Boeing Debt Explodes After Sale Of $25BN In Massively Oversubscribed, Junk-Like Bonds

Who could have known that instead of asking for taxpayer bailouts, all Boeing – whose market cap is now far below that of Tesla – had to do to replenish much needed liquidity, was to come to the Fed-backstopped bond market.

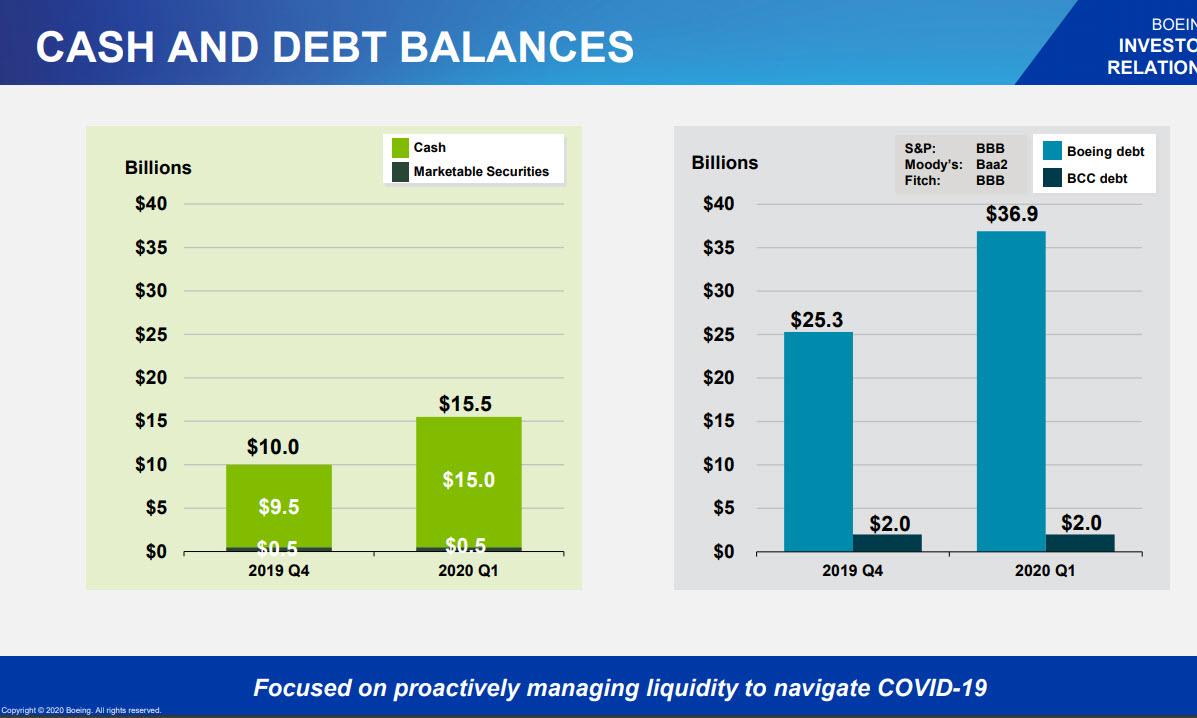

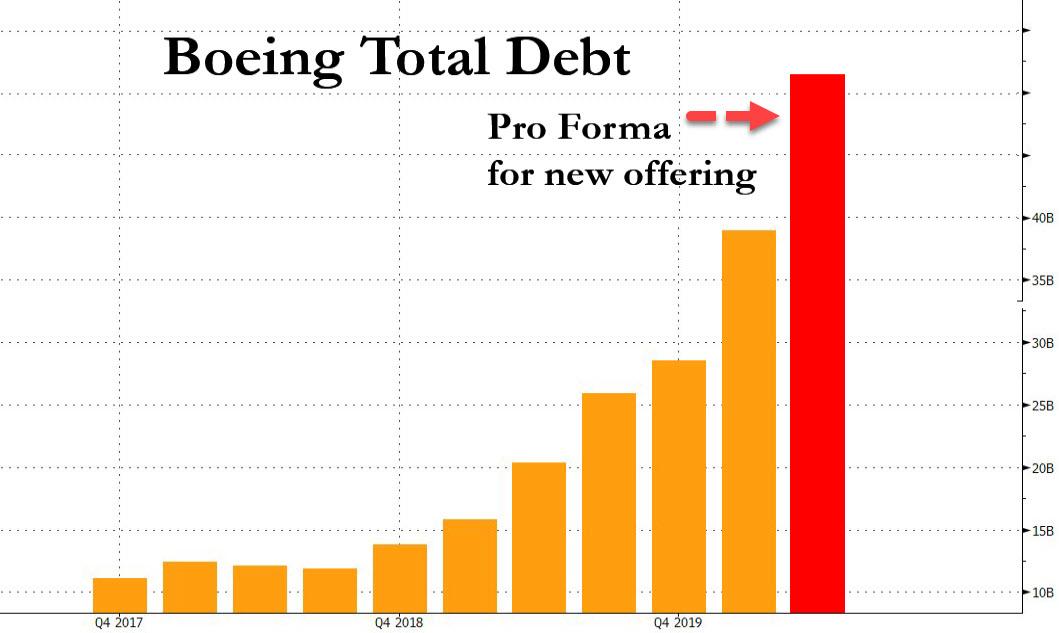

One day after S&P downgraded Boeing to just one notch above junk, or BBB-, as a result of the company’s massive debt load which was a record $38.9 billion as of the end of Q1…

… the Baa2/BBB- company added another $25 billion in debt to its balance sheet, effectively assuring that it will be downgraded to junk in the coming months. But what is fascinating is how easy it was for the soon-to-be fallen angel to issue the debt.

According to Reuters, Boeing approached the market targeting a $10BN in new debt. However, after a brief but successful roadshow, Bloomberg reported that the company had received $70BN in orders for its offering. The massive, 5x oversubscribtion meant that the company could upsize the offering at will, and what was originally a $10BN bond sale ended up being $25BN – the largest offering this year – across seven tranches, with initial price talk as follows:

- 3yr T+425bp

- 5yr T+450bp

- 7yr T+450bp

- 10yr T+450bp

- 20yr T+440bp

- 30yr T+450bp

- 40yr T+462.5bp

Those initial risk premiums are more in line with junk-rated companies, and will “get the greed juices flowing,” said David Knutson, head of credit research for the Americas at Schroder Investment Management.

According to Bloomberg, Boeing is betting its balance sheet strength and access to capital will see it through the current crisis. Chief Financial Officer Greg Smith told investors in reporting earnings Wednesday the company is committed to maintaining investment-grade ratings, but ultimately that’s up to the market to decide.

Ironically, as we reported last night, S&P cut the company to one level above junk with a stable outlook precisely because of its massive debt load. Fitch rates the new bonds BBB, though the rater doesn’t expect global aviation markets to return to 2019 levels until 2022, and in some cases 2023, analysts Craig Fraser and Nicholas Varone said in a report Thursday. Boeing should be able to rebuild its credit metrics to levels consistent with the BBB rating within the next two years, they said. Then again, one wonders just how an exponential debt increase is “consistent with a BBB rating.”

Boeing had already fully drawn on a nearly $14 billion term loan which it needed to fund its operations at a time when the entire ec0onomy had virtually shut down, and Thursday’s bond sale will add even more cash as the company received $70 billion of orders at the peak, according to a Bloomberg source.

Boeing burned through a record $4.7 billion of cash in Q1, which could quadruple by year-end and continue into 2021 as the pandemic and global recession sap demand for plane sales, Barclays analyst David Strauss said in a note to clients Thursday, not to mention the ongoing 737 MAX fiasco. Strauss estimates the company will need to raise $15 billion from the capital markets and U.S. government to navigate the severe market correction. Well, it has done all that and more just a few hours later.

Assuming roughly $24 BN in net proceeds, Boeing’s new cash balance will be $40BN. It will, however, also have a record $63BN in debt as shown below.

The extra liquidity will provide “solid upside” to Boeing’s stock, Bernstein analysts led by Douglas Harned said in a report Thursday. Creditors however were less amused at the surge in leverage, and its existing bonds traded lower, with debt maturing in 2050 and 2059 quoted at less than 80 cents on the dollar.

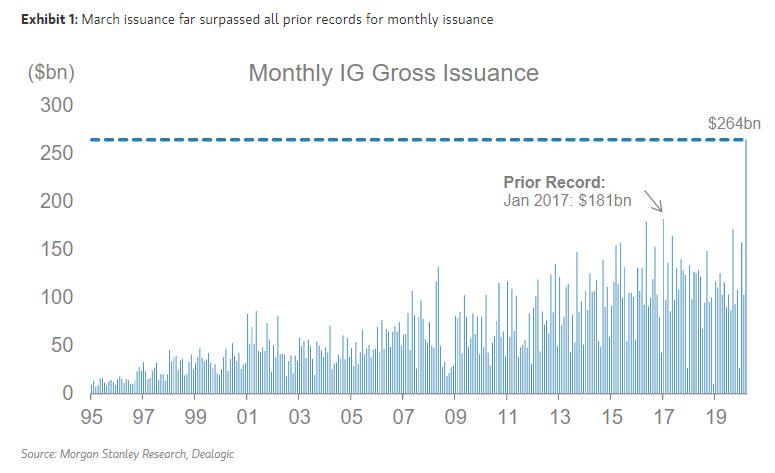

None of this mattered to new bond investors however, who assumed that the Fed will backstop Boeing’s debt – after all it was IG at time of issuance, and nothing else matters.

“It is almost paradoxical that companies with little to no income or a very hazy outlook would have substantial access to capital markets,” Knutson said. “Despite the worst economic contraction in history, the debt markets are wide open.”

No David, it’s not paradoxical: now that the Fed has backstopped all investment grade debt, fundamentals no longer matter as we showed this weekend, when we showed just how much debt has been sold this month during an economic depression.

And yes, this time the Fed owns the bubble from top to bottom. In other words, if it was the Fed’s intention to make the current bond bubble much, much bigger, it has succeeded.

The good news is that creditors have made Boeing’s taxpayer bailout moot: after all, they can fund all the company’s needs, right, so no need for taxpayer money to be put on the line. When asked if Boeing no longer needed federal aid given the strong response to its bond offering, a Boeing spokesman declined to comment and referred to the earnings call commentary.

“We believe that government support will be critical to ensuring our industry’s access to liquidity,” Chief Executive Officer Dave Calhoun said, even as he knew his bond offering just one day later would be massively oversubscribed . “We continue to evaluate options in the capital markets as well as funding options from the U.S. Government via the U.S. Treasury and various Federal Reserve programs.”

Tyler Durden

Thu, 04/30/2020 – 14:04

via ZeroHedge News https://ift.tt/35k4Xed Tyler Durden