Stocks, Gold, Oil, And COVID-Cases Soar

Tyler Durden

Mon, 06/22/2020 – 16:01

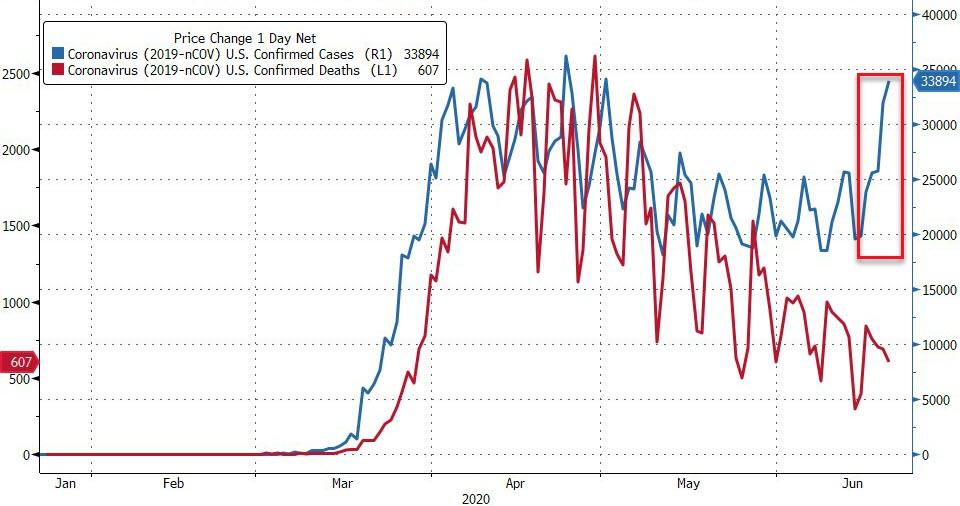

Stocks fell Friday on the heels of various virus headlines and Apple’s decision to re-close some stores. Things have got worse in terms of cases and hospitalizations over the weekend (but the median age of positive tests is plummeting as test volumes soar)…

Source: Bloomberg

And WHO’s director general Tedros Adhanom Ghebreyesus told the virtual health forum organised by Dubai in the United Arab Emirates.

“The pandemic is still accelerating… We know that the pandemic is much more than a health crisis, it is an economic crisis, a social crisis and in many countries a political crisis… Its effects will be felt for decades to come.”

…but this time stocks are bid…

But we note that The Dow remains well below the 50DMA…

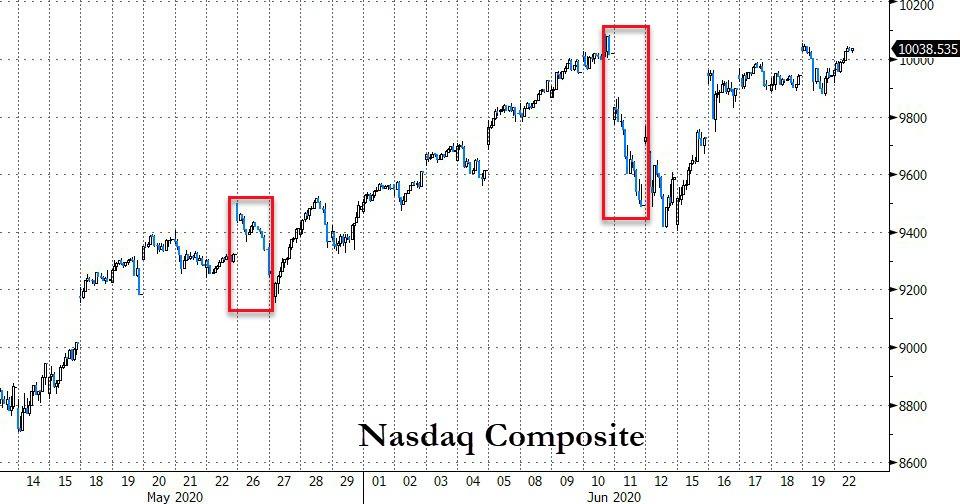

Infrastructure stimulus chatter provided the fodder to buy every dip. Nasdaq Composite is up 7 days in a row – its longest streak since Dec 2019 – a new record closing high. However, today’s rally merely filled the gap from a week ago and was unable to breakout…

Source: Bloomberg

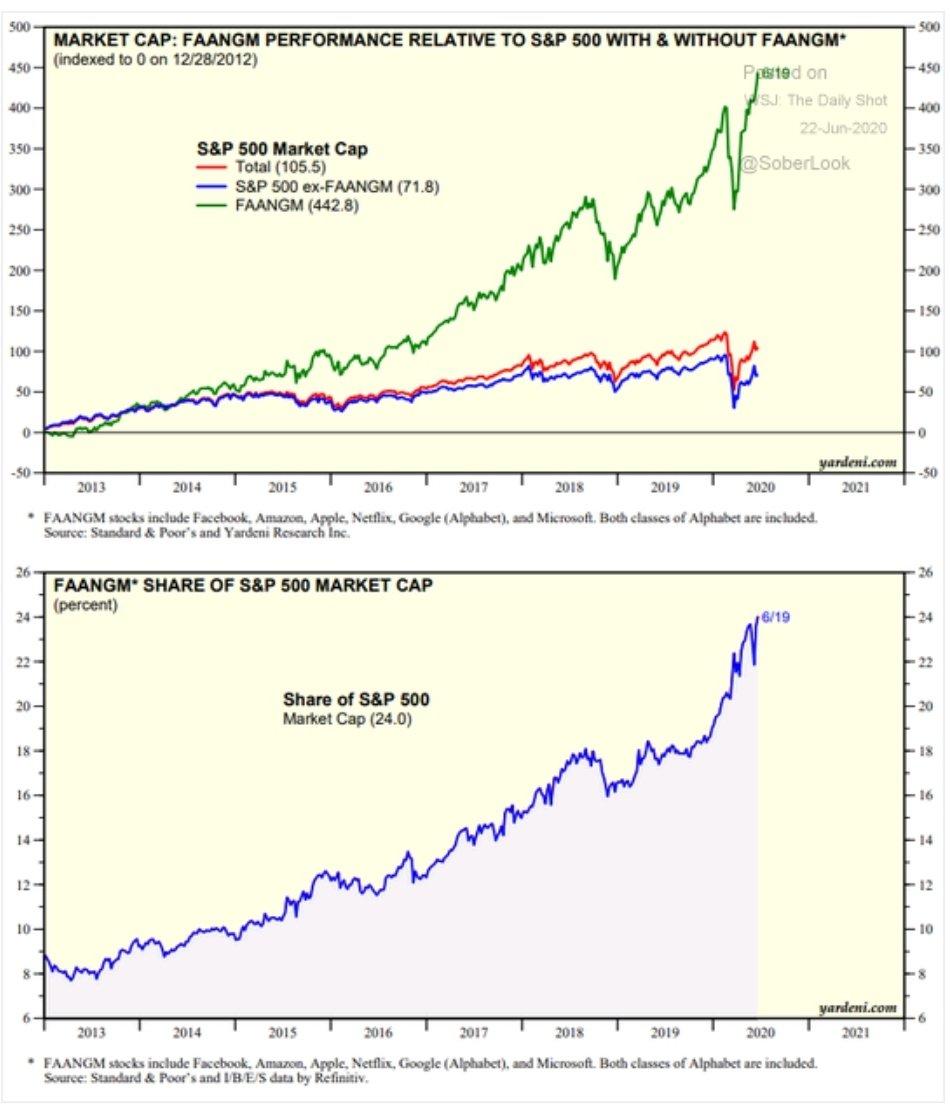

FAANGM is now at a stunning 24% share of S&P market cap…

Source: @WinfieldSmart

But it’s different this time…

It’s different this time.

It’s worse, much much worse. pic.twitter.com/GjcHhaV4IW— Sven Henrich (@NorthmanTrader) June 22, 2020

One word sums it all up…

On the day, Nasdaq and Small Caps outperformed with the latter up over 3% from Sunday night opening lows… things went a little bit turbo late on as Texas Governor said the virus was spreading at an unacceptable rate but that was quickly bid on Illinois headlines:

-

1513ET *TEXAS GOVERNOR SAYS VIRUS IS SPREADING AT UNACCEPTABLE RATE

-

1545ET *ILLINOIS 7-DAY POSITIVITY RATE FELL TO 2% FROM 13% A MONTH AGO

Since the open on Friday, something has changed – Gold and bonds are bid as stocks are lower…

Source: Bloomberg

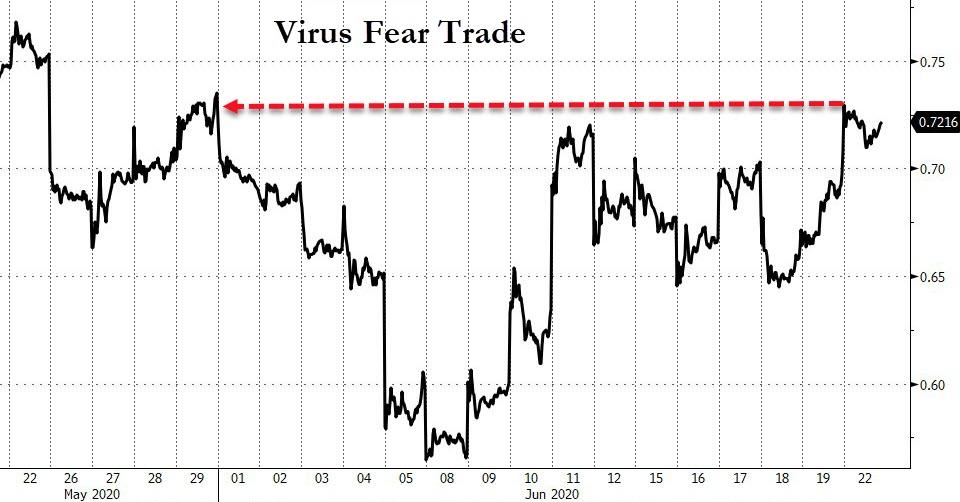

Notably, the Virus Fear trade (long food, short leisure) surged up to its highest since May…

Source: Bloomberg

HTZ shares tumbled today (*but remain astronomically higher than their BK day lows)..

Treasury yields ended the day higher after pushing lower overnight to one-week lows..

Source: Bloomberg

Bonds and stocks remain entirely decoupled…

Source: Bloomberg

The Dollar reversed all gains from Thursday and Friday…

Source: Bloomberg

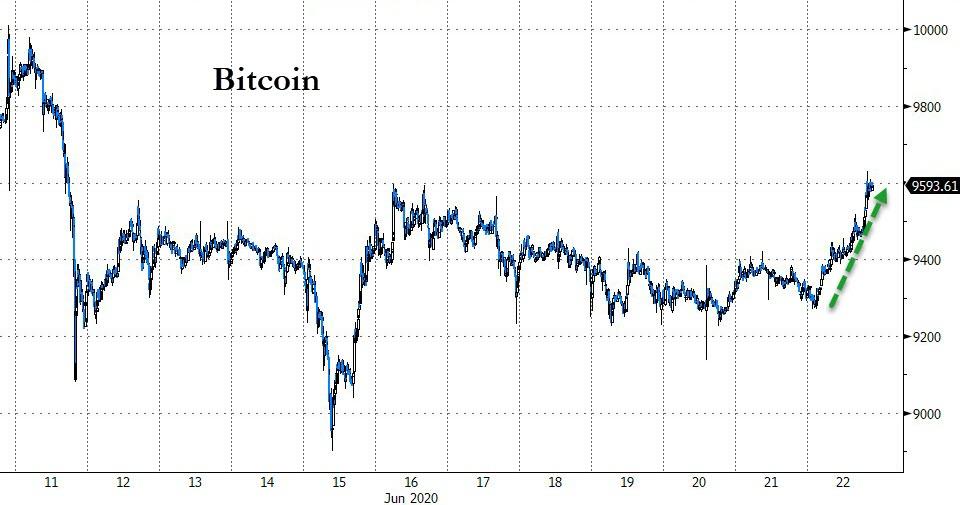

Bitcoin rallied back above $9500 today…

Source: Bloomberg

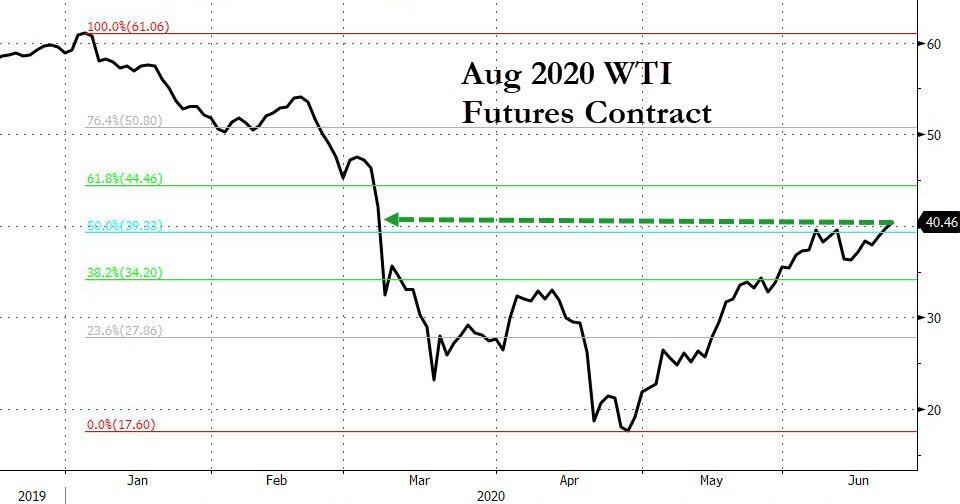

WTI closed above $40 for the first time since March…

Source: Bloomberg

Spot Gold topped $1760 today – within $2 of May’s multi-year highs…

Source: Bloomberg

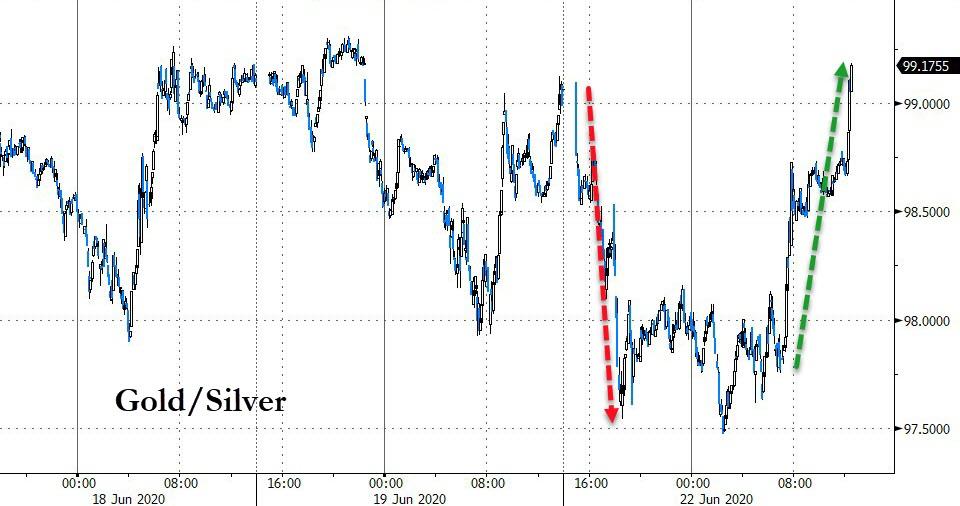

Gold and silver danced around each other today with silver outperforming overnight and gold coming back strongly during the day…

Source: Bloomberg

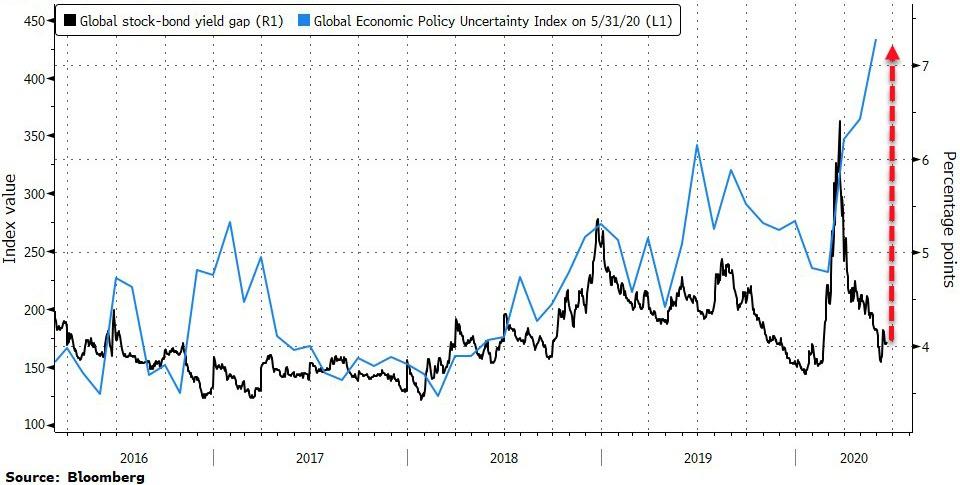

And finally, as if you needed another example, Bloomberg notes that stocks worldwide are in the midst of an “epic divergence” from the economic-policy outlook, according to Luca Paolini, Pictet Asset Management Ltd.’s chief strategist.

Source: Bloomberg

Paolini cited the gap between the MSCI World Index’s earnings yield, which falls as prices rise, and government-bond yields in a Twitter post Friday. The MSCI World’s spread to the Bloomberg Barclays Global Aggregate Government Index narrowed 2.4 percentage points through last week from a March 23 peak, according to data compiled by Bloomberg. By contrast, the Global Economic Policy Uncertainty Index rose to records in April and May.

via ZeroHedge News https://ift.tt/3dqPlZ0 Tyler Durden