Stocks Suffer Worst September Since 2011 As Dollar & Election Doubt Soars

Tyler Durden

Wed, 09/30/2020 – 16:01

On the day, it was a story of stimulus hype, hope, nope, and rope-a-dope. Overnight weakness apparently suggested a Biden win, but then the buying panic was shrugged off as meaning the market liked Biden’s plan? Pelosi’s “hopeful” comments sparked early exuberance. Mnuchin meeting details added to the hype. And then McConnell told the truth late on that the two sides were “very very very far apart” and it all dumped…only to be ripped higher into the close!

The other big intraday news was the direct listing of Palantir, which opened at $10 and did not end well…

* * *

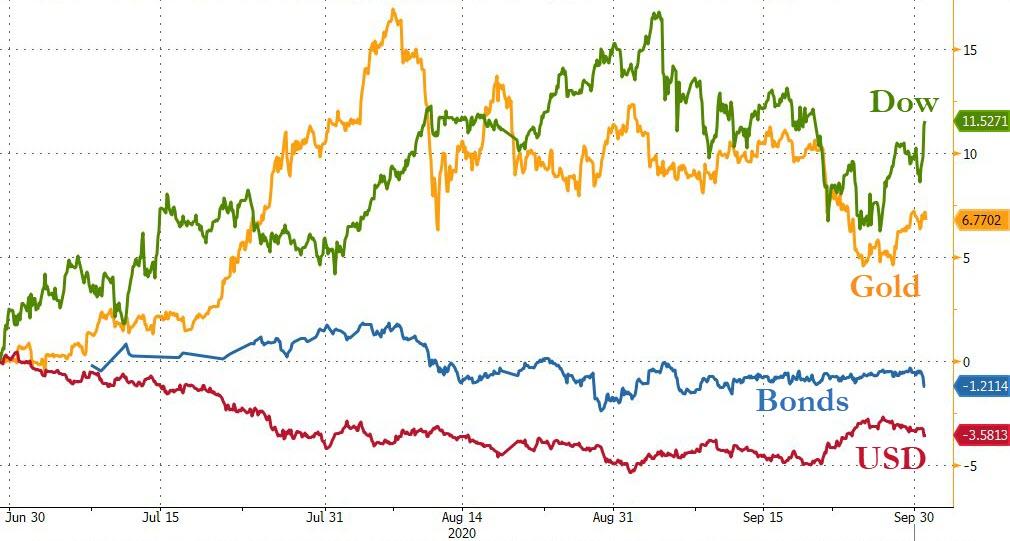

Q3 saw stocks and gold outperform as the dollar and bonds weakened…

Source: Bloomberg

But, in September, the story was reversed with gold and stocks slammed while the USD was bid and bonds erasing their gains today…

Source: Bloomberg

Which is “inconceivable” since “stocks only go up”?

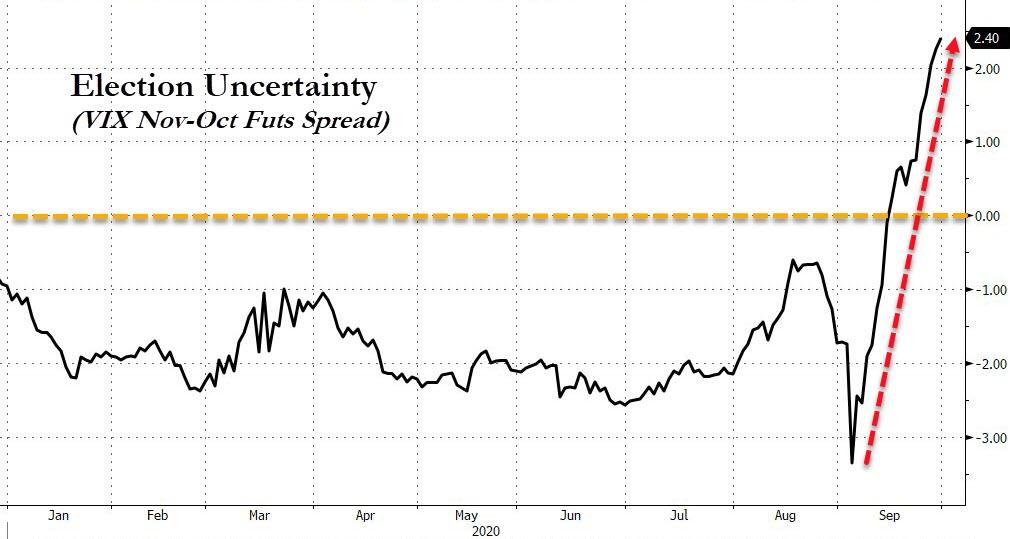

Election uncertainty has screamed higher in September…

Source: Bloomberg

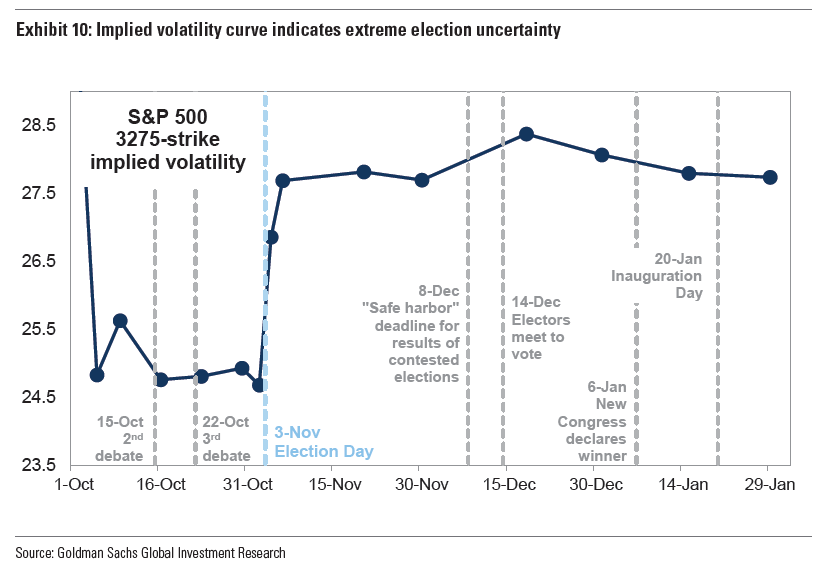

And as the following chart suggests, that vol may be here to stay for a while after the election…

Source: Goldman Sachs

Which may have weighed on stocks in September – pushing the S&P to its worst September since 2011, and Nasdaq was the worst of the US majors on the month…

Source: Bloomberg

While most of the majors all retraced their exuberance in September, Dow Transports held on to notable gains during Q3…

Source: Bloomberg

Despite the bounce in equities and the reflation trade from last week’s lows, credit markets have not showed the same strength in the past week. Single-B credit spreads are the widest relative to BBB spreads in over a month and continue to widen. Bottom line: the weakest links in the credit arena are getting worried.

Source: Bloomberg

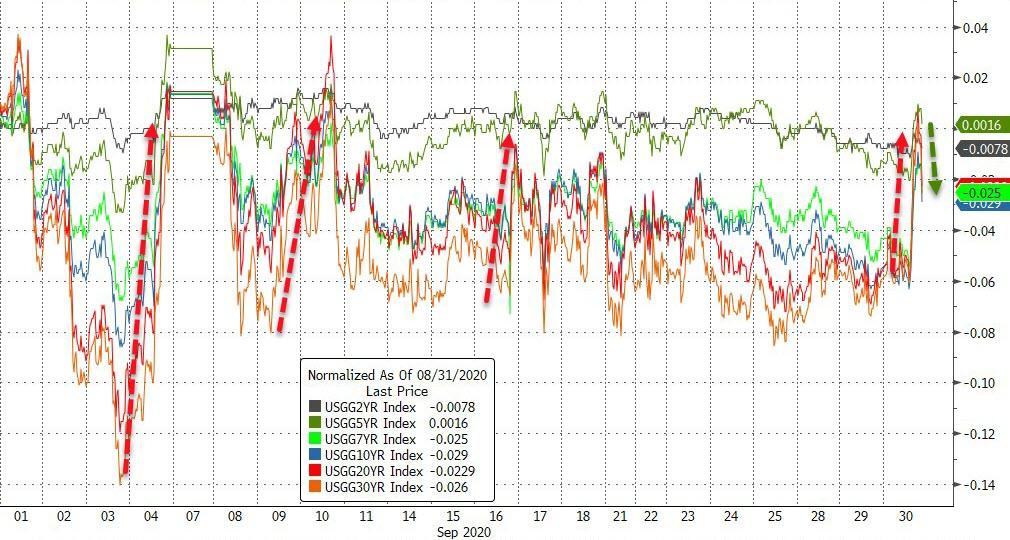

Treasury yields spiked overnight (to unch on month) on stimulus hopes (and a Biden win?) but McConnell poured cold water on it all late on and sent yields lower for the month…

Source: Bloomberg

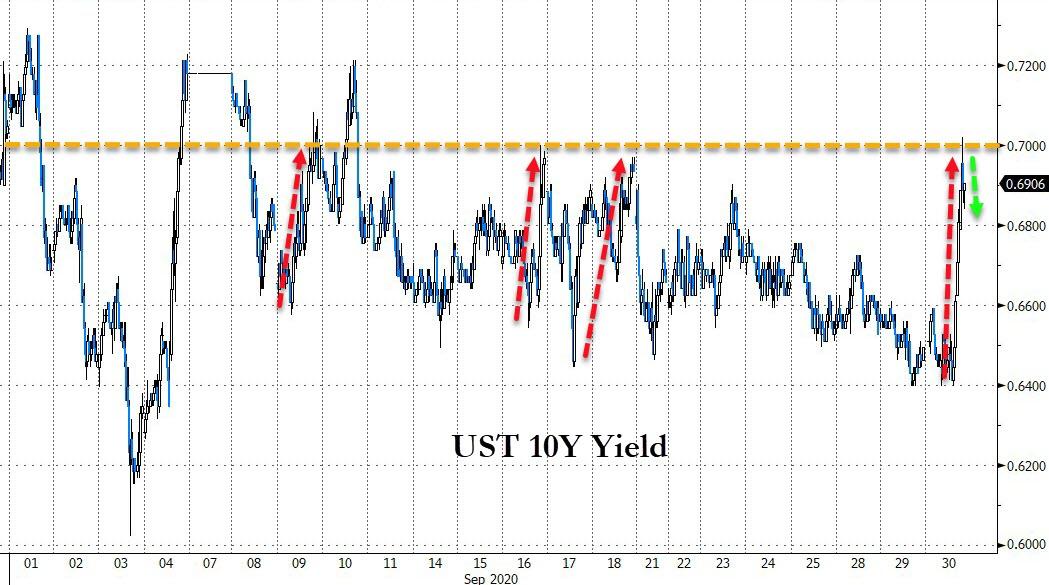

10Y Yields spiked hard today (perhaps on post-debate Biden-win fears) but reversed perfectly at unch for September around 70bps after McConnell poured cold water on stimulus hopes…

Source: Bloomberg

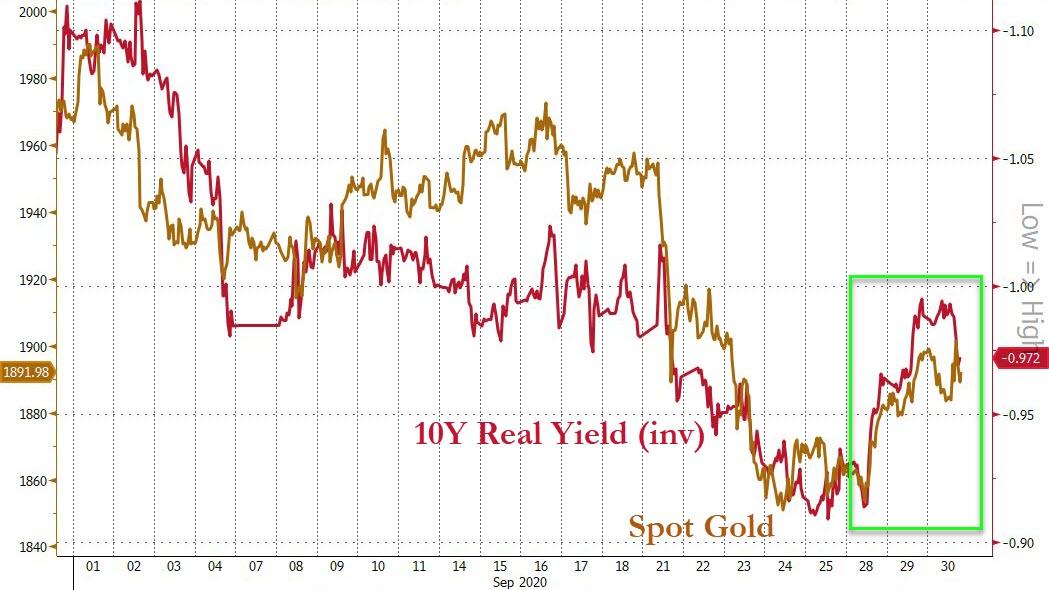

Real yields surged in September (dragging gold lower), but the last couple of days saw some of that reverse…

Source: Bloomberg

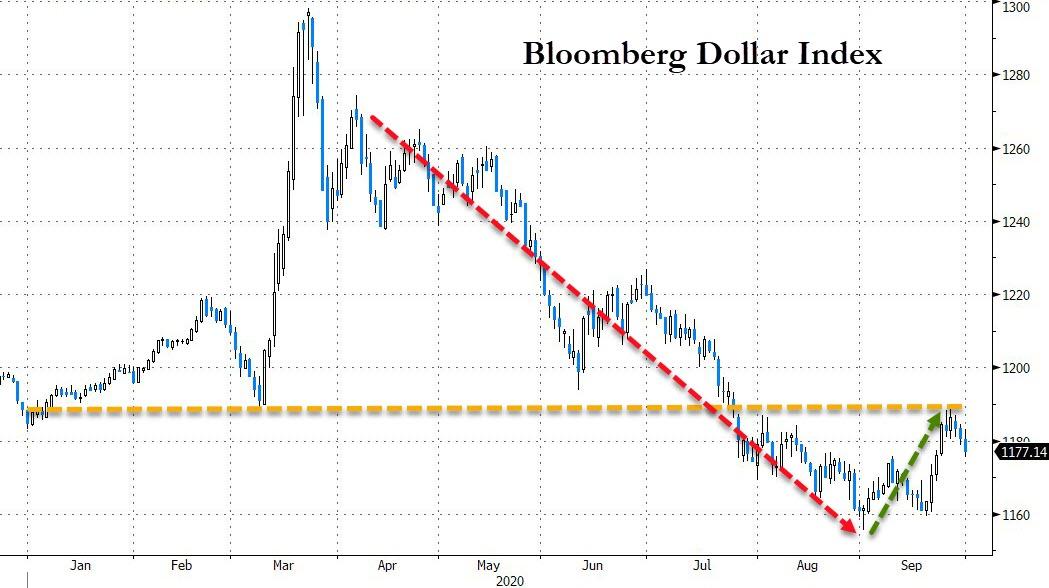

The dollar rallied in September – its first positive month since March – but note that the USD has reversed in the last few days after tagging key resistance…

Source: Bloomberg

China’s yuan strengthened for the 4th straight month and Q3 was its best quarter since Q1 2008…

Source: Bloomberg

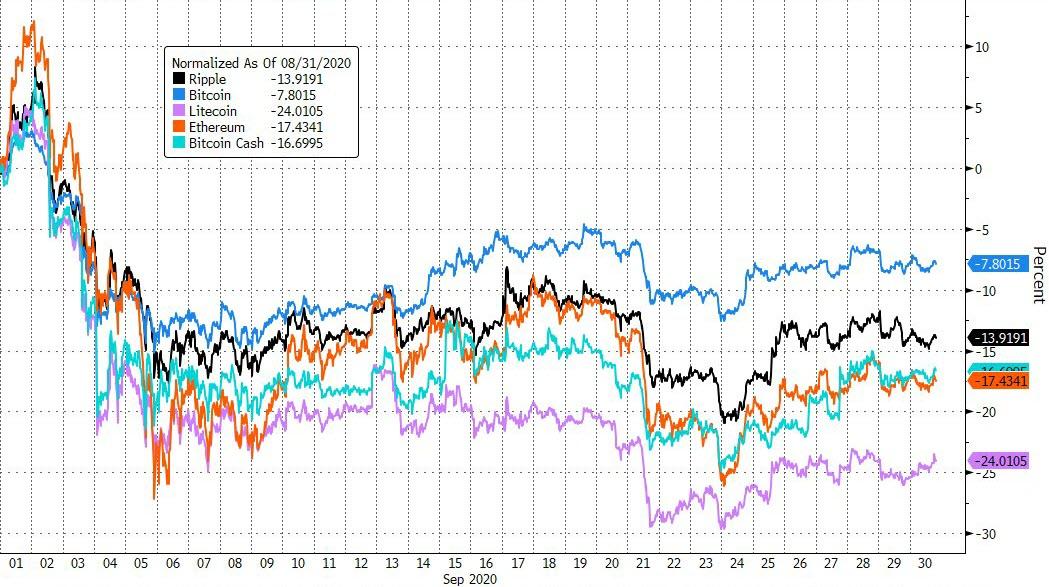

Bitcoin had its worst month since March, unable to bounce back above and hold $11,000…

Source: Bloomberg

But Bitcoin outperformed in September with Litecoin worst…

Source: Bloomberg

But Ethereum was a massive outperformer in Q3…

Source: Bloomberg

All the major commodities were lower on the month, as the USD rallied, led by silver…

Source: Bloomberg

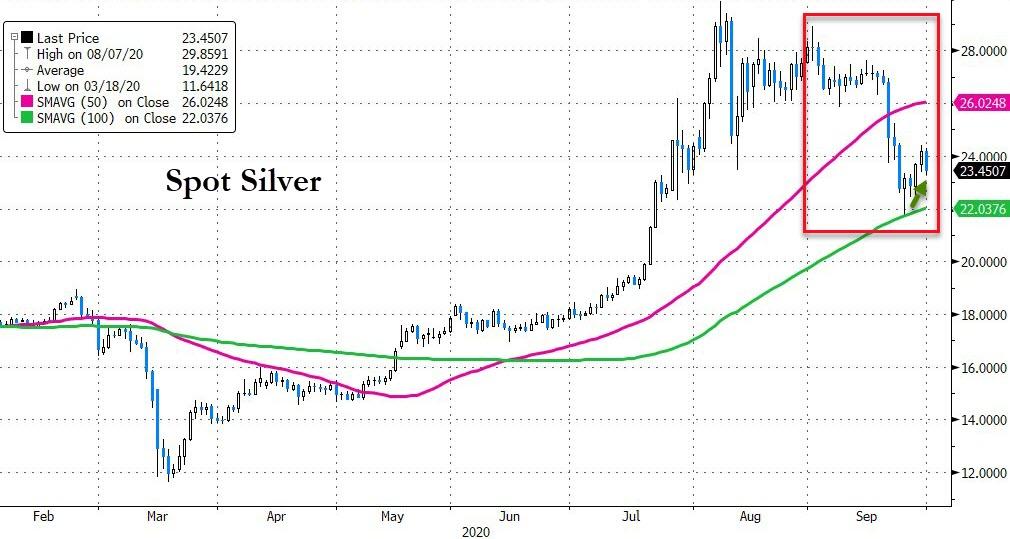

Silver’s collapse in September was the worst month since September 2011 (note that Silver bounced off its 100DMA in the last few days)…

Source: Bloomberg

Gold dramatically outperformed silver in September (the first since March) as the gold/silver ratio bounced off 70x…

Source: Bloomberg

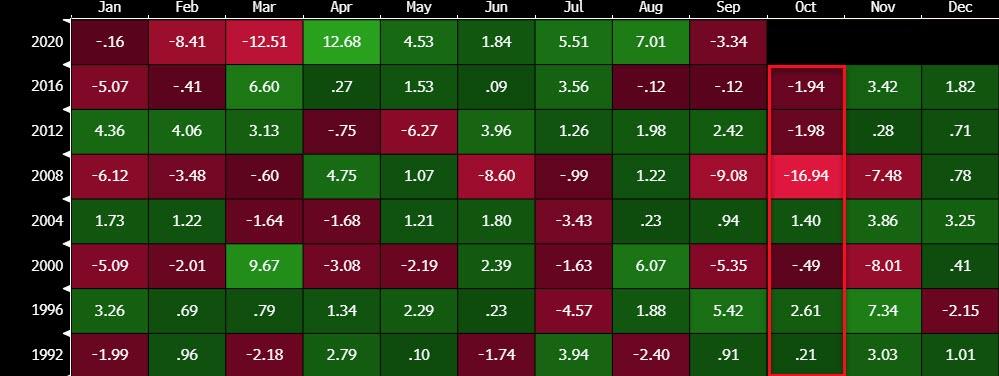

Finally, after an ugly September, history shows that election-year Octobers usually aren’t kind, either. As Bloomberg notes, on average, the S&P 500 has lost 2.5% in October over the past seven election years (since 1992), the worst performance of any month during those years.

Source: Bloomberg

Even excluding the 17% decline during the financial crisis in 2008, October posted an average loss of 0.03% compared with a gain of 1.65% in November, pointing to the risk premiums ahead of the votes.

via ZeroHedge News https://ift.tt/30m5Gup Tyler Durden