Where In The Reopening Are We: Here Is The Real-Time State Of The US Economy

Tyler Durden

Mon, 06/22/2020 – 15:13

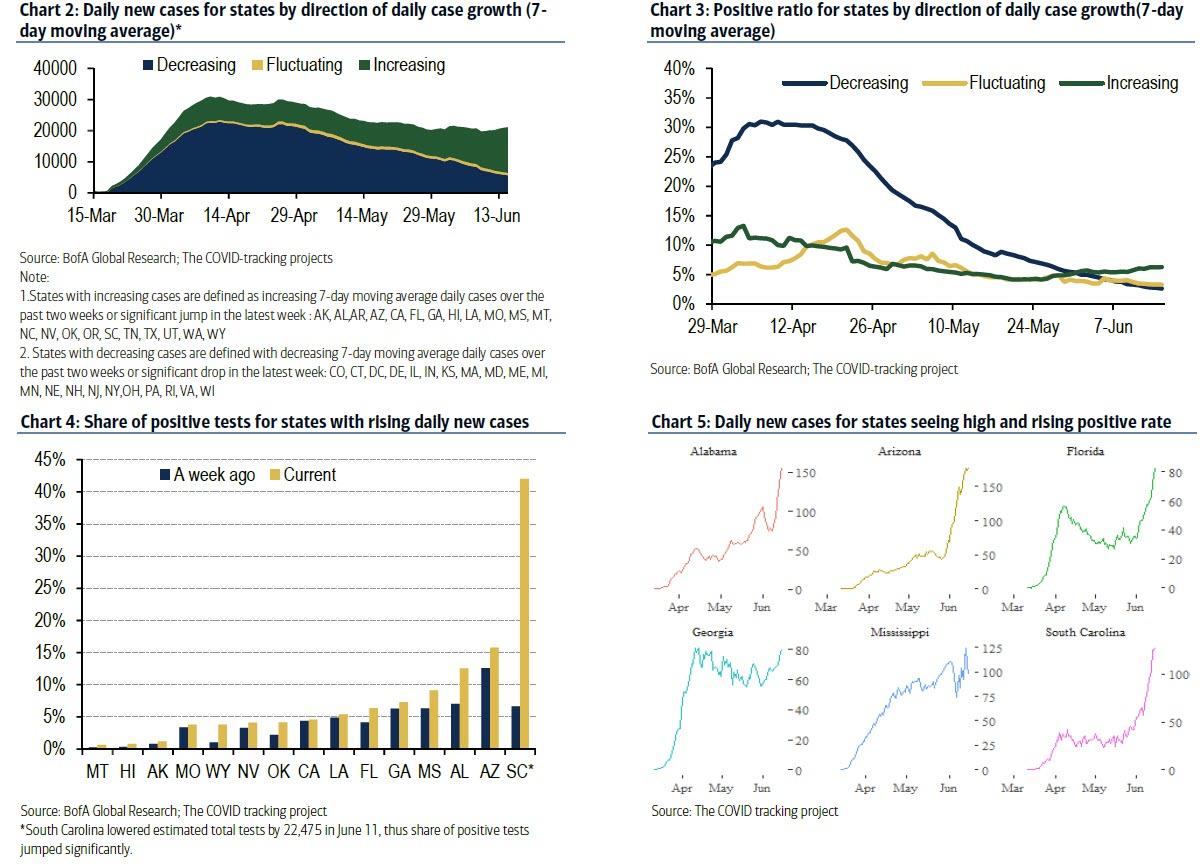

Even as certain US states face a growing number of virus cases and an increasing share of positive rates, stoking occasional concerns of a second wave…

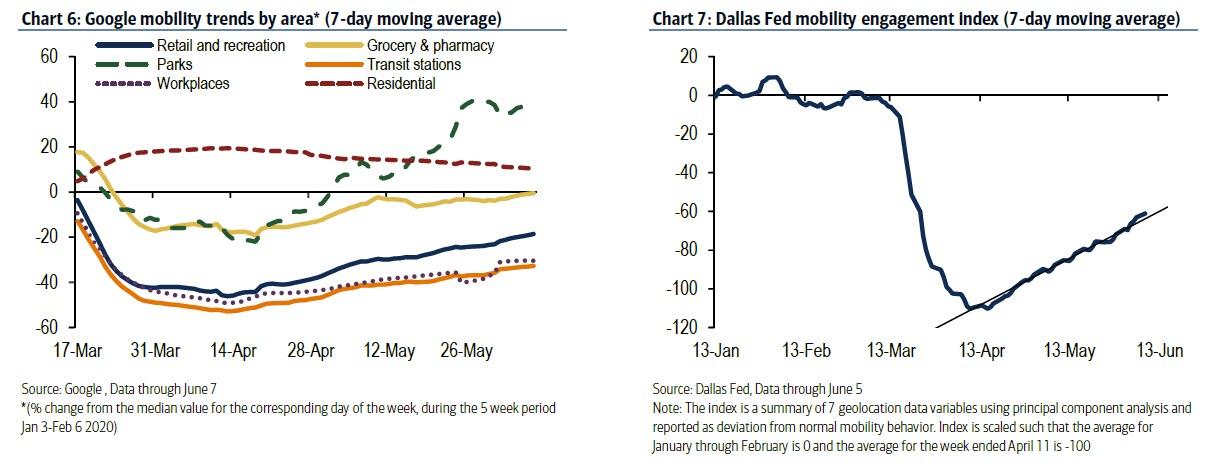

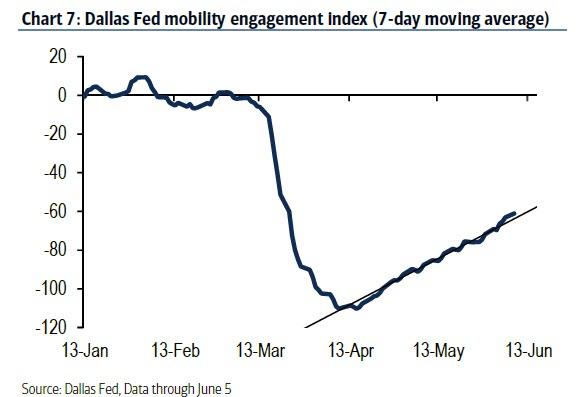

… steady progress toward reopening means that overall economic activity continues to return in aggregate. And, as BofA observes in its weekly covid activity tracker, measures of mobility from Google and the Dallas Fed have continued to improve…

… with data from Google showing increased visits to retail and recreation locations, and grocery and pharmacy stores.

Additionally, data from Homebase and the Census Bureau show that small business hiring has also continued to edge up, although the pace of improvement has slowed:

Moreover, demand for housing remains robust as purchase applications are running near the January peak

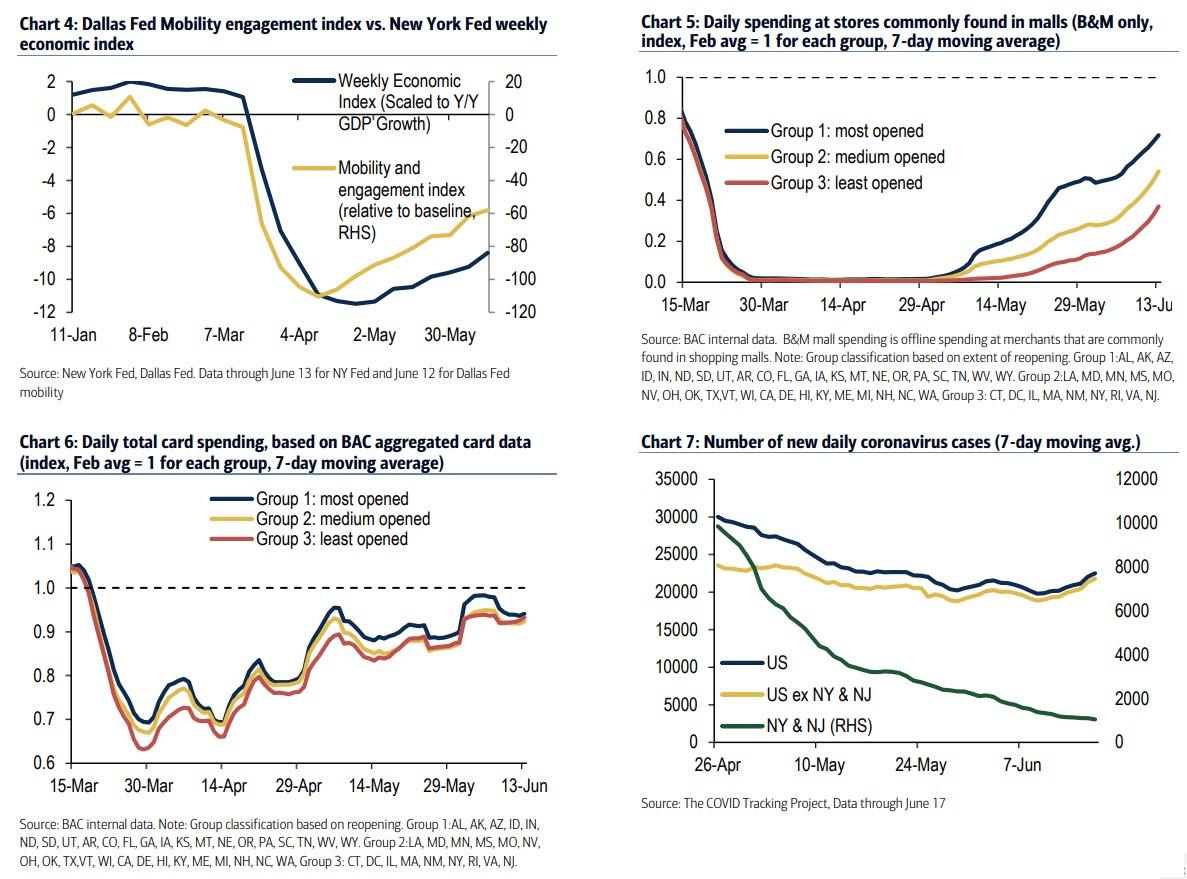

The BAC aggregated card data suggests that those states that have eased restrictions more than others are seeing consumers return to retail storefronts (Chart 5). Additionally total card spending is running higher in these states versus states that are less open (Chart 6). Despite these differences in activity, spending remains below pre-Covid levels across states. But as more people reengage in normal day-to-day activities, we are seeing worrying signs that the number of infections are picking up (Chart 7).

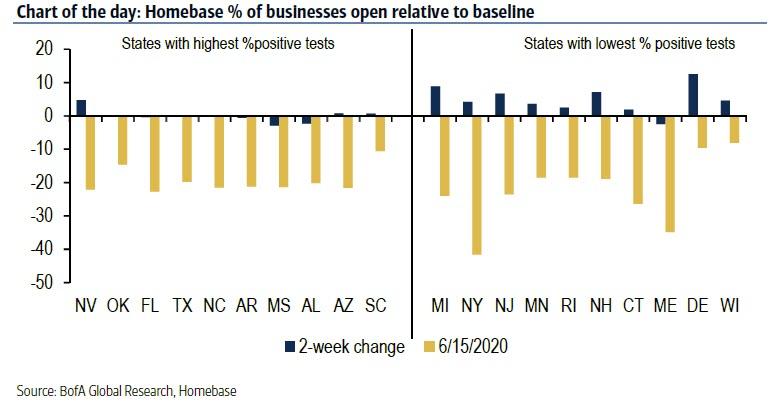

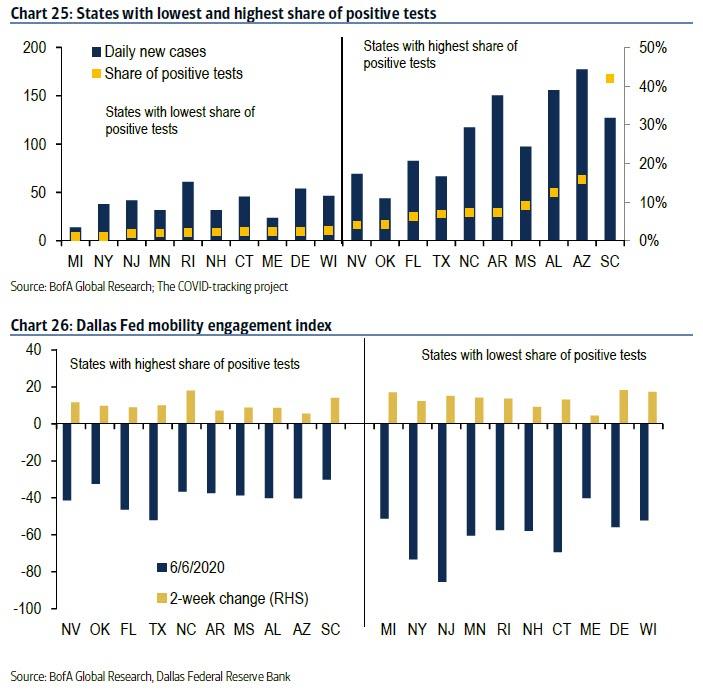

Meanwhile, given the focus in news reports around growth in cases in particular states, BofA compares activity states with low positive test rates to those with high positive test rates. It finds some suggestive evidence that states where the rate of positive tests are relatively higher are seeing slower gains in the number of small businesses reopening compared to those with the virus more under control.

This could signal the role the virus has on economic activity, although it is also likely that there are numerous other factors that could explain these differences.

Mobility Data

Visits to retail and recreation locations have picked up and are increasing at a faster pace than they were a week ago; meanwhile, the Dallas Fed’s mobility engagement index has continued its gradual ascent rising and if the current trend continues, the measure should return to the pre-COVID-19 level by late August. However, that will depend a lot on how states are able to manage the virus.

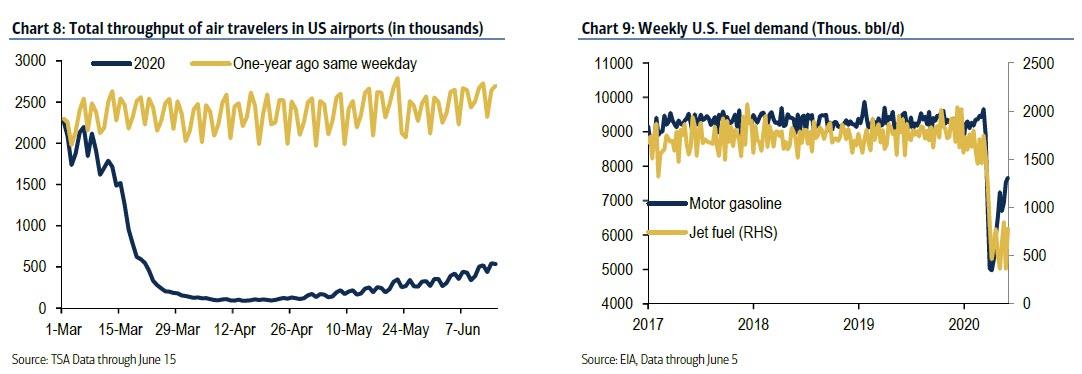

In addition to these two mobility measures, air travel, and demand for motor gasoline and jet fuel continue to recover.

Air travel is facing a long road before it returns to 2019 levels as businesses dial back on travel and people remain uncertain over flying. This could mean that driving stands to benefit as households substitute driving for flying especially given favorable gasoline prices.

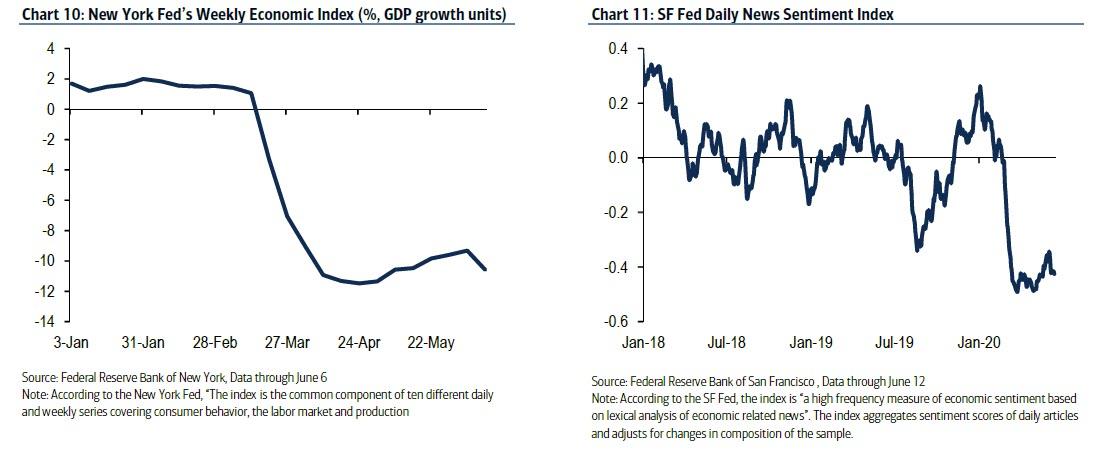

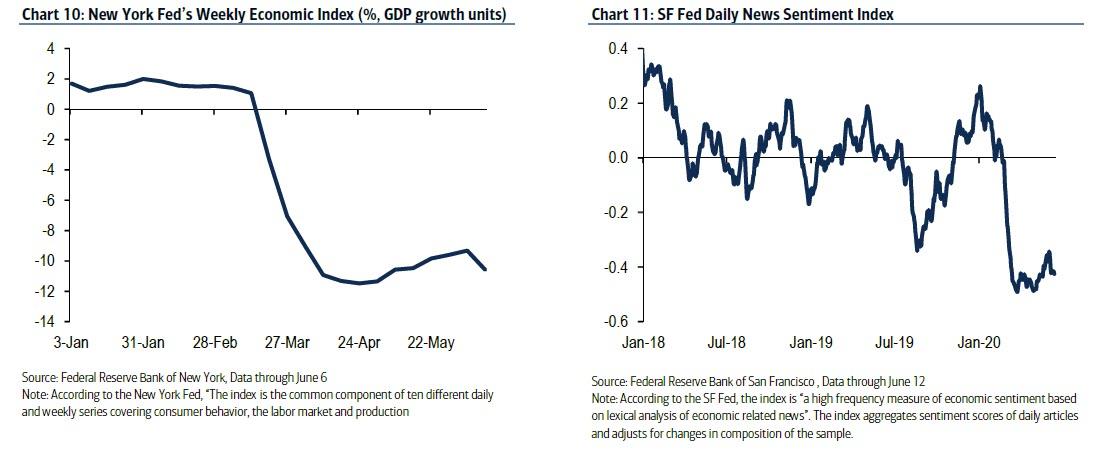

Economic activity

While the New York Fed’s weekly economic index continues to signal 2Q is on pace for a post-World War II record low for GDP growth, other high frequency indicators of economic activity continue to show improvement. Similar to the New York Fed’s weekly gauge, the San Francisco Fed’s daily news sentiment index continues to signal depressed sentiment, likely reflecting the severity of the labor market shock to date. This measure underscores the fact that confidence, much like activity still has a long way to go before returning to normal.

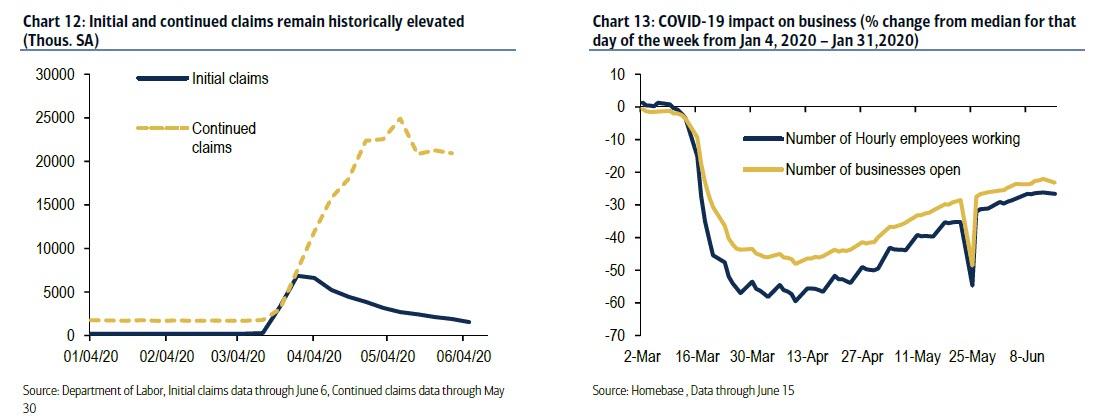

The labor market and small business activity

Measures of labor market activity remain depressed but have continued to show progress, albeit gradual. Initial jobless claims fell for a tenth consecutive week to 1.5mn for the week ending June 6 (Chart 12). Continuing claims also edged down modestly from 21.3mn from 20.9mn for the week ending May 30.

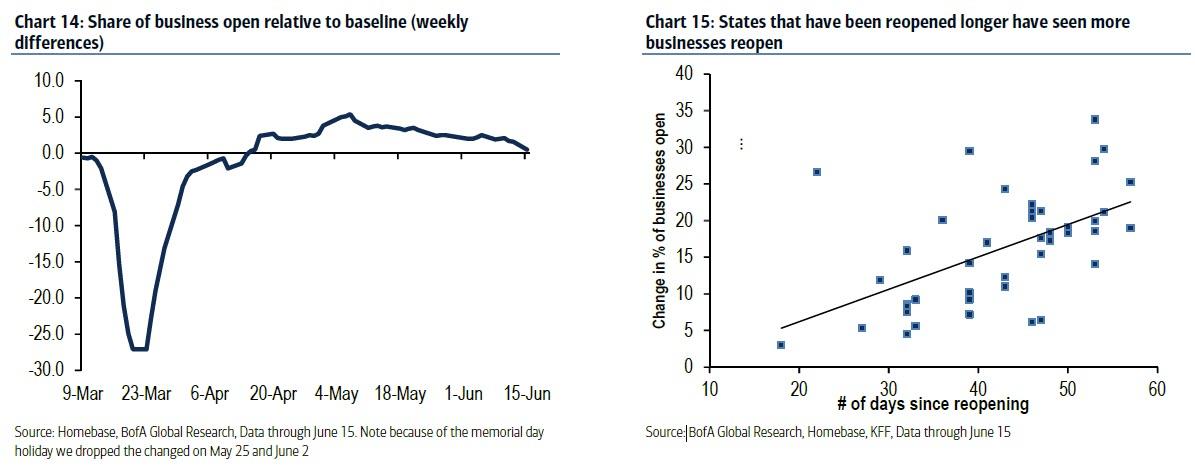

Meanwhile, as noted above, the latest Homebase data indicates that more small businesses are opening back up and are hiring, though the pace of both measures appears to be slowing.

If the reopening is able to continue on its current trajectory, we would expect further improvement as we find a positive relationship between the time states have been reopened and the change % of businesses open from Homebase (Chart 15).

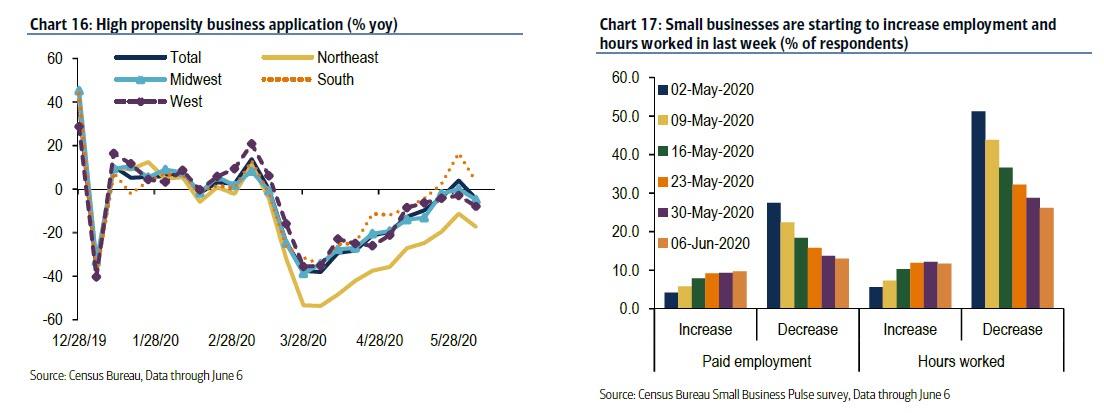

It is, of course, the case that not all businesses return. The good news is that we are seeing a recovery in the annual growth in high propensity business applications, those most likely to actually become a business with employees. Therefore, new businesses may be able to replace those who end up going out of business.

Consistent with the Homebase data, the latest reading from the Census Bureau’s Small Business Pulse survey suggest there’s been a leveling off in the number of businesses who are increasing hours worked and number of employees in the past seven days (Chart 17).

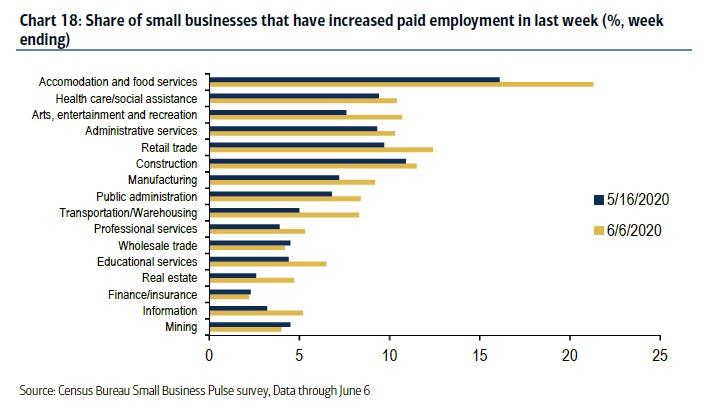

At an industry level, 13 of the 16 sectors reported a higher share of businesses adding to employment over the last seven days than during the May payroll week. That is a positive sign ahead of the June employment report.

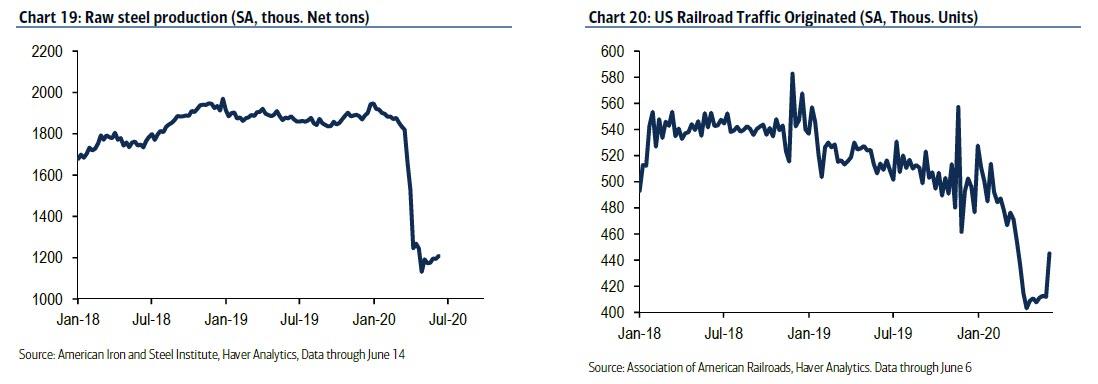

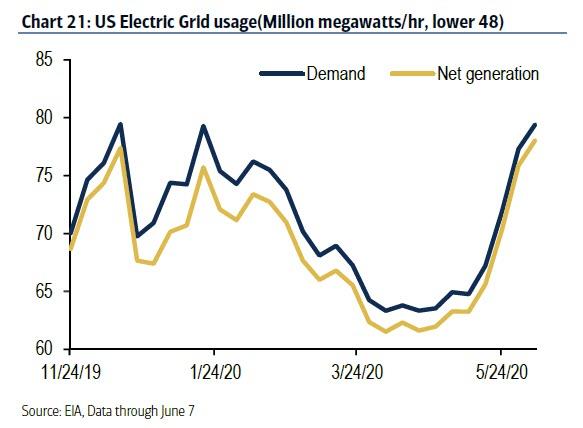

Manufacturing

The May industrial production report shows that manufacturing production rebounded with a 3.8% mom increase, primarily due to a huge rebound in motor vehicle and parts production. However, production remains woefully depressed relative to pre-COVID-19 levels. This is consistent with what we had seen in high frequency indicators related to the sector. The latest data show that steel production has yet to rebound, but railroad traffic and demand for utilities have continued to recover

Absent a major shock, these data should continue to improve in the coming months as the manufacturing sector is likely better suited to return more quickly than the service sector. However, the sector will still have to cope with the massive demand shock from the virus.

Housing activity

The recovery in the housing market has been V-shaped. Pent-up demand and buyers fleeing cities for refuge in the suburbs has likely contributed to the spike in MBA mortgage purchase applications, which are now running near the recent January peak. While this is a bright spot for the economy, it is unsustainable over the long term.

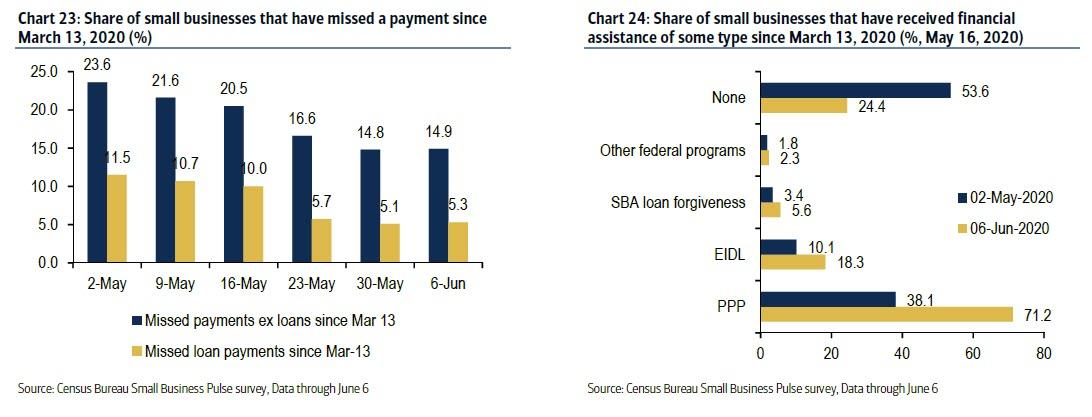

Small business survey

Stimulus for small businesses continues to payoff as there has been no material increase in the share of small businesses that have missed either a loan or non-loan payment since March 13 over the last three weeks (Chart 23). As of June 6, only 24.4% of small businesses had not received some type of financial assistance, while more than 71% had received a PPP loan (Chart 24). This is likely helping keep small business balance sheets healthy and should help to prevent a massive wave of bankruptcies.

State level activity and the virus

BofA next looks at states that are seeing the highest share of positive tests & increasing daily cases to those that are seeing the lowest share of positive tests. The bank has identified ten states in each group (Chart 25). The reopening has likely played a major factor as has the behavior of individuals in these states. On average, mobility in the states with a higher share of positive tests has been higher than those with a lower positive ratio (Chart 26).

This is likely a result of decisions by Governments in these states to reopen more quickly than others in addition to other factors.

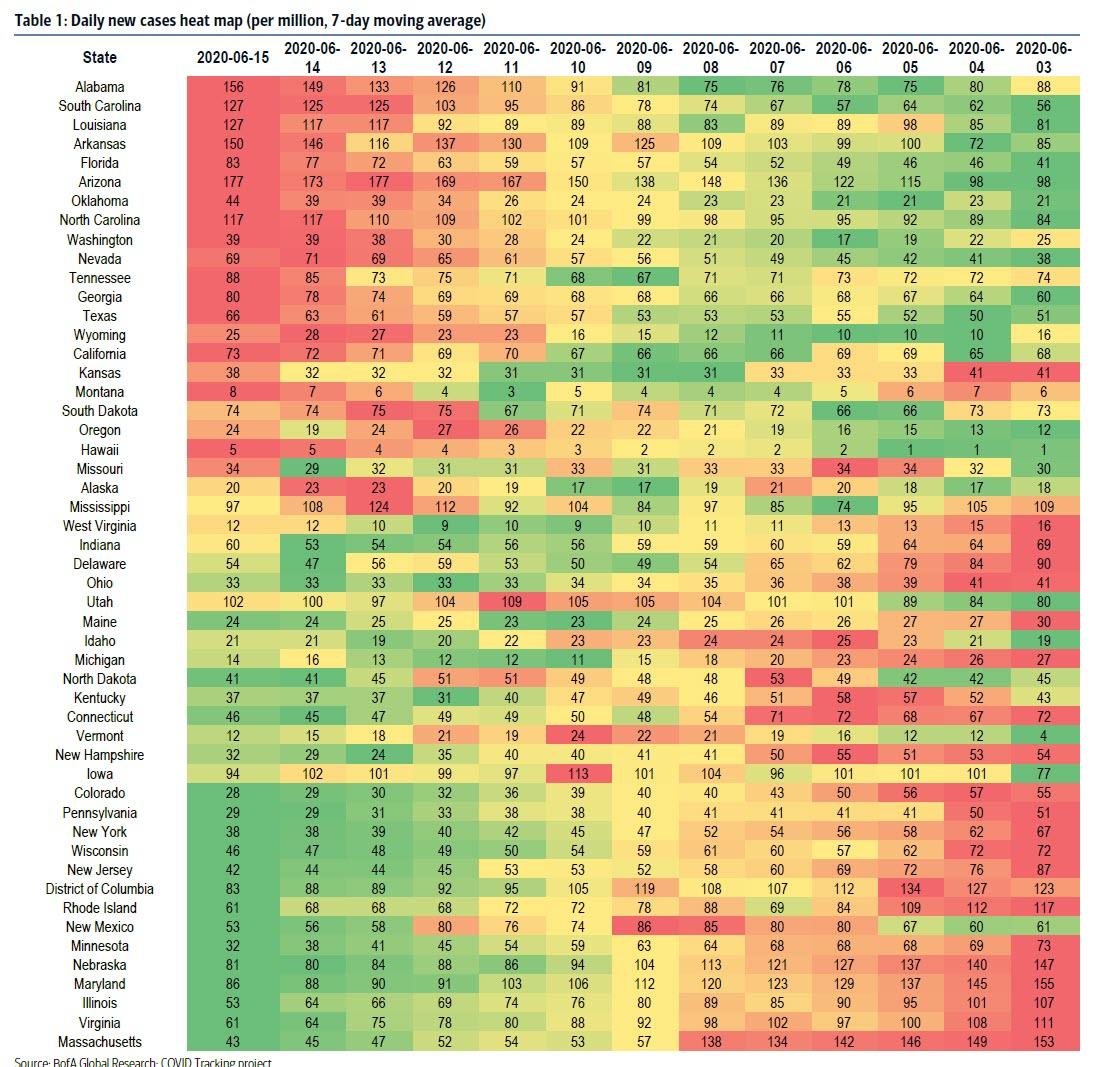

Finally, here is a heatmap of new cases across all states, showing where the situations is best and worst.

via ZeroHedge News https://ift.tt/2YoKT8X Tyler Durden