Here Are The Best And Worst Performing Assets In May And 2020

Tyler Durden

Mon, 06/01/2020 – 16:35

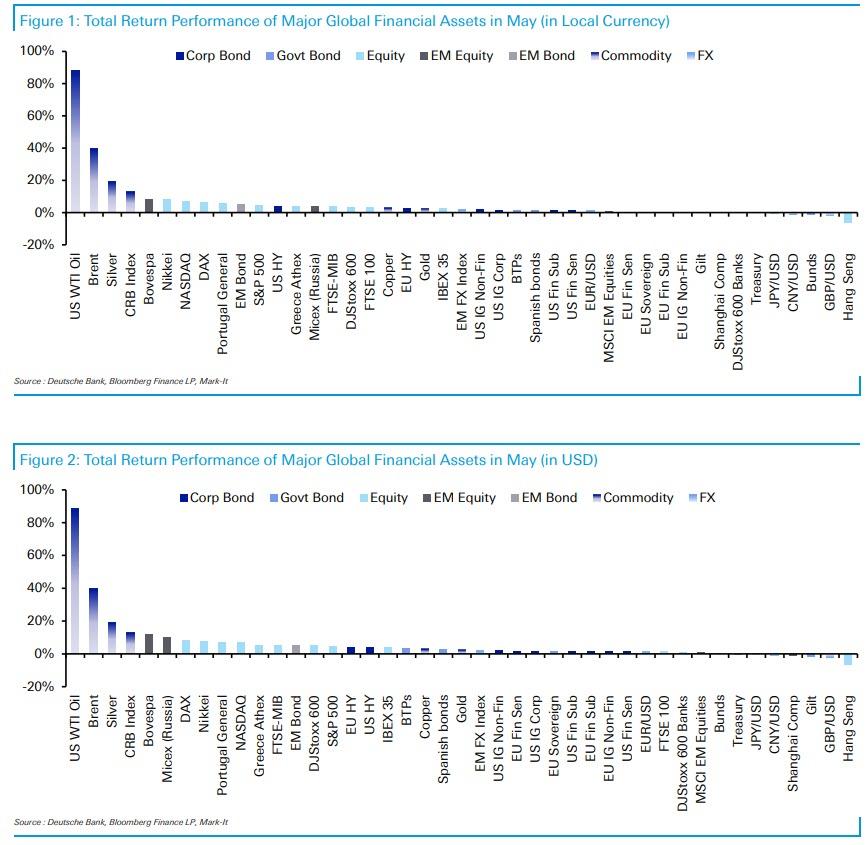

After a catastrophic March and an euphoric April, in May risk assets posted another strong performance, as the global growth rate of Covid-19 cases continued to slow, offering hope that the worst of the pandemic may have passed according to the monthly DB review of the best and worst performing assets of the prior month. Furthermore, as countries throughout the developed world moved to ease their lockdown restrictions, data showed that economic activity might be starting to gradually pick up again, which further helped to boost investor sentiment.

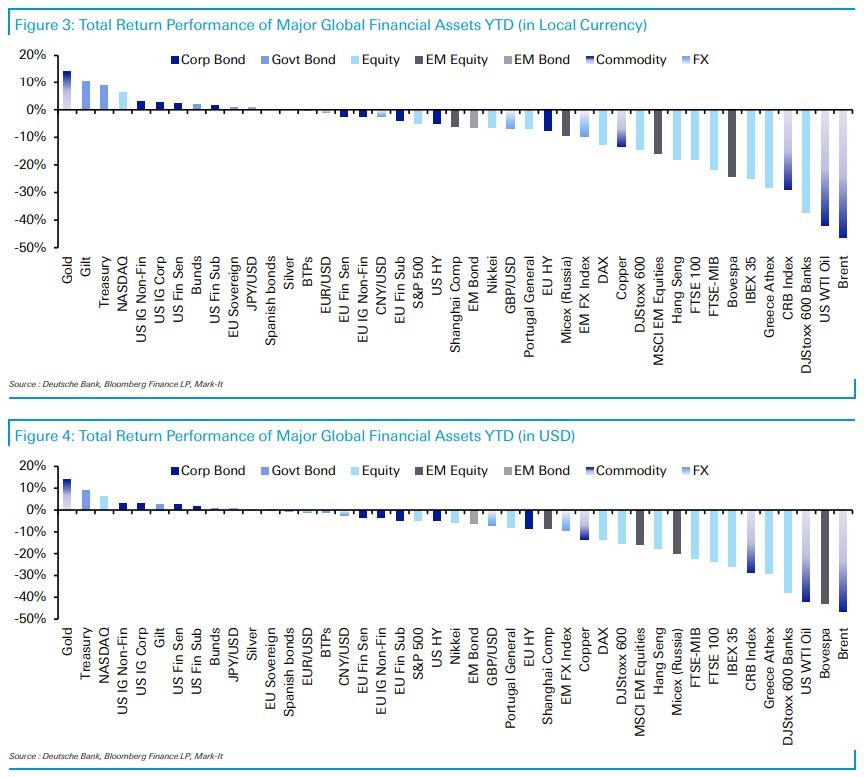

Looking at the overall sample of assets tracked by the German bank, a total of 33/38 of the noncurrency assets had a positive return over the month, meaning that 12/38 are now positive on a YTD basis too.

Oil was the big story once again in May, though it marked a reversal of fortunes for WTI as it gained +88.4% over the month, bringing an end to a run of 4 successive monthly declines. The moves came as global oil demand started to pick up again, thus moving WTI from the worst performer in the April sample to the best in May, even if this still leaves it down -41.9% on a YTD basis. Brent crude saw a similar move higher, though not as extreme, climbing +39.8% in May to leave it “only” -46.5% lower on a YTD basis.

Commodities more broadly had a good month as well: silver was one of the best performers in May, up +19.3% in its biggest move higher since April 2011. Meanwhile gold cemented its existing lead as the top YTD performer in our sample with a further +2.6% rise in May, which means it’s now up +14.0% on a YTD basis.

Equities for the most part had a strong performance, with the majority of indexes seeing solid increases in May. Brazil’s Bovespa led the way with a +8.6% increase, while the NASDAQ’s +6.9% move higher means the index is now solidly positive on a YTD basis. The worst performance overall was the Hang Seng, however, which fell -6.3% in May amidst further political unrest in Hong Kong.

In fixed income, sovereign bonds in southern Europe made gains as President Macron and Chancellor Merkel unveiled a proposal for a new EU recovery fund that was met positively by investors. BTPs and Spanish bonds were up +1.7% and +1.6% in May, outperforming bunds which fell -1.3%. Though the proposal would need to be decided unanimously among the EU member states, investors were cheered by the prospects of progress, and the spread of Italian and Spanish ten-year yields over bunds fell by -43bps and -30bps, respectively. Reflecting this renewed risk appetite in fixed income, US HY saw the strongest performance among our credit sample, with a +4.2% gain in May.

Finally in FX, the pound sterling was one of the worst performing currencies, falling -2.0% against the US dollar and -3.3% against the euro. It comes as little progress has been made in negotiations with the EU on the UK’s future relationship, and ahead of an important high-level meeting between the two sides taking place later this month. It also covers a month where negative rates were debated in the UK. Emerging markets were among the stronger FX performers however, with the EM FX index up +1.9%, paring back some of their YTD losses.

Here are the best and worst performing assets in May in local currency and USD terms…

… and here are the top and bottom assets of 2020 to date:

Source: Deutsche Bank’s Jim Reid

via ZeroHedge News https://ift.tt/3eK41DD Tyler Durden