Federal Reserve Unhinged

Tyler Durden

Thu, 07/09/2020 – 18:00

Submitted by Joseph Carson, former chief economist at Alliance Bernstein

Since the pandemic tanked the economy in March the Federal Reserve has expanded its balance sheet by nearly $3 trillion to support the financial markets and asset prices. The injection of Fed liquidity into the financial system has roughly matched the $3 trillion in fiscal stimulus that Congress authorized to send stimulus checks to people, offer additional assistance to newly unemployed people, and provide loans to businesses.

Federal Reserve officials have also promised “unconditional support” as long as the pandemic continues to plague the financial markets and the economy. Never before has a group of non-elected officials been given unchecked authority and unlimited financial resources.

In 1996, a speech by Federal Reserve Chairman Alan Greenspan titled “The Challenge of Central Banking in a Democratic Society” is best remembered for the phrase, “ How do we know when irrational exuberance has unduly escalated asset prices”? But also in the speech, Mr. Greenspan stated, “Our monetary policy independence is conditional on pursuing policies that are broadly acceptable to the American people and their representatives in the Congress”.

Little did Mr. Greenspan know at the time that future Federal Reserve officials would concoct a twisted set of policies that offer incentives and protection to investors, and in the process unduly escalate asset prices.

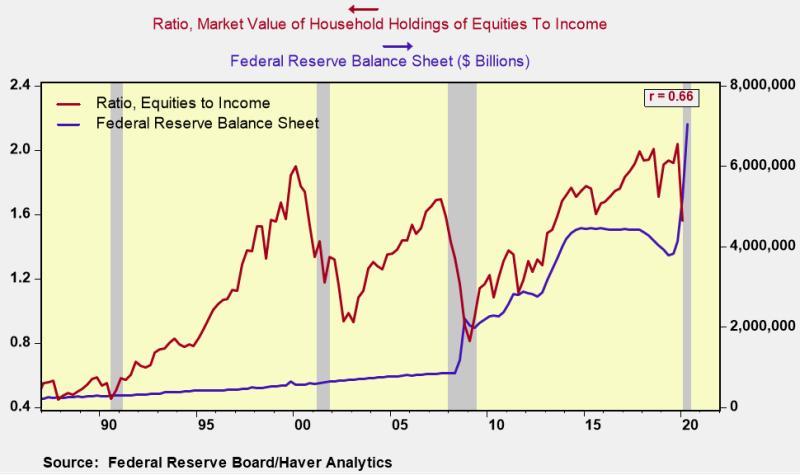

In 1996, the same year as Mr. Greenspan speech, the market value of household equity holdings, directly and indirectly, owned matched the annual flow of disposable personal income. Since then boom and busts in asset prices pushed the ratio as high as 2X and slightly below the levels of 1996. (Note: In the chart below the latest observation for the ratio of equities to income is Q1 2020, while the data on the Federal Reserve balance sheet is through the end of Q2 2020.)

There is nothing unusual for wealth cycles to outpace economic and income cycles, on the way up, and on the way down. But what has been unusual are the actions of policymakers.

Each time asset prices dropped hard pulling the ratio towards 1996 levels policymakers engaged in a series of monetary maneuvers to reverse the trend. That happened in the early 2000s during the tech bubble, following the Great Financial Recession in 2008/09 and also in Q1 2020. However, the opposite did not occur when asset prices soared pushing the ratio of equities to income to record highs at the end of 2019.

Wealth creation, driven by growth and innovation, has always been an important feature of the US economic system. But wealth creation directly linked to monetary policy maneuvers are arbitrary and create unfair, unbalanced, and unsustainable outcomes.

Congress will soon be debating whether to extend “conditional” unemployment compensation to millions of displaced workers. Opposition to the extension centers on creating disincentives to work while some also worry about adding to the record budget deficit.

Critics are right to point out that workplace distortions can be caused by paying people more to not work that what they could earn working. But monetary policies that offer protection and incentives to investors can easily cause distortions in finance as they do in the workplace.

Citing the budget deficit, as an argument against extending unemployment benefits is rather weak. The same critics have no reservation or qualms about the Federal Reserve printing more money to offer protection and incentives to the financial markets and investors.

Proponents and beneficiaries of the current system have too much to lose to change. So my bet is that change will only come if voters decide to elect a new Administration and Congress.

Before the pandemic, 70% of Americans thought the system favored the wealthy and the special interest groups. No doubt that percentage is as high or higher given the unevenness in policies and outcomes since the crisis started.

There’s an old saying, “If you build it, you own it”. The Federal Reserve owns the unfair system they created, and all the problems and changes that come with it. It’s impossible to make the system fairer if you don’t change policies, mandates, and charters that distort incentives and produce uneven outcomes. Policymakers are forewarned as investors should be as well that elections could trigger a lot of fundamental change.

via ZeroHedge News https://ift.tt/328IvoK Tyler Durden