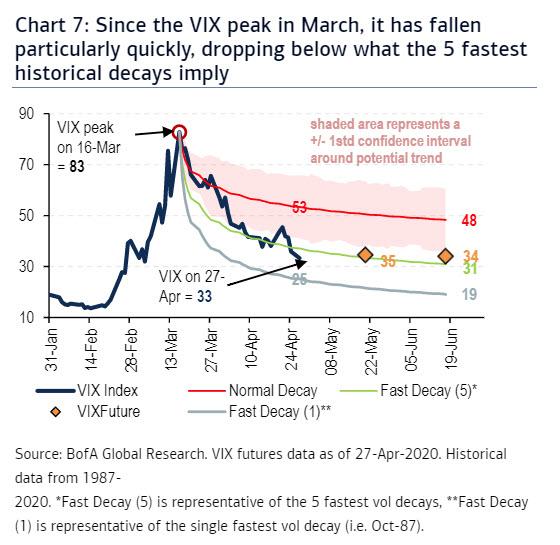

Meanwhile, the flip side of the fast market rally is the rapid collapse in the VIX, and as BofA’s Benjamin Bowler again points out, since the VIX peaked and the S&P bottomed in mid-March, VIX has been falling at among its fastest pace in history, dropping this Monday (27-Apr) below what the 5 fastest decays in history would suggest.

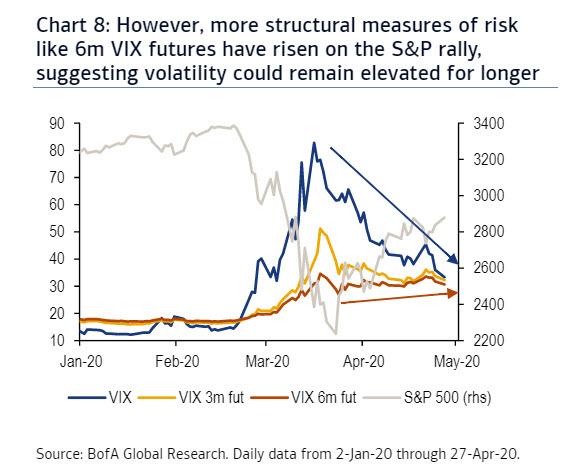

However, and as Hugh Hendry picked up in his latest twitter thread, VIX isn’t the full story as longer-dated vols (e.g. 6m VIX futures) have actually been rising, not falling, during the rally which to BofA means that volatility could continue to remain elevated for longer and suggests markets are indicating increasing systemic risk.

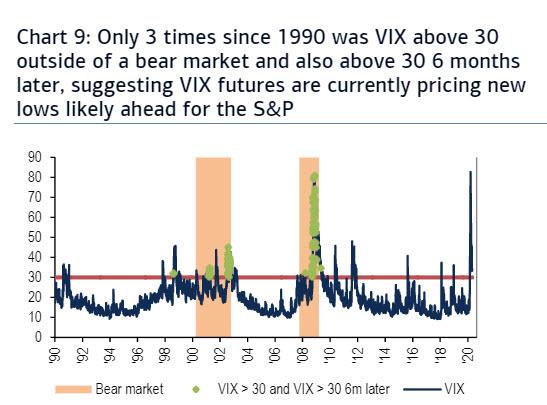

Both spot VIX and 6m VIX futures trading above 30 offer clues about what derivatives markets expect the S&P’s path to be in the medium term. Of all instances since 1990 in which VIX was above 30, there were 105 days in which VIX also closed above 30 6m later. Strikingly, only 3 of those days (twice in 1998 and once in May-2009) happened outside of bear markets, i.e., only 3 times was VIX above 30 outside of a bear market and also above 30 6 months later. Additionally, vols on markets less directly supported by the Fed (like commodities) have also been rising, “indicating deepening recessionary risks that history shows equities are unlikely to escape.”

As Bowler ominously concludes, “assuming VIX futures markets are pricing in this fact, the 6th VIX future trading above 30 suggests the expectation is that the bear market is likely not over.”

And just in case that wasn’t explicit enough, the position from BofA’s derivatives team – which clearly differs from the Bank of America’s far more cheerful and bullish “house view”, is that “US equities are in a bear market rally and that they are likely to retest the lows before a full recovery, a view supported by strong historical evidence.”

Tyler Durden

Thu, 04/30/2020 – 13:26

via ZeroHedge News https://ift.tt/3fg3Dhg Tyler Durden