S&P Plunges To Critical Technical Level, Bond Yields Hit One-Month Lows

Tyler Durden

Fri, 06/26/2020 – 10:46

It’s been quite a morning for bad news and its hitting markets:

-

1000ET *TEXAS GOVERNOR ORDERS TAVERNS TO CLOSE IN RESPONSE TO VIRUS

-

1050ET *CHINA MESSAGES THAT U.S. PRESSURE COULD JEOPARDIZE PURCHASES OF U.S. EXPORTS

-

1100ET *HARRIS COUNTY, TX, TO DECLARE TOP-LEVEL EMERGENCY ON COVID-19

The volatility in markets is allowed to leak out as The Fed balance sheet shrinks for the second week in a row…

Maybe Powell will need to start printing again?

The S&P 500 just broke down and bounced at its 200-day moving-average…

Dow futures have tumbled nearly 600 points to 25k with small caps leading the collapse (down 2.5% on the day)…

Pushing The Dow back to two-week lows…

And bond yields are plunging, with 30Y back to one-month lows…

But stocks have a long way to fall to catch down to reality…

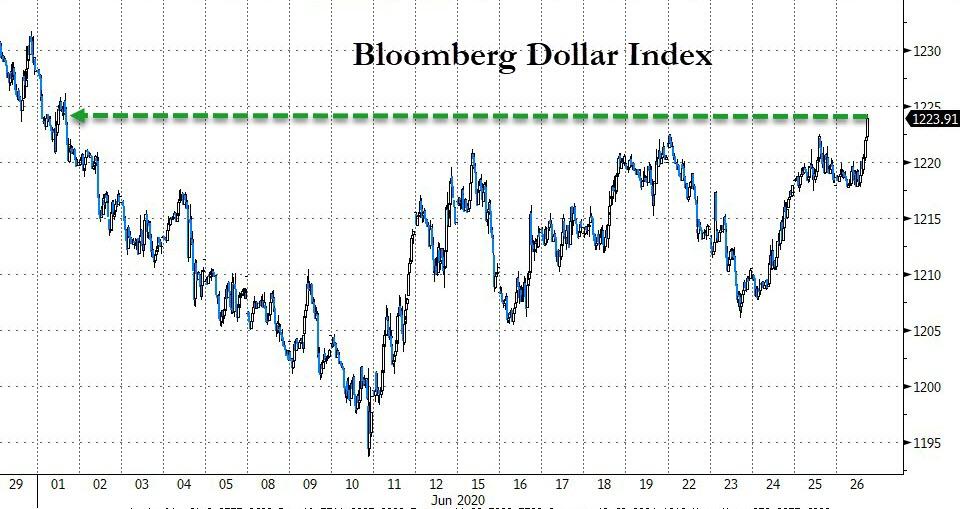

The Dollar has broken out to its strongest since May…

Mnuchin, get someone on the phone!

via ZeroHedge News https://ift.tt/31fa3sm Tyler Durden