Buybacks Are Back: Here’s Who Is Repurchasing The Most Stocks

Tyler Durden

Sun, 05/31/2020 – 14:25

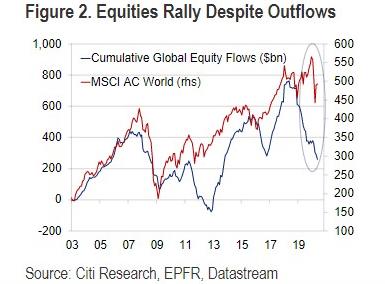

On Friday, Citi rekindled a mystery, or as we called it – a conundrum – that plagued markets for much of 2019: how was it possible that stocks have been rising (shaprly) even as outflows from equity funds have soared?

Citi’s explanation was simple: according to strategist Robert Buckland, the 31% global equity rally since March lows has probably been driven by short covering, given the $120b outflows the asset class suffered over the period.

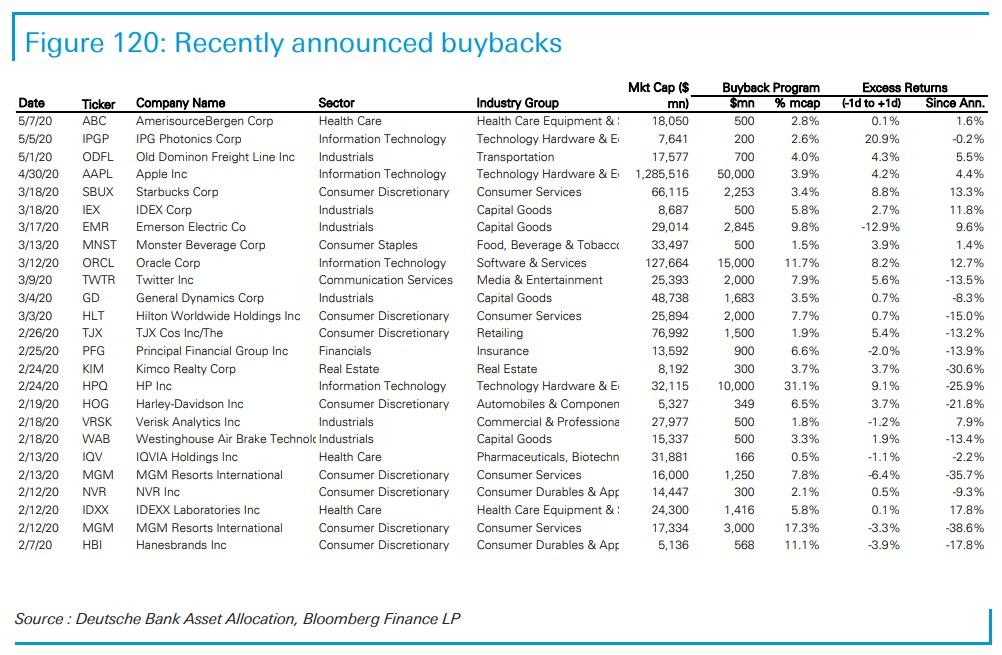

Perhaps too simple, because while one of the concerns in recent weeks has been that companies have tapered stock buybacks, that’s not exactly true as the following table of recent buyback announcements indicates.

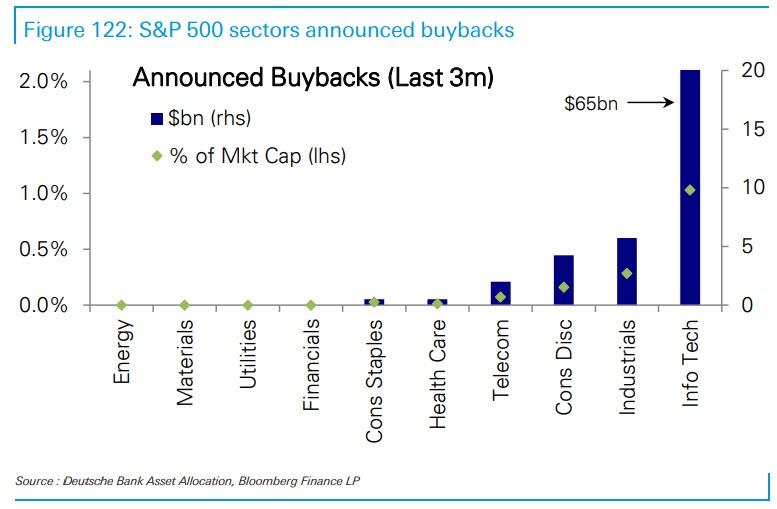

And while most sectors have indeed frozen buybacks, one group of companies stands out: we’ll let readers spot it.

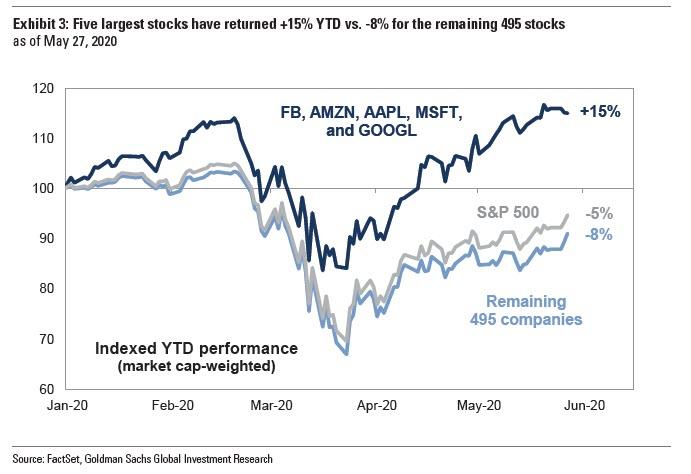

Which is why to Citi’s assumption that it is all short covering, we will just add that the $65 billion in tech buybacks did not hurt. Oh, and incidentally, it just may explain the dramatic divergence between tech and everyone else.

via ZeroHedge News https://ift.tt/2XF0lMg Tyler Durden