JPM Finds That Rising Virus Cases Are Starting To Hit Consumer Spending Again

Tyler Durden

Thu, 06/25/2020 – 22:10

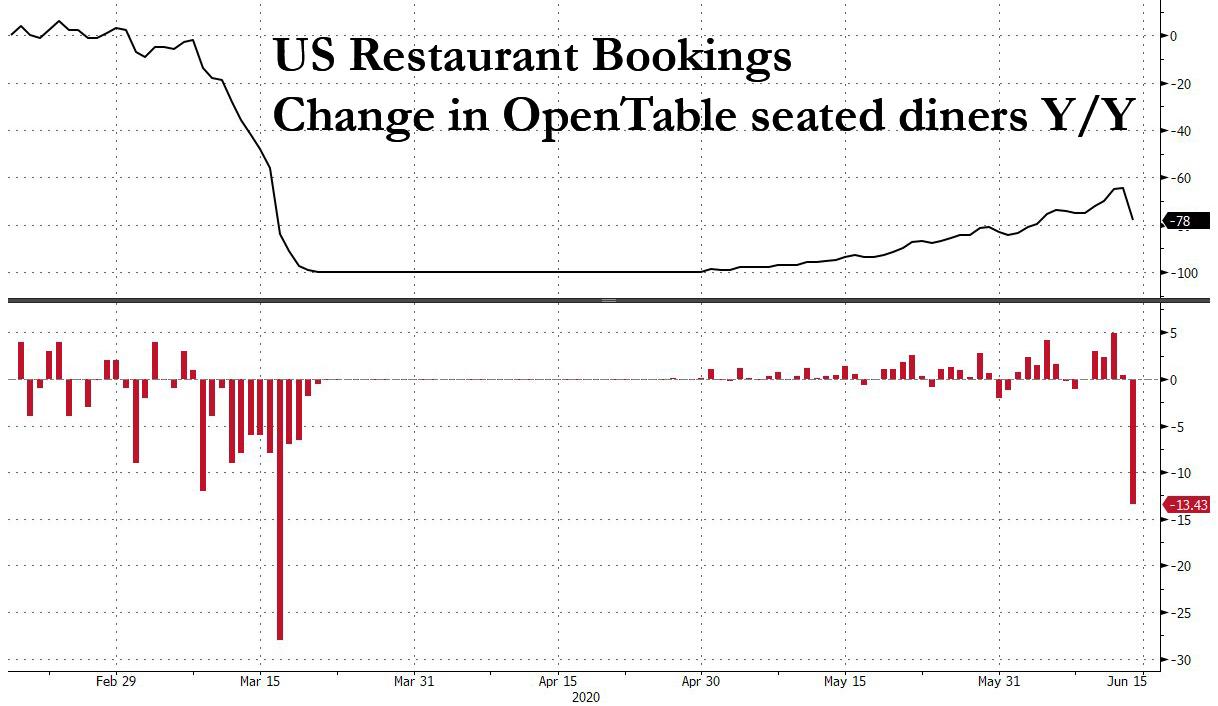

Two weeks ago, in the immediate aftermath of renewed fears that various sunbelt states are seeing growing coronavirus infections, we showed that restaurant booking as measured by Opentable seated diners posted its biggest daily drop on its path to gradual recovery since the lockdowns were imposed in March.

Since then there was a modest stabilization in the trend, until another sharp drop took place on Monday amid new concerns of rising cases in states such as Texas, Arizona, Florida and California.

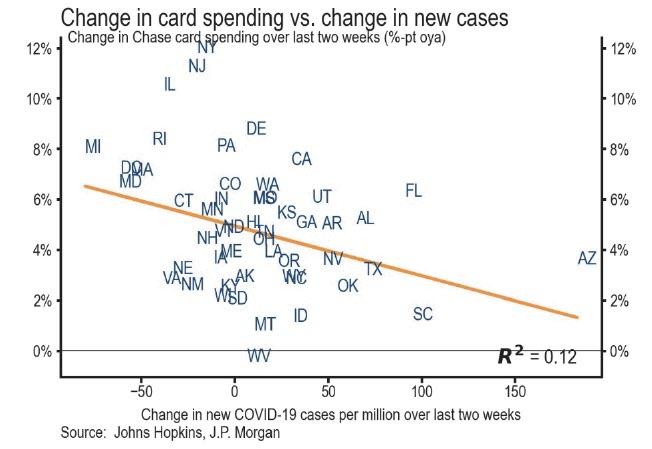

That said, two one-day drops in the closely watched restaurant index hardly is confirmation that the economy is starting to shutdown again. While that may be true, according to JPMorgan’s tracker of spending on the bank’s own debit and credit card, the bank said today that it can now detect a relative slowdown in spending growth in recent weeks in states where the virus has begun to spread again, even if differences across states are fairly subtle so far. In some states like New York and New Jersey where new virus cases are flat or falling, JPM’s spending tracker has risen by more than 10%-pts over the last two weeks through June 21. However, in states like Arizona, Texas, Oklahoma, and South Carolina, where the virus is spreading rapidly, the tracker is up by less than 4%-pts. Still, total spending has been increasing even in these

places thus far.

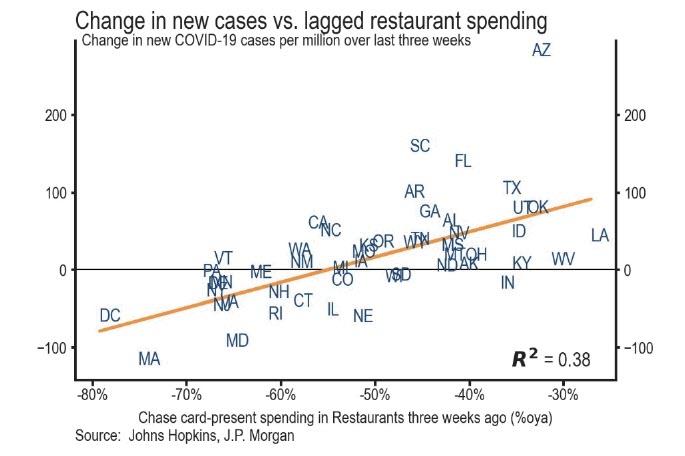

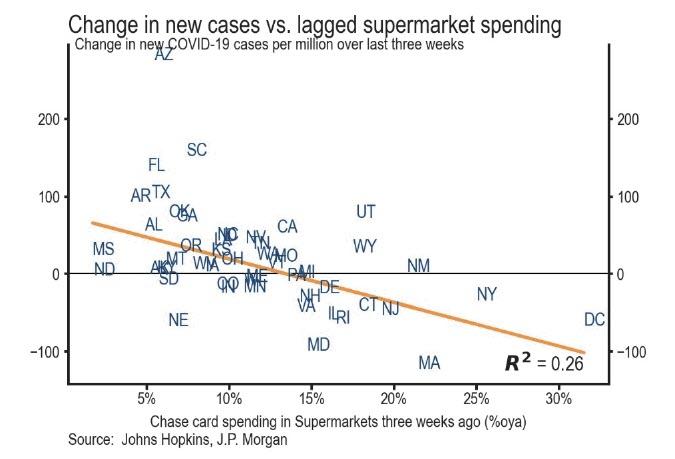

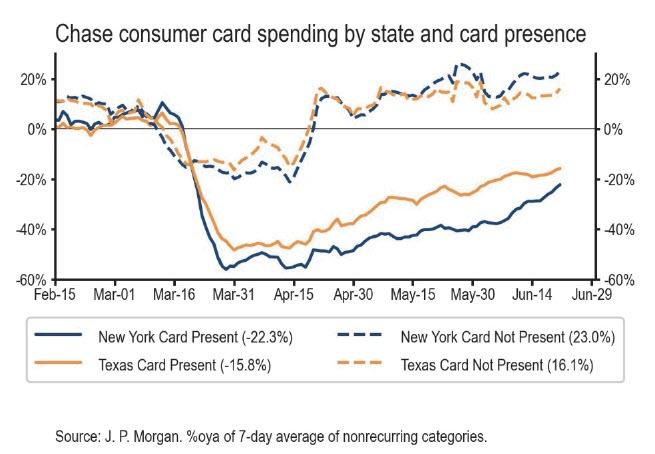

JPM has also found that spending patterns from a few weeks ago have some power in predicting where the virus has spread since then. Looking across categories of card spending, the bank has found that the level of spending in restaurants three weeks ago was the strongest predictor of the rise in new virus cases over the subsequent three weeks, echoing the results last week using OpenTable data. “Card-present” restaurant spending (meaning in-person, rather than online, spending) is particularly predictive. Interestingly, higher spending in supermarkets predicts slower spread of the virus, hinting that high levels of supermarket spending are indicative of more careful social distancing in a state. For example, as of three weeks ago, supermarket spending was up 20% or more from last year’s levels in New York and New Jersey, while it was up less than 10% in Texas and Arizona.

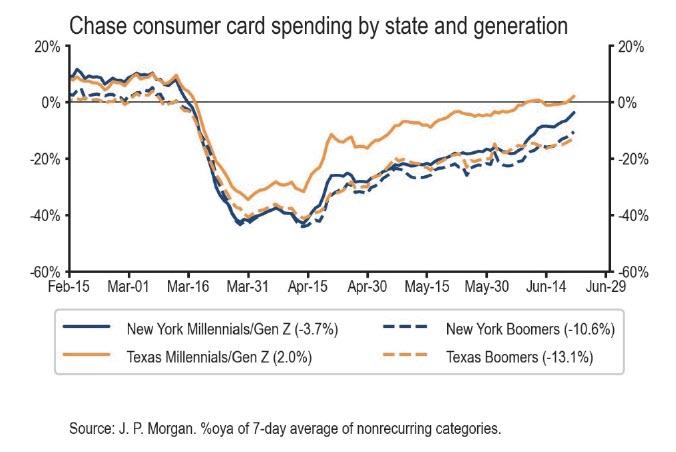

Elsewhere in the data, JPM notes that recent rebounds in spending in states like New York have been concentrated among Millennial and Gen Z cardholders and in card-present spending, suggesting that younger generations are leading the way in returning to normal offline life.

via ZeroHedge News https://ift.tt/2A4U19j Tyler Durden