Cryptos Are Spiking Again: Ether At 2-Year Highs, Bitcoin “Perfectly On Track” For $100k

Tyler Durden

Sat, 08/01/2020 – 14:55

The incessant fall in the dollar and surge in global negative-yielding debt appears to continue to push the global citizenry into alternative assets, such as precious metals and cryptos.

Source: Bloomberg

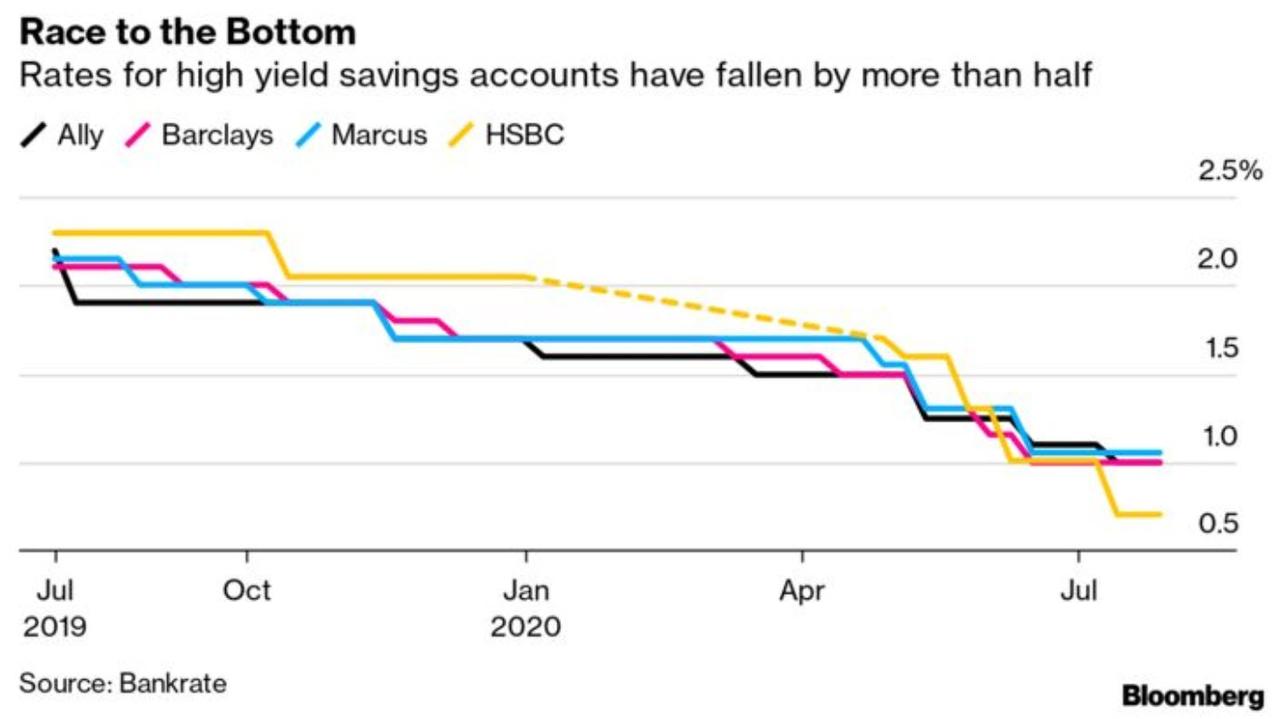

And, as CoinTelegraph’s Michael Kapilov notes, a recent Bloomberg article claims that Americans are foregoing the safety of the dollar. Because of the COVID-19 lockdown, the personal savings rate in the U.S. is at a historic high. The yield offered by the financial institutions on savings accounts, however, is close to zero. At the same time, assets as Bitcoin, equities, and gold, all have made double-digit gains since March. This is making them an attractive option for investors.

Source: Bloomberg.

The article mentions a 28 year-old Californian, who told the reporter that he is going to convert his $15,000 savings held in a high-yield savings account at Ally Bank into Bitcoin. He says that he is doing so because he expects long-term economic stagnation.

image courtesy of CoinTelegraph

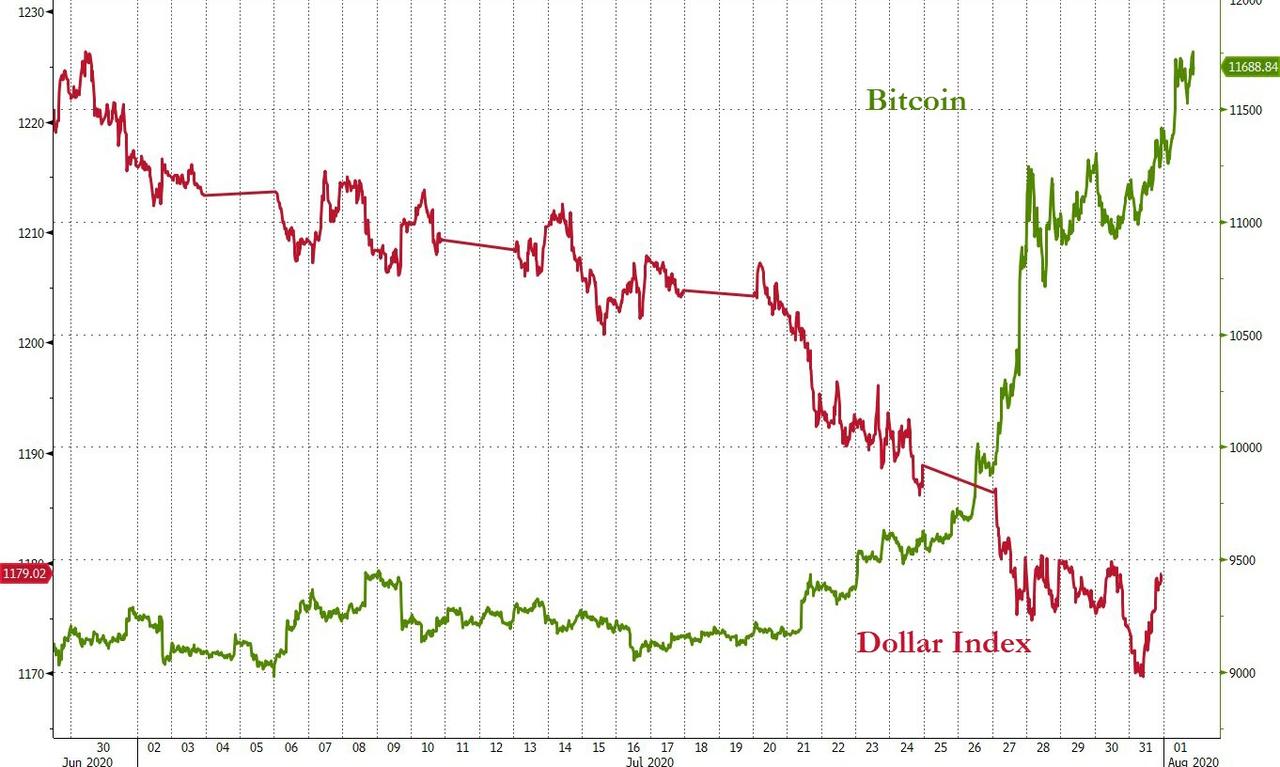

July was USD’s worst month in a decade

The reality is even worse than what the Bloomberg article posits. It is no secret that the dollar is rapidly depreciating against other leading fiat currencies. In fact, according to the Financial Times, July is the dollar’s worst month in a decade.

Bitcoin and U.S. Dollar Index (DXY) July 2020.

With another round of stimulus checks around the corner and most of the nation still affected by COVID-19 restrictions, it is possible that this problem will only get worse. Americans may likely have more depreciating fiat on their hands in the short term, and could seek to convert their holdings into higher-yielding assets. However, there is no such thing as a free lunch. In the investment world, high-return comes with high-risk.

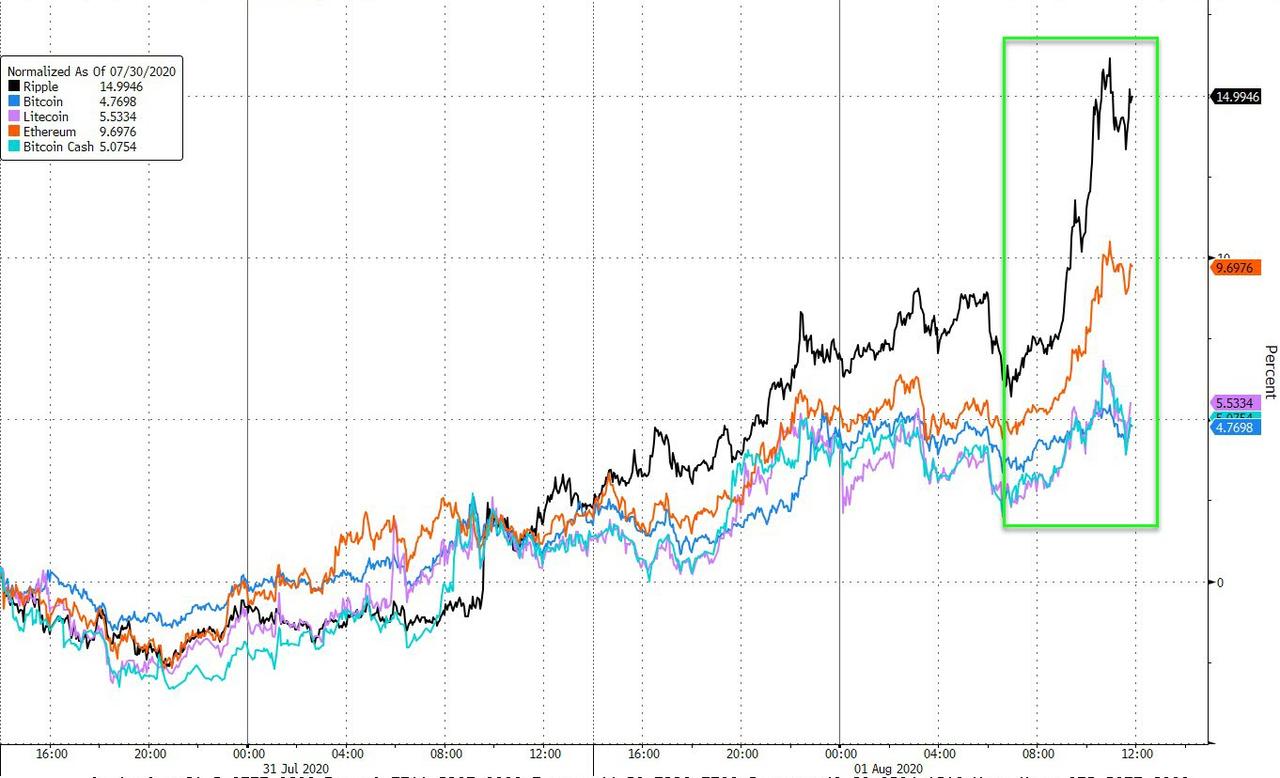

And the gains are increasing this weekend…

Source: Bloomberg

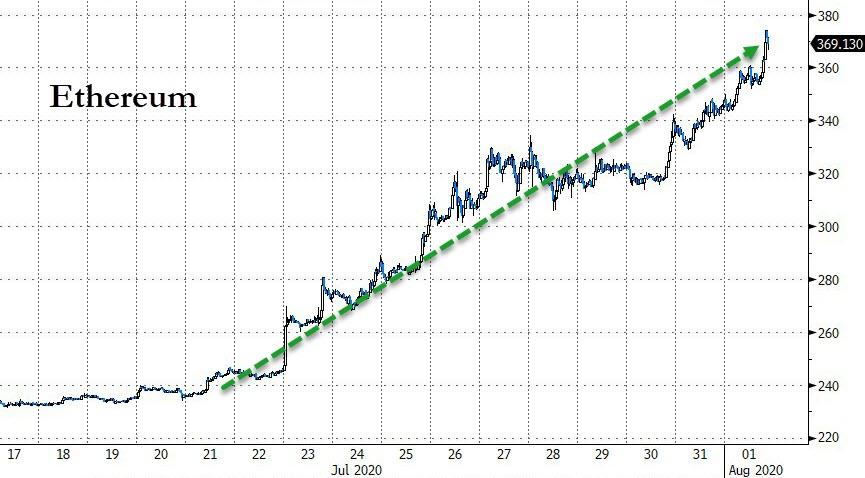

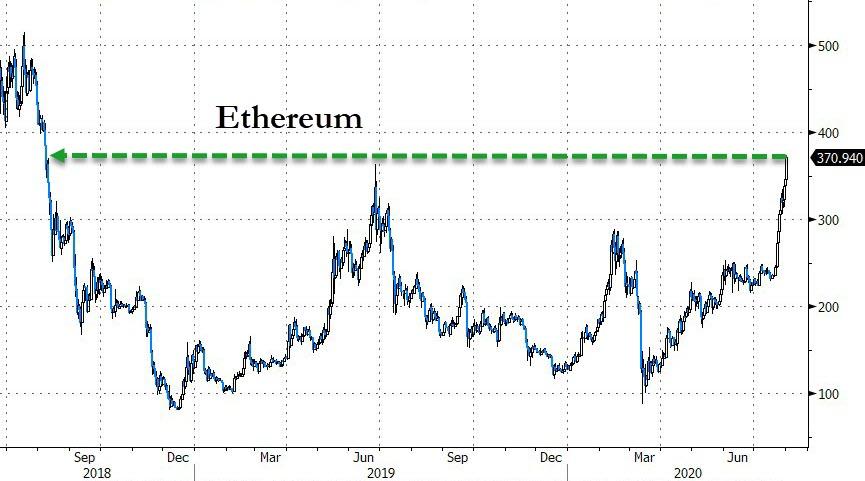

Ethereum is now up 12 of the last 13 days…

Source: Bloomberg

Soaring to its highest in two years…

Source: Bloomberg

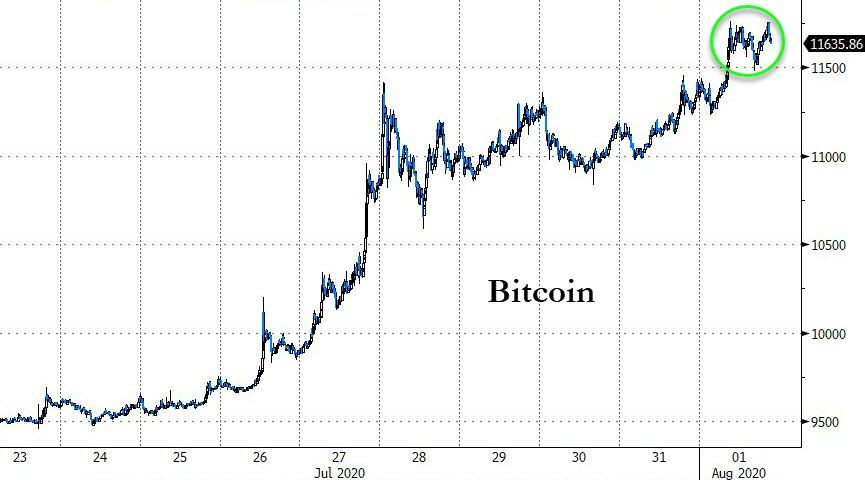

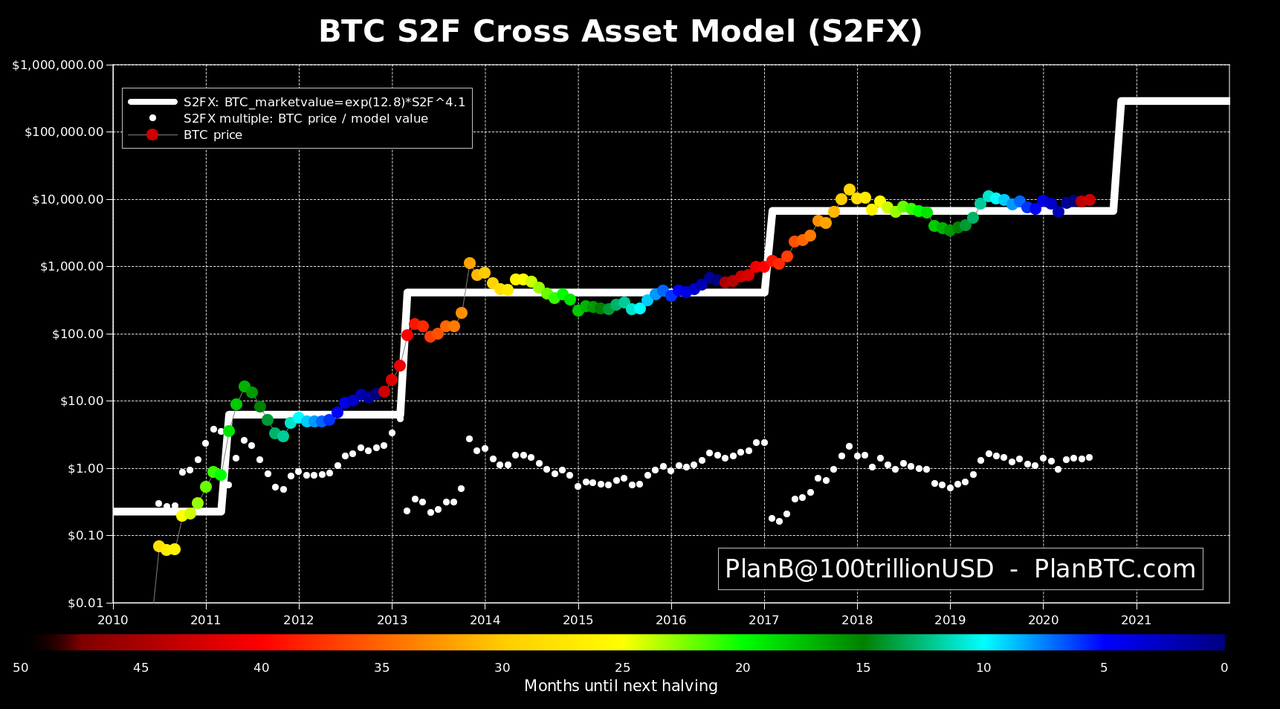

And Bitcoin surpassed $11,700 as CoinTelegraph’s Joseph Young notes that the creator of the Stock to Flow model says BTC to $100,000 is well on track.

Source: Bloomberg

PlanB, the well-known creator of the contested stock-to-flow (S2F) model, believes Bitcoin (BTC) is now well on track to reach $100,000 as the price has risen to yearly highs. The optimistic sentiment coincides with the shift in momentum from alternative cryptocurrencies, or altcoins, to BTC.

He said:

“I can’t make a chart for you now (at sea), but S2F model perfectly on track.”

At the same time, the price of Bitcoin has increased by 17% this week, as it broke through a major three-year trendline. As Cointelegraph reported, traders seemingly expect BTC to test higher resistance levels in the near term.

The price of Bitcoin surpasses $11,700 on its way to $100,000

Data shows it might be the time for Bitcoin to shine

Altcoin declined particularly in the past 72 hours when the price of Bitcoin started to rally. Ethereum’s Ether (ETH) moved in tandem with BTC throughout the rally, but it slumped against BTC in the past two days.

In the short term, as Bitcoin sees a profit-taking rally from altcoins, some investors expect BTC to outperform altcoins. Kelvin Koh, the co-founder of Asia-based venture capital firm Spartan Group, said:

“If BTC breaks the resistance at $11.4K, we are going above $12K in no time. Will take the wind out of alts again short term.”

The pattern of a Bitcoin rally following a strong altcoin season is not new. In previous cycles, the top cryptocurrency typically saw a sharp uptrend after altcoins initially gained against BTC. Such a trend materializes because investors seek safer options, like BTC, when the altcoin market gets overheated.

Most recently, the fear of missing out, or FOMO, of retail investors around DeFi led small market cap tokens to surge substantially. In the early days of the DeFi market craze, for example, Compound (COMP) saw a major rally. Then, smaller tokens, including Yearn Finance (YFI), Synthetix Network (SNX), and Aave (LEND), followed.

Eventually, as small tokens saw five to ten-fold spikes in price, investors started to take profit. The abrupt pullback of DeFi tokens coincided with a BTC rally as momentum shifted back to Bitcoin.

Traders say the trend is still up

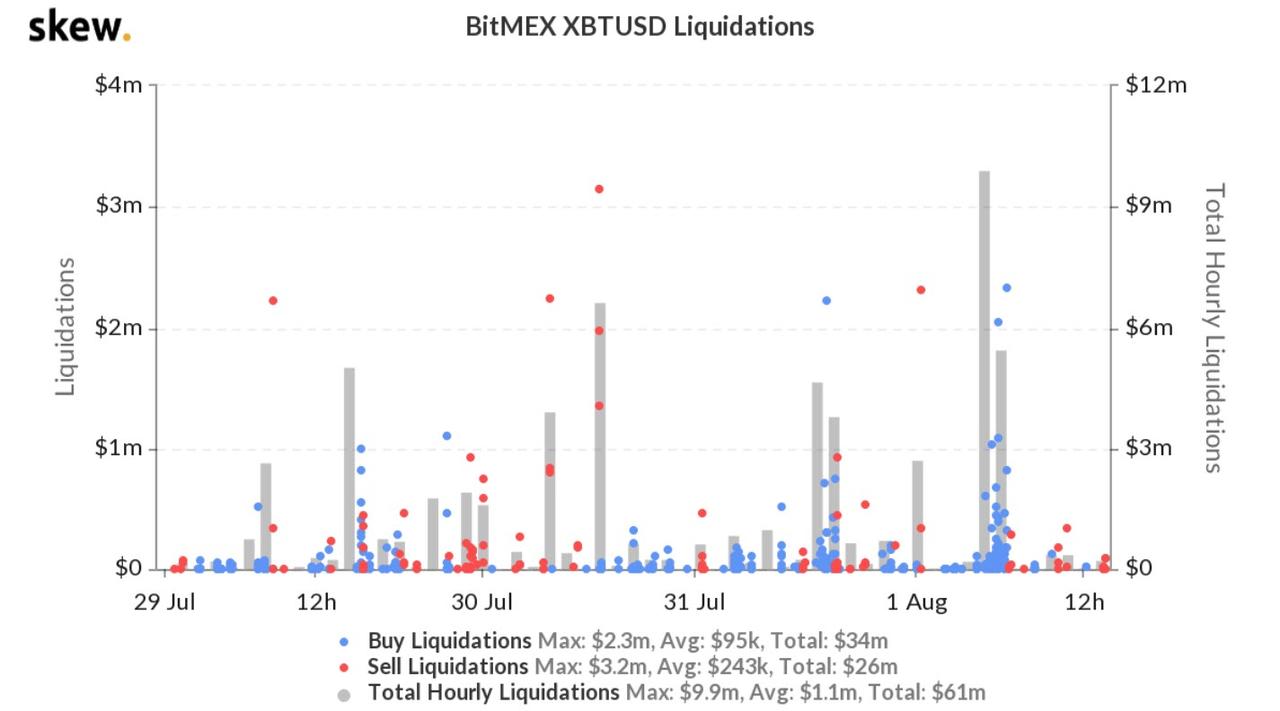

Data from Skew shows that tens of millions of dollars worth of short contracts are still getting liquidated. It indicates that a relatively large number of investors are betting against BTC in the near term.

Bitcoin liquidations on BitMEX. Source: Skew

Cryptocurrency trader Cantering Clark said that while he understands why shorts are compelling, the upward trend is too strong. He said:

“Looking at trades from the standpoint of R:R is good, but understanding context is superior. After a major contextual change like this, you can assume that your shorts have a lower probability of resolving successfully. Bets should be on strength always showing up.”

For some traders, a short against Bitcoin could be attractive because BTC has increased steeply in the past week and is testing major resistance levels.

A 17% rally in six days — even during a bull market — is substantial, even for Bitcoin. But when the trend of BTC is overwhelmingly bullish, a short squeeze could only add more rocket fuel.

In the last 12 hours, more than $23 million worth of shorts were liquidated, for example, as the price hit as high as $11,750. Thus, during a strong upward price trend, shorts could indirectly catalyze a larger rally.

via ZeroHedge News https://ift.tt/3fi2N23 Tyler Durden