iPhone Sales Crash 77% In April, Hammered By COVID-19 Lockdowns

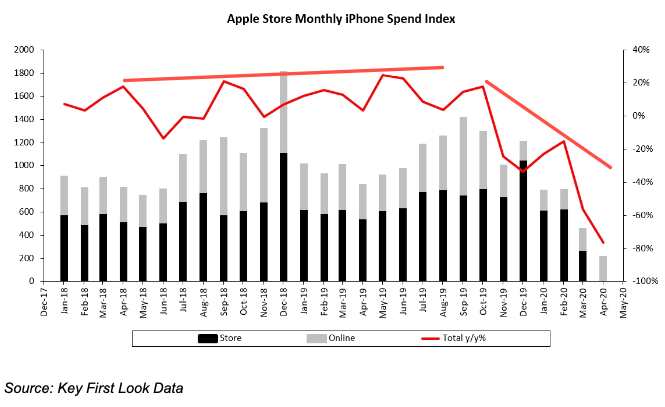

KeyBanc Capital Markets outlines in a new report, using internal credit card data, that Apple’s iPhone sales recorded a “sharp decline” in April as coronavirus-related shutdowns crimped consumer spending and kept many of the company’s brick and mortar stores closed.

The report says iPhone sales plunged 77% on a year-over-year basis in April and were down 56% over the previous month.

“Our Key First Look Data indicates a sharp decline in iPhone sales in April (-77% y/y, -56% m/m), which reflects the first full month that Apple brick-and-mortar stores were fully closed,” analyst John Vinh wrote.

Apple closed US retail stores on March 14, which contributed to a significant deterioration in iPhone sales through April. Shipments in the month declined 57% year-over-year basis and 37% on a month-over-month basis.

Vinh notes that “online sales did increase m/ m but were unable to offset store closures, so sales were still down y/y.” He said a “modest bump” in iPhone sales in 2H April was observed, likely the result of President Trump’s stimulus payments to the working poor, adding that iPhone sales in 2H April jumped by 14% compared to 1H April.

The KeyBanc analyst notes that consumers are shifting towards cheaper iPhone models over the month. This trend will likely persist as high unemployment, recession, and uncertainty plagues consumers.

KeyBanc’s data is based on anonymous spending data from 2 million KeyBank credit and debit cards, showed the slowdown in iPhone sales at stores and online began last summer and accelerated into early 1Q20. By the time the pandemic triggered lockdowns in March, sales at stores collapsed. It wasn’t until April when store sales plunged to zero with a slight increase in online sales, but as noted above, the offset is not enough to stem year-over-year losses in iPhone sales.

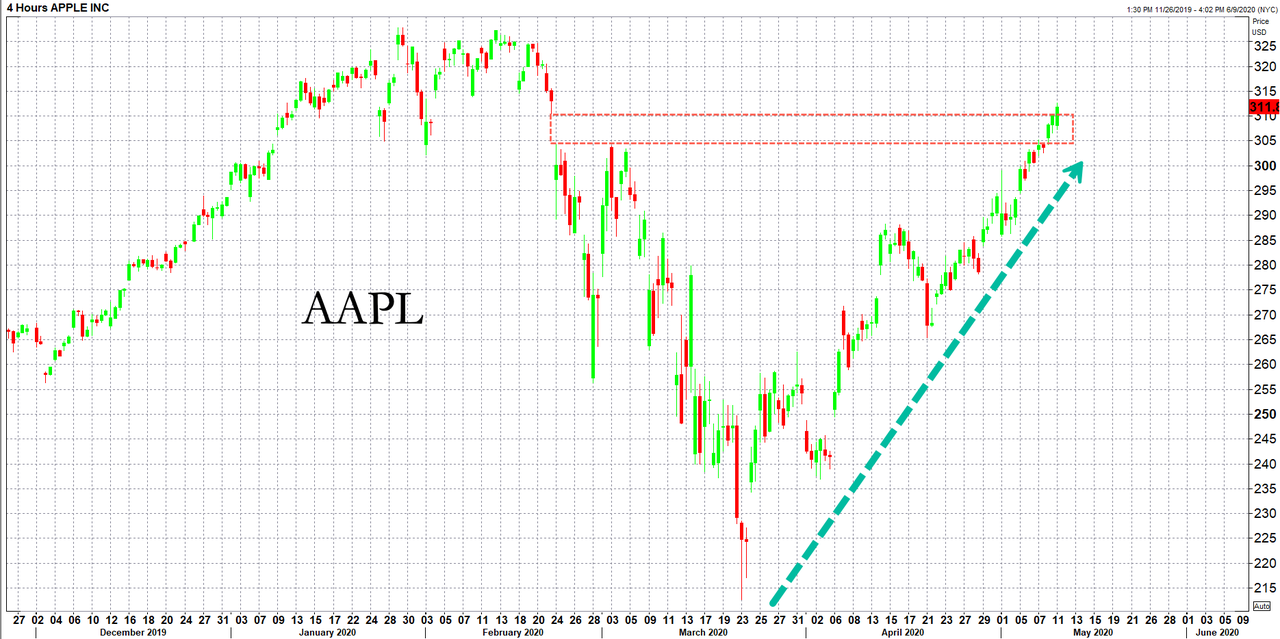

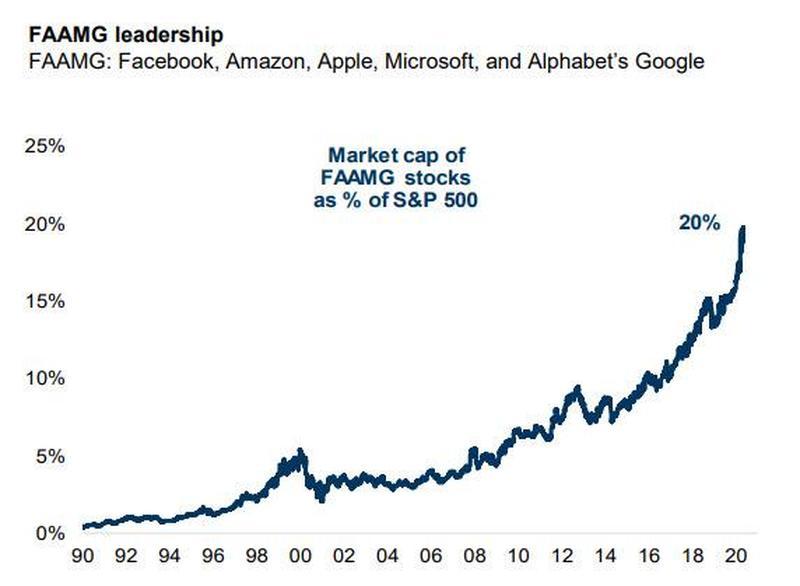

Apple investors have overlooked KeyBanc’s warning about plunging iPhone sales as Tim Cook continues to fuel debt-fuelled stock buybacks.

Despite souring fundamentals, Apple’s stock continues to rise. It was noted that the Swiss National Bank’s latest 13F, as of March 31, said it purchased $4.4 billion worth of Apple in the market rout last quarter. Possibly explains Apple’s share price levitation.

With tens of millions of Americans out of work and some might not be able to find jobs as the probabilities of a V-shaped recovery for the real economy in the back half of the year continues to wane — KeyBanc’s data is an eye-opener for a consumer that has been severely damaged and might not be able to afford expensive iPhones this year.

Tyler Durden

Mon, 05/11/2020 – 14:35

via ZeroHedge News https://ift.tt/3dMWOlR Tyler Durden