The “Greatest Bear Market Rallies Of All Time”, And Why This One Is Ending

Tyler Durden

Sat, 06/27/2020 – 11:59

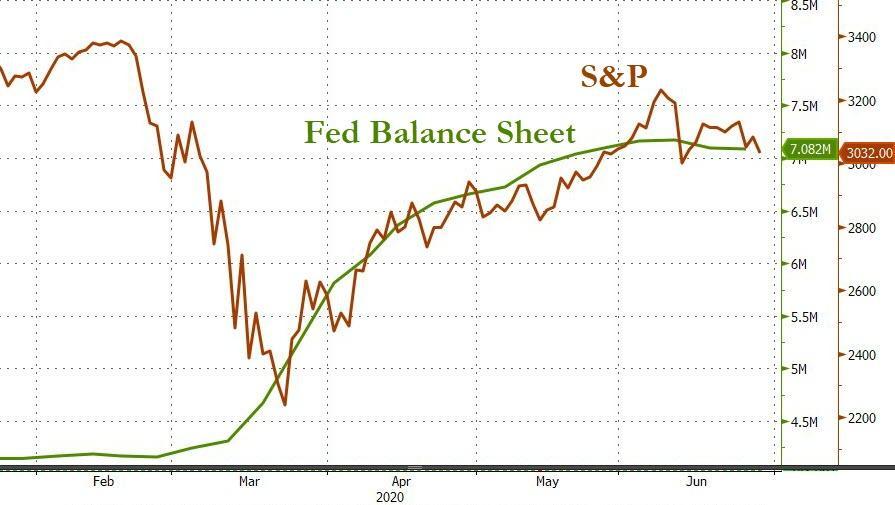

After two consecutive weeks of declines in the Fed’s balance sheet, the stock market has started to look especially wobbly, and after several days of steep declines, all June gains have vaporized.

Of course correlation isn’t causation, and the prevailing narrative is that the market weakness has been due to a spike in coronavirus cases across sunbelt states and fears that the V-shaped recovery is not coming, although as we have repeatedly said, the Fed will urgently need to expand its QE which is now running at “only” $80BN per month for TSYs, an amount that will be insufficient to monetize the flood of new debt in the coming years. To do that, however, the Fed needs a “shock” pretext to resume aggressive balance sheet expansion and a “second wave” is just that.

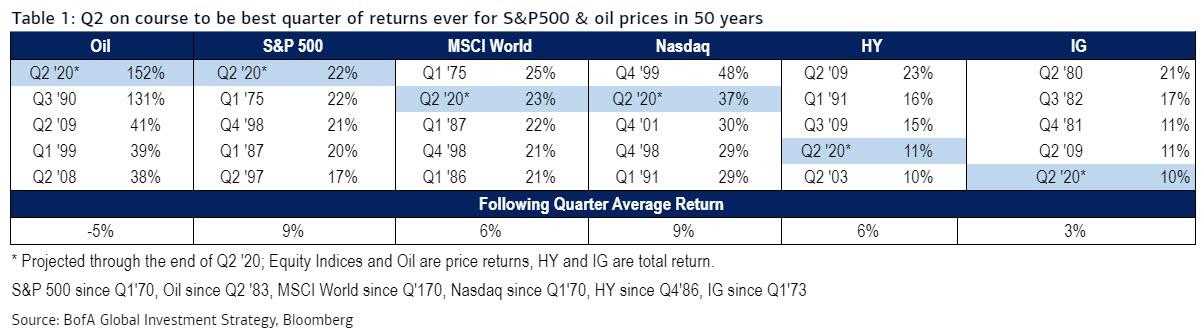

So while we wait for the media narrative to “confirm” that the next escalation in the pandemic has arrived and is forcing states to resume shutdowns, it is hardly a surprise that on Wall Street strategists are taking a step back and after bearish projections virtually disappeared in the past month, discussions of a bear market rally are once again front and center with BofA’s Michael Hartnett taking the lead. According to the BofA CIO, while Q2 is on pace to be the best quarter for the S&P500 and oil in 50 years…

… a rebound largely driven by reopening optimism (“Mar 20th NY lockdown – SPX 2304; Jun 8th NY reopening – SPX 3232″), it’s time to admit that the furious 50-day, ~40% rally may have been nothing more than a bear market rally.

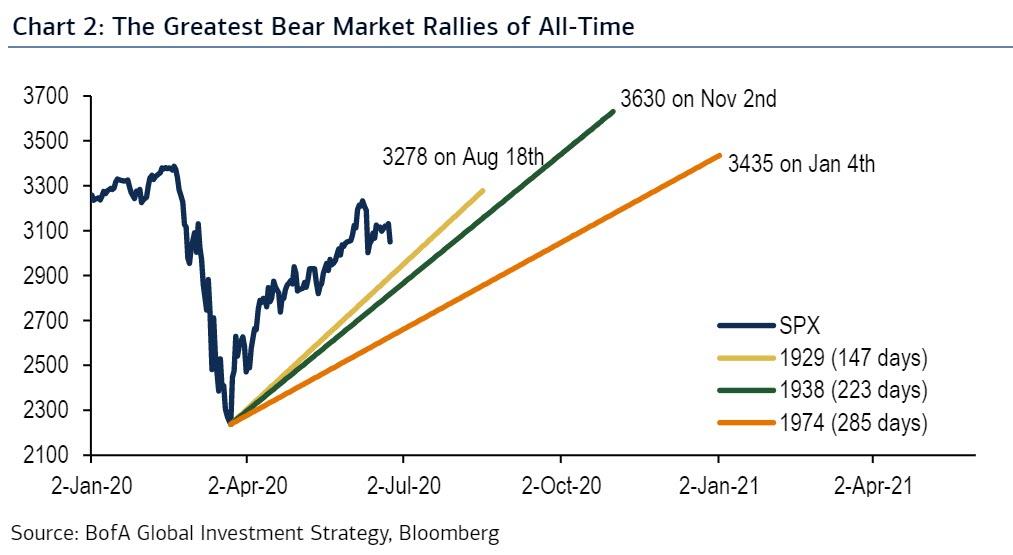

To put it in context, Hartnett shows that the current rebound has largely been following the trajectory of the three “greatest bear market rallies of all-time” (1929, 1938, 1974), which would put the S&P at 3300-3600 sometime between Aug & Jan’21, but what follows would be a far more painful move lower, as was the case after all these bear market rallies fizzled resulting in lower lows.

Hartnett is not the only one trying to predict how the bear market rally dies. Leuthold Group’s CIO, Doug Ramsey, who in March told his clients to sit out what’s coming and thus missed the $10 trillion surge in market cap, has a message: it ain’t over yet.

“The bulls could be proved right in that the March 23rd low holds, but you could lose a lot of money in a drawdown here,” said the Leuthold chief investment officer. “You could still very easily have a drop of 20% from the peak we made on June 8th. Very easily.”

As Bloomberg notes, “the warning reflects a wider schism on Wall Street these days. Many of the bears whose jaws dropped over the resiliency of stocks remain steadfastly skeptical, awaiting the moment of vindication. Meanwhile, early believers are running victory laps, doubling down on the rally on the theory skeptics will have to capitulate and stimulus will continue to flow.”

But what may be the single most beneficial aspect of the recent Fed-fueled ramp which saw the central bank inject or backstop nearly $8 trillion (and counting), is that technical analysis has finally been thrown out of the window, and “by now, everyone’s aware there’s no moment of the past that can be used as a template to tell which way stocks will lurch next.“

Just days before the March 23 bottom, Ramsey cautioned clients that it was “too early” to expect a major bear market trough, as a phase would come when stocks and economic data fell in tandem. A study by the firm showed that on average, over 11 past recessions, stocks didn’t start to recover until 1 1/2 years after the economy started contracting. Little did he know that on March 23 the Fed would toss all the playbooks, and go so far as to break the law by creating a SPV in collaboration with the Treasury that would allow it to buy corporate bonds… a similar approach that will soon give it the ability to buy stocks after the next crash.

It wasn’t just Leuthold: Barclays strategists mapped out a scenario where an extended recession could lead to a 50% peak-to-trough selloff. The farthest the S&P 500 ever fell was 34%. Goldman was expecting a second wave of selling to push the S&P below 2,000. Northern Trust Wealth Management pointed out that it typically takes about 1 1/2 years to recover from a 20% drop. Instead, the S&P 500 rose 40% in 50 days, the fastest rebound in nine decades. Anyone who tried to use 2008 as a road-map was badly burned.

In other words, we are – and have been – in truly uncharted territory, where the only thing that matters is what the Fed does next. Of course, we can make some educated guesses as to what comes next, and as we have been claiming for months, the Fed needs another crash to unleash even more helicopter money and further take over capital markets. After all, it already controls most of the bond market where Treasurys no longer have any signaling power whatsoever; as such the Fed will soon need a stock market crash to fully take over equities next by following the BOJ and SNB in purchasing ETFs, and eventually single stocks. That’s why when looking, ahead one has to think not like a financial strategist but a central bank criminal whose only purpose is accelerating the wealth transfer from the middle class to the 0.01% while avoiding the inevitable coming systemic reset.

For now, however, Ramsey isn’t alone in claiming “it’s too early to say” calls for further downside were wrong. As Bloomberg notes, economists at TS Lombard remain bears, expecting a drop of at least 20%. Still, they’ve dropped their March call that the S&P 500 would fall below 2,000 over the summer. Incidentally so did Goldman which now is expecting the S&P to trade around 3,000 by year end, and while JPMorgan expects a correction due to quarter end rebalancing, the bank last twekk finally upgraded stocks to Overweight, telling its clients to buy… just as the record bear market rally was about to end.

Because while the market may have changed – or rather died thanks to the Fed – one thing that will never change is that for Wall Street to prosper it needs fools who are willing to play its game.

via ZeroHedge News https://ift.tt/385LAag Tyler Durden