The Biggest Disconnect Between Prices And Profits In Stock Market History?

Tyler Durden

Fri, 06/26/2020 – 08:19

Authored by Jesse Felder via TheFelderReport.com,

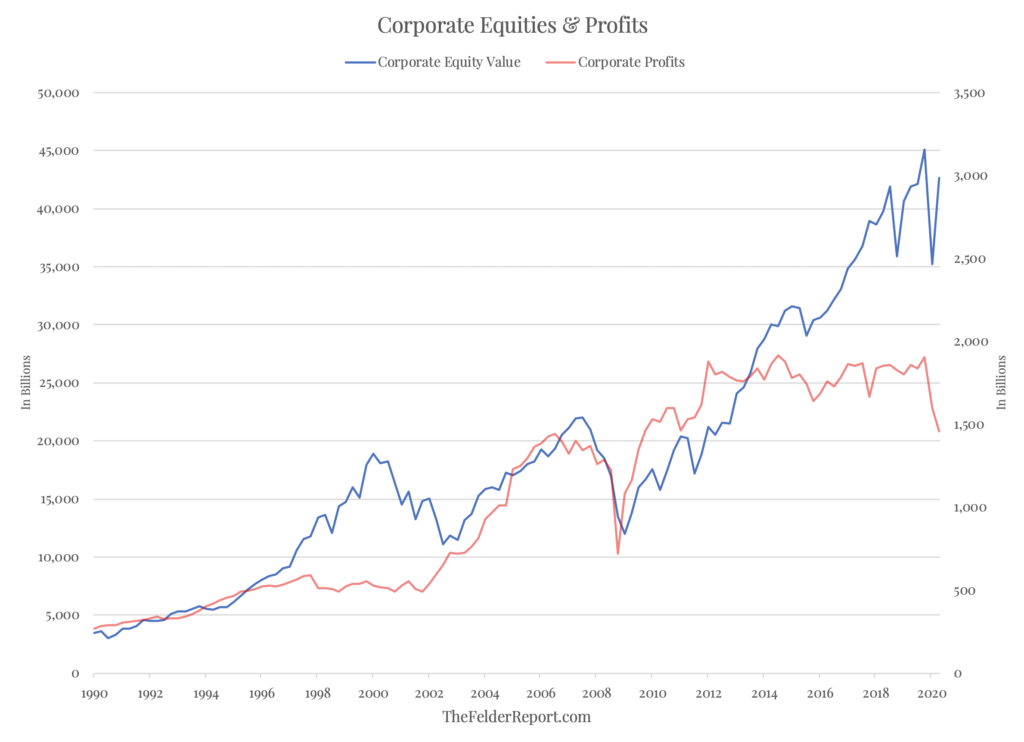

Everyone is talking about the massive disparity between stock prices and fundamentals right now. To paraphrase Jeremy Grantham, we now find ourselves in the top 1% of stock market valuations and the bottom 1% of economic outcomes (based on the annualized rate of decline in second quarter GDP). A popular way to demonstrate this gap is seen in the chart below which plots total equity values along with total corporate profits.

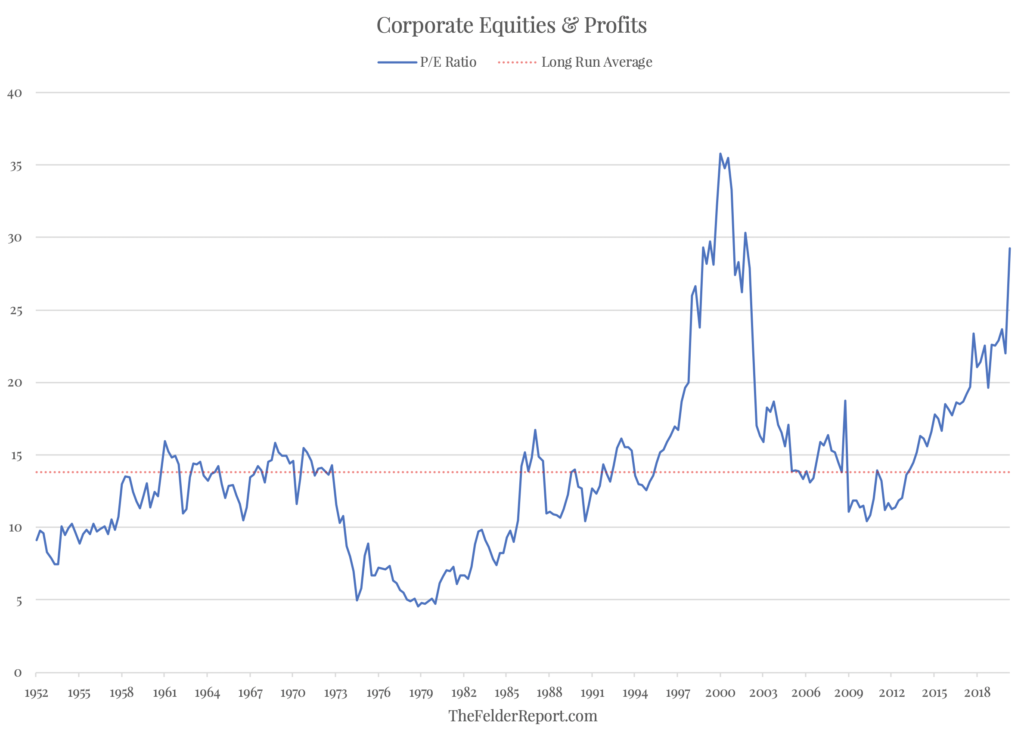

At first glance, it appears this is the biggest disconnect between prices and profits in at least 30 years. However, if we turn this into a price-to-earnings ratio, it becomes clear that the stock market bubble of 20 years ago actually takes the cake.

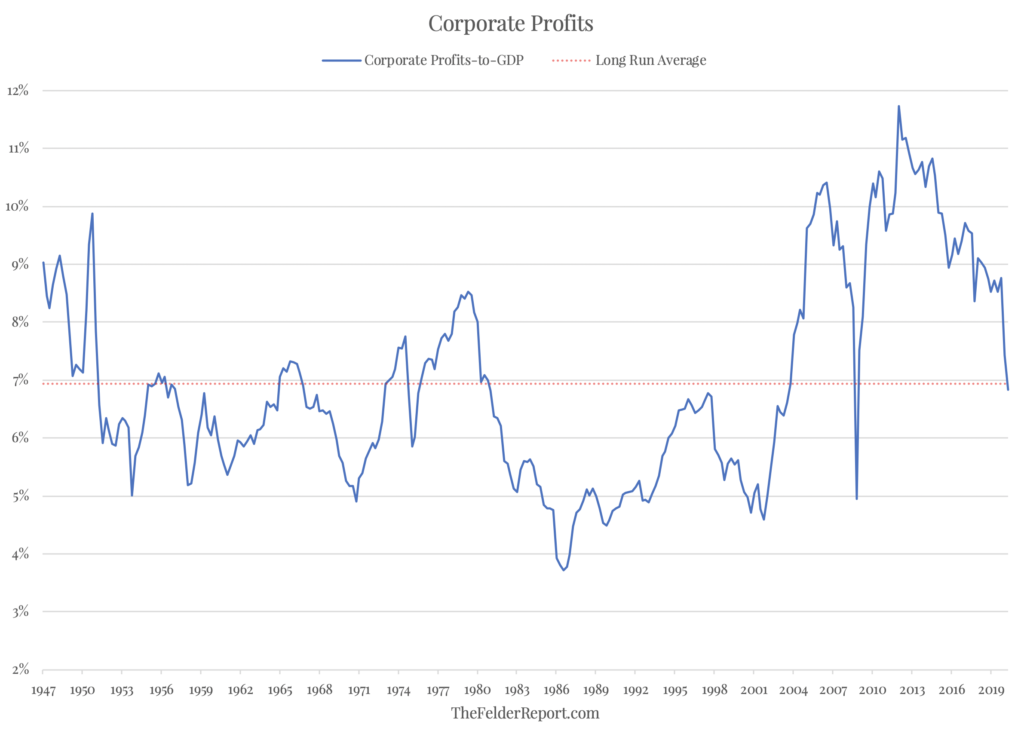

But what a simple price-to-earnings ratio doesn’t account for is the fact that Dotcom bubble appears so severe in the chart above largely because profit margins were relatively depressed at the time. Furthermore, profit margins in recent years became extremely inflated. This serves to make stock prices over the past few years look less expensive than they otherwise would.

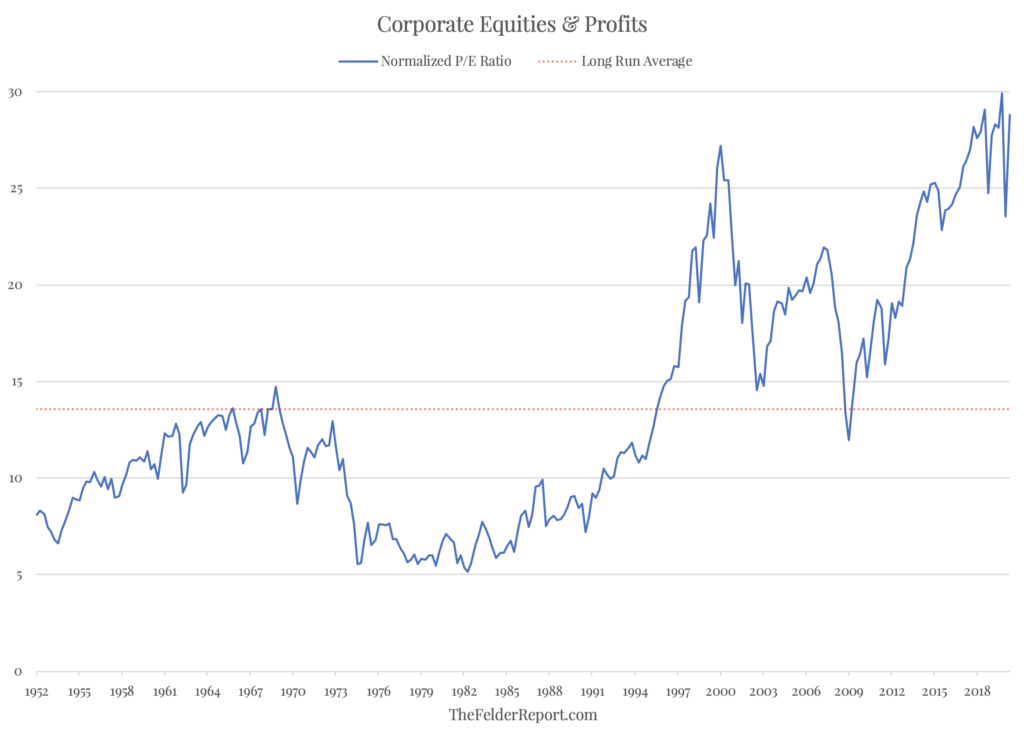

So if we normalize profit margins (hat tip, John Hussman), we can see that stock prices today are more expensive than they were 20 years ago at the peak of the Dotcom mania. It turns out that the current disconnect between stock prices and sustainable profits is, in fact, greater than anything we have seen in modern history.

The last time we saw prices and earnings disconnect in such an extreme way famously led to a “lost decade” for the stock market from 2000 to 2010. Is it unreasonable to think the current extreme in valuations could lead to another “lost decade,” especially if profit margins are only beginning to revert to their historical mean?

via ZeroHedge News https://ift.tt/2YA0GSb Tyler Durden