Record Foreign Demand For Spectacular 30Y Treasury Auction

Tyler Durden

Thu, 07/09/2020 – 13:15

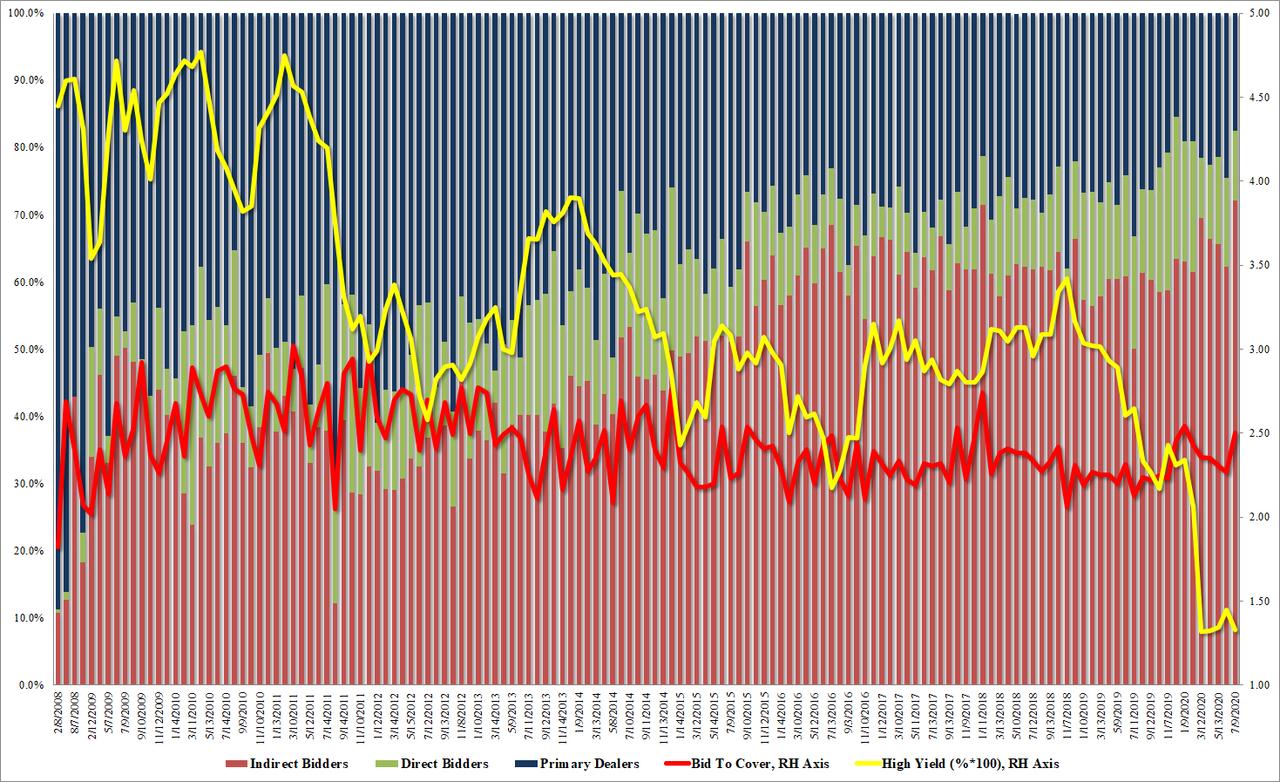

If yesterday’s 10-Year reopening auction was blockbuster, then today’s just concluded sale of $19BN in 30Y paper was spectacular.

Pricing at a high yield of 1.330%, the auction stopped through by a whopping 2.7bps, the most in at least four years. And while it wasn’t the lowest yield ever for a 30Y auction unlike yesterday’s 10Y, it was just 1 basis point higher than the all time low 30Y auction hit in March when the auction priced at 1.32%.

The Bid to Cover saw an impressive jump from both the June and recent auction, rising to 2.50, above June’s 2.265, and above the six auction average of 2.37%; it was also the highest bid to cover since January.

Finally, the real surprise was in the internals, where Indirects took down a record 72%, as foreign central banks, reserve managers and private buyers seemingly couldn’t get enough, and with Directs taking down 10.5%, Dealers were left with just 17.4%, which while not quite the lowest ever (that was 15.5%) was the second lowest in history.

Overall, a stellar auction which saw blockbuster demand with foreigners now flooding US paper thanks to favorable USD-hedging dynamics (thanks Fed), and which sharply flattened the curve in kneejerk response, sending 10Y and 30Y yields tumbling.

via ZeroHedge News https://ift.tt/3gFMQ75 Tyler Durden