“Look Out Below”: Why The Economy Is About To Fly Off A Fiscal Cliff

Tyler Durden

Mon, 06/29/2020 – 18:35

One look at the latest economic data, conveniently summarized by the exploding Citi US econ surprise index, should be sufficient to convince most that the US is well and truly following a V-shaped recovery path.

Alas, nothing could be further from the truth because the current economic sugar rush is almost entirely a function of the massive government spending spree, a spree which in just over a month will be effectively over. As a result, as Bank of America writes, the economy is facing fiscal cliffs which could cause the recovery to disintegrate, with four particular areas of focus:

- expiration of extended unemployment insurance,

- the fading support from stimulus checks,

- exhaustion of PPP

- stress from state and local aid gov’ts.

In response, BofA expects another stimulus bill to be passed in late July to address some – but not all – of these concerns, and “instead of a cliff, we will likely be facing a hill.” That may be optimistic, because any stimulus would need to be bipartisan, and if the Democrats wish to crush Trump’s re-election chances, now is the time for them to push the economy into a depression with elections in just 4 months.

Will they do it? We’ll know in a few weeks, and certainly once the July 31 benefits cliff hits.

Until then, here is BofA on the likely fiscal cliff outcomes:

Fiscal: look out below

In the face of the shock from the COVID-19 pandemic, fiscal stimulus has poured into the economy. Washington has pushed in roughly $2.8tr of stimulus, equaling 13% of GDP while the Fed has expanded its balance sheet to $7.1tr. The rapid and forceful support on the policy front likely limited the downside during the recession and has helped to support the ongoing recovery. But we are now approaching a few “cliffs” which would prove painful if unaddressed. We see four areas of concern:

- Unemployment insurance (UI): the incremental $600/week is set to expire on July 31st. To put some numbers around this, at the current level of nearly 20 million people receiving unemployment insurance this would equate to a reduction in personal income of $48bn ($576bn annualized) or 2.7% of GDP.

- Stimulus checks are no longer rolling in: the majority of the tax rebates / checks were distributed in mid/late April. To date, around $270bn of the $290bn has been pumped in. We find that consumers quickly spent the additional cash which means a diminishing support to spending.

- Payroll Protection Program (PPP): of the $670bn allocated to the PPP, around 77% has been approved. The new legislation allows small businesses until the end of the year to allocate the funds (vs end of June previously) which prolongs the support from the program. However, the magnitude of the support is lessened given that the size of the program has not changed and it was initially designed to help small businesses get through a shock lasting roughly two months.

- State & local aid: the CARES Act allocated $150bn to state & local governments to be used for unexpected coronavirus-related costs. But this did not address the revenue shock state and local governments have experienced. According to the National Conference of State Legislatures (NCSL), 29 states and DC expect FY 2021 general fund revenues to be lower than their pre-COVID projections. Without aid, these governments will be forced to make further cuts to employment and services.

Quantifying the impact

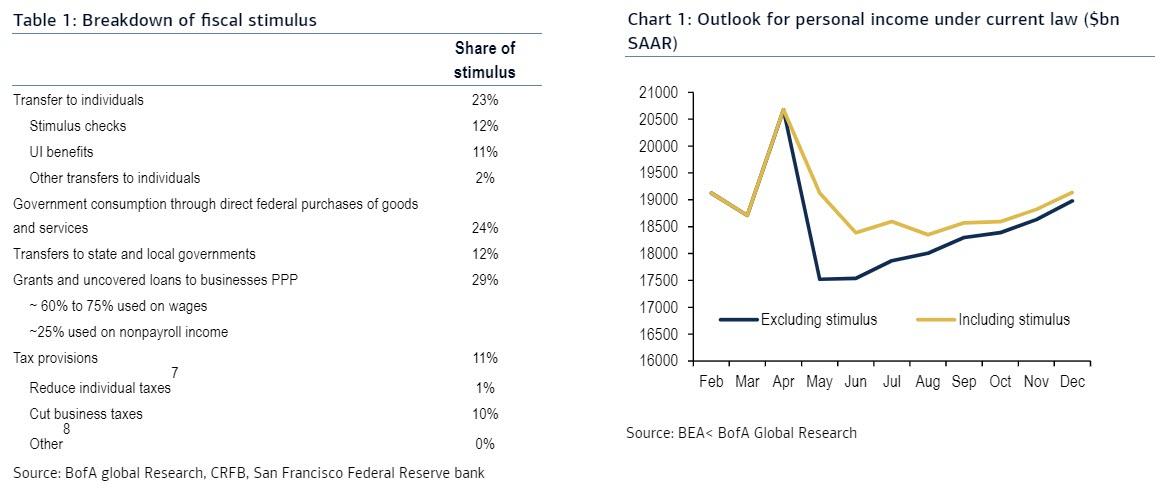

In Table 1, BofA groups the stimulus programs to date into major sectors. About 23% of the funds have been directed toward households to offset the significant strain on household incomes from massive job cuts. Moreover, if you include the required wage portion of the PPP loans, the household share of stimulus is over 40% of funds.

The good news is that these measures have worked. Personal income jumped 10.5% mom SA in April. An $879bn annualized decline in compensation was offset by a $2,999bn increase in transfer payments, of which $361bn was from unemployment insurance. Given that PPP was first getting underway in April BofA assumes it had little/no impact on labor income in April. If one nets out the boost from stimulus checks and unemployment insurance, personal income would have declined by 5.6% mom SA in April vs. the 10.5% reported increase.

In line with expectations, and the fading of a fiscal impulse, last Friday we observed a sizeable decline in personal income given that the boost from stimulus checks declined substantially compared to April. Looking ahead to June, BofA expects another drop in income as people shift back into the labor market from unemployment insurance. Given that the majority of those on unemployment insurance earned more from benefits than when they were working, the move back to employed will actually be a net negative for overall income. Indeed a recent paper (Ganong et al. 2020) found that roughly two-thirds of UI recipients are earning more than their lost wages.

The big question is what happens in August?

This will be the first month following the “cliff”. The current law calls for the additional $600/week to expire. Based on BofA’s forecast for the labor market, continuing claims in August could still be running around 16mn, up by nearly 15mn from the pre-COVID February levels. Assuming it is 16mn, the loss of the $600/week benefit would translate into roughly a $36bn drop in income in August, or a 2.3% mom decline.

The Payroll Protection Program (PPP) has also underpinned labor income. The Small Business Administration (SBA) has approved $516bn in PPP loans. Under previous rules, 75% of those funds had to go to payrolls over an 8 week period in order for the loan to be forgiven. As such, this would translate to $387bn in support for labor income, mostly in May and June. The law has since been amended such that businesses only need to use 60% of the funds for payroll costs over a 24 week period. However, no changes were made to the maximum size of the loan, which is the lesser of $10mn or 2.5x 2019 average monthly payrolls. While the changes will help businesses stay afloat as they deal with reduced demand, it also means that the support for labor income has been substantially reduced and spread out.

From income to spending

Clearly there has been a significant boost to personal income from stimulus. But now it is time to consider how this filters into the real economy via consumer spending. The biggest jolt to spending likely came from the stimulus checks. A paper from the Chicago Fed (Karger et al. 2020) found that in the two weeks after households received their stimulus check, they spent roughly 48% of it. Then spending fell back to normal levels. Based on analysis with aggregated BAC card data, the bank similarly found that the bulk of the incremental spending from the stimulus checks occurred over a 5-day period following receipt of the money.

Meanwhile, the path of consumer spending will be impacted by the trajectory for unemployment insurance. A paper from Ganong found that spending on nondurables declined by less than 1% while people were receiving UI, but at exhaustion dropped by 12%. Not extending the program would mean a 2.3% decline in personal income in August. Given the high propensity to consume out of unemployment insurance this would be a similarly sized hit to consumer spending in August.

However, by extending the program, the unemployment rate is also likely to be stickier as people have an incentive to stay out of work. Indeed, a recent analysis from the CBO found that if the program was extended as is through the end of the year then 5 out of 6 recipients would earn more on unemployment than they would if they were to return to work. They estimate that while this may boost GDP this year it would be a drag on growth next year. If the program was instead allowed to expire, presumably the unemployment rate would fall faster and more people would return to work. However, even with greater engagement in the labor market, income would still decline given that unemployment insurance is more generous and many workers will find challenges returning to the workforce.

The state and local stress

In addition to the impending “cliff” for household income, many state and local governments are facing a concerning revenue outlook as they move closer to the start of FY 2021. According to CBPP (Center on Budget and Policy Priorities), initial estimates of the revenue impact from the COVID-shock indicate that state revenue could drop in FY 2021 by more than it did during the Great Recession. States will be forced to tap into their rainy day funds first before ultimately making cuts to spending to offset the revenue shortfalls, as they are required to balance their budgets. Indeed, governors in Ohio, New Jersey and Georgia have already asked state agencies to prepare for sizeable cuts to spending. Indeed state & local government have already started to cut jobs – in the April and May employment report, state and local governments shed nearly 1.6mn workers.

Congress to take action in late July/early August

Republicans and Democrats are at odds over whether to extend the expanded unemployment insurance program for obvious reasons. The Democrats in Congress generally advocate for a full extension as was passed in the HEROES Act but Republicans are resisting, arguing that the generosity of the program has discouraged a return to work. A middle ground may be a smaller dollar amount (perhaps $250-300/ week) with back-to-work bonuses that will create an incentive to return to the workforce.

On state & local aid, the HEROES Act called for close to $1tr in relief. While this number is unlikely in our view, a bipartisan bill proposed by Senator Cassidy (R-LA) and Senator Menendez (R-NJ) proposed in May would allocate $500bn in aid to state and local governments. The ultimate number will likely be nearer to that number than the amount from the HEROES act.

There has also been some talk of another round of stimulus checks with President Trump affirming “Yeah, we are” [going to do another stimulus check], and White House Economic advisor Larry Kudlow saying that a second round would likely happen but be more targeted. While this also showed up in the Dem’s HEROES Act, some Republicans in the Senate (Sen. Toomey (R-PA) and Sen. Cornyn (R-TX)) have voiced opposition to another round recently. Republicans have generally raised concerns that stimulus checks are not the most efficient way to target those who are most in need.

The White House has also been calling for other measures such as a payroll tax cut and an infrastructure package, although neither of these are likely as the payroll tax cut would only help those who still have a job while an infrastructure bill is unlikely to be tackled until after the election.

In summary, after July 31 the US economy is set to fly off a fiscal cliff that could be just as painful as what happened in late March/April unless there is a bipartisan agreement in Congress on trillions more in fiscal stimulus. The clock is now ticking.

via ZeroHedge News https://ift.tt/2NC70lU Tyler Durden