Hi-Crush To File For Bankruptcy: Shares Crash After Robinhooders Went All-In

Tyler Durden

Fri, 06/26/2020 – 08:04

As we’ve been warning – a bankruptcy tsunami has only just begun – there’s a striking correlation between the unemployment rate and loan delinquencies.

So it comes at no surprise, yet another company, Hi-Crush (HCR), a fracker with shale plays in Texas, the Midwest, and interior Northeast, is working on the terms for a prearranged bankruptcy filing with lenders, reported Reuters.

HCR is expected to file for bankruptcy imminently regardless of the terms and conditions of a prearranged filing agreed upon with its debt holders. With already signed forbearance agreements, lenders will not exercise default-related rights on the company until July 5.

As oil prices corrected and went negative during the pandemic (read: US Shale Faces Bankruptcy Wave) – management had no other choice but to slash the workforce by 60% and idle three production units as demand for oil collapsed. HCR took a $145.7 million asset impairment charge on its production and terminal facilities in Q1, which resulted in a $1.46 per share loss.

Shares of HCR plunged 29% in pre-market Friday after the news of imminent bankruptcy.

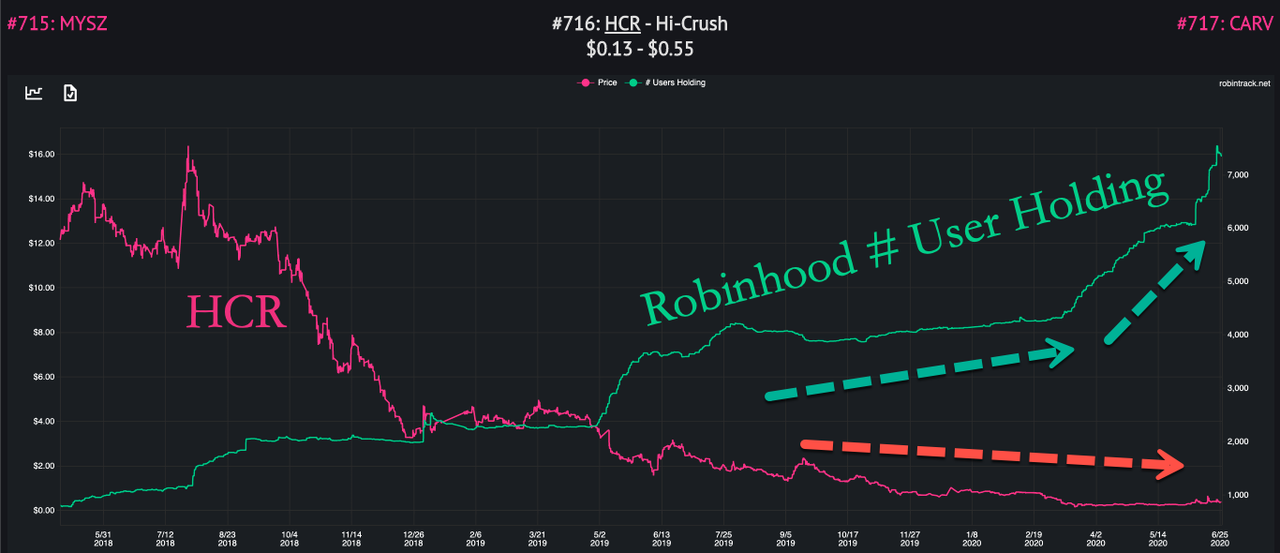

Ahead of officially announcing insolvency – you’re never going to guess who was loading up on HCR shares. Well, Robinhood daytraders, of course…

Add HCR to the long list of bankrupted companies Robinhood daytraders have been panic buying. Just yesterday, we noted these inexperienced pajama traders loaded up on GNC Holdings as it filed for bankruptcy protection.

via ZeroHedge News https://ift.tt/2VoQKJs Tyler Durden