The Urban Exodus – Will They Or Won’t They Come Back?

Tyler Durden

Wed, 09/30/2020 – 21:20

Submitted by Philip Fischer, founder of eBooleant Consulting, LLC; previously he was Managing Director, Head of Fixed Income And Municipal Bond Strategy, Global Bank & Markets, at Bank of America Merrill Lynch.

Years before this pandemic began, I gave a speech at the Library of Congress in Washington DC on “Science and the Literary Imagination.” It was an exploration of the ways in which the limits of literary thought were stretched by the possibilities introduced by scientific discovery.

Now, I think it is timely to think how this era of great scientific discovery has stretched the risk and return potentialities in economics. The growth of the tech giants makes the return potential clear. But the scientific risk component of systemic risk is also clear.

There should be no doubt that I favor the acquisition of scientific knowledge and in any event, we have little, if any, ability to keep the Genie in the bottle. But the acquisition of knowledge creates new states of nature to price. These include genetic manipulation and air conditioning.

Here we should note that discoveries are discoveries specifically because they are uncorrelated with current events. As such, scientific discoveries are unhedgable. In my last blog entry, I commented on the role that pandemics play in inducing mass migrations. Whether this virus itself is a “natural” or man- made disaster remains unresolved. The pandemic, however, was clearly facilitated by the amalgamated collection of technology facilitating its spread. And the role of technology in this cycle of municipal depopulations needs to be considered carefully in light of the many discoveries made in recent years.

They are leaving because they can

The press is replete with stories about the exodus from major American cities. And has been so for a long time. A September 2019 Forbes article “New Yorkers Are Leaving The City In Droves: Here’s Why They’re Moving And Where They’re Going” seems almost quaint now.1 The Mayor of New York was trying to run for President of the United States while the moving vans were going into overdrive on the East Side of Manhattan. Much of the interstate migration was the product of tax policy in the blue states. And that was in the good times.

And, then as now, economists disregarded the depleting populations of the large American population centers. “It has long been a tenet of municipal finance that residents so love their cities that they are largely indifferent to their taxes. This is belied by the experience of the past two decades.”2

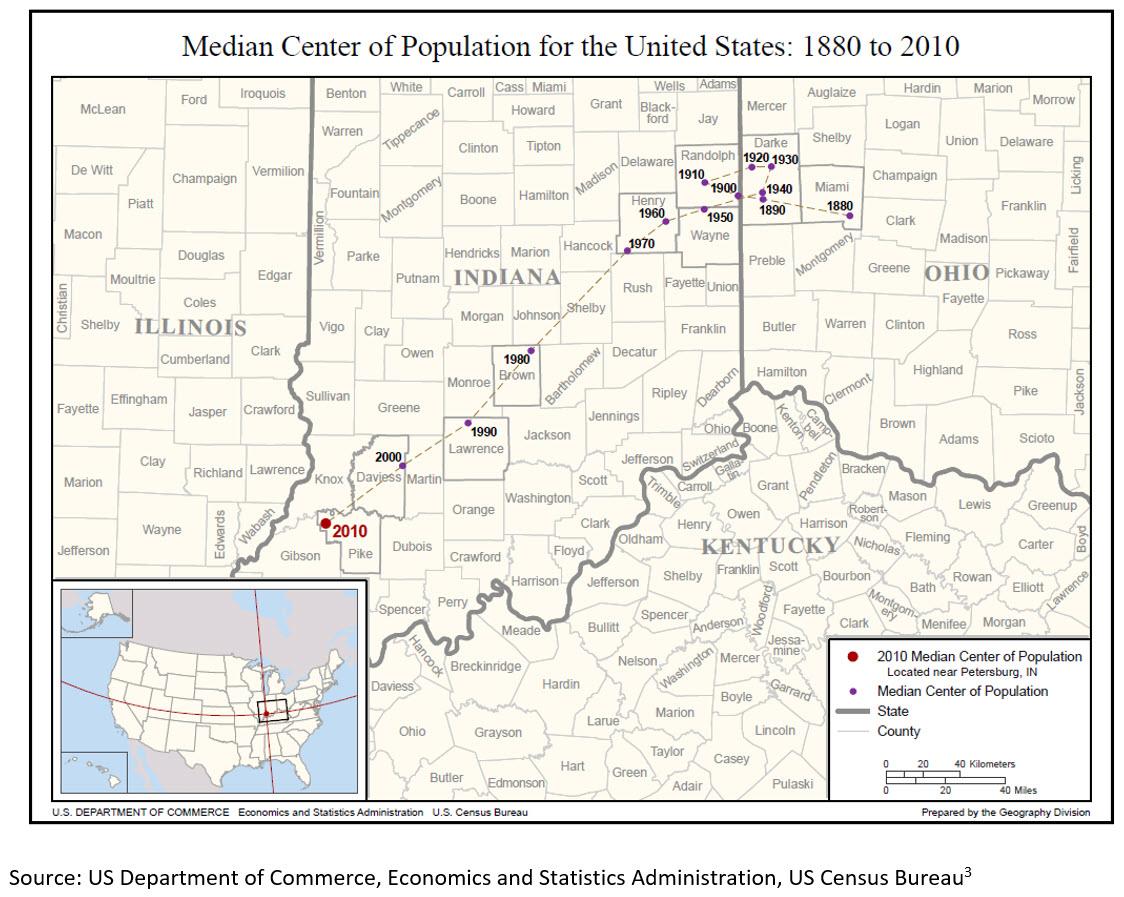

While a few places like New York City and Boston have managed to buck the general malaise, most cities in the Northeast and North Central United States have faced a multigenerational decline. In fact, the Census Department’s graph of the center of the US population, illustrates as well as any, the relentless thrust of the population west and south.

While the westward shift of the population occurs for many reasons, we are concerned with one particular item. That is the role of technology in the decline of the Eastern states. And here one invention is particularly relevant. While there are many places where air conditioning drove demographics, the deserts of the Southwest for example, it is in the East where its impact is most relevant. The invention of air conditioning was an important factor in the Eastern cities losing their relative advantage to the South.

Perhaps the best example was Washington DC where the adoption of air conditioning was a significant factor in converting a sleepy southern city into a governmental mega city.4

And the analog to air conditioning this time is telecommunications. Those leaving the cities add the ability to work remotely to the increasing taxes and decreasing quality of life in deciding whether to return. Municipal finance needs to respect the change in technology. It adds another credit negative to these cities.

A discussion of municipal credit and technology can be very extensive and there will be a plethora of topics to consider in this blog. Nevertheless, we should note the point I made at the Library of Congress. Science imposes a discipline in our risk analysis. Ordinarily in financial analysis the black swans, low probability events, are just that, unlikely. In a more rigorous sense, however, we have to consider that discovery shortens our time horizon. In the limit, if innovation is fast enough, we are driven to say that if it is now possible that something can happen, it must happen.

* * *

[1] New Yorkers Are Leaving The City In Droves: Here’s Why They’re Moving And Where They’re Going

[2] Schramm, Carl. “Save America’s Dying Cities.” Issues in Science and Technology 36, no. 4 (Summer 2020): 62–70. https://issues.org/americas-dying-cities-carl-schramm-revitalizing-competitiveness/

[3] https://www.census.gov/library/visualizations/2010/geo/center-of-population-1880-2010.html

[4] Air-Conditioning Comes to the Nation’s Capital, 1928–60, Joseph M. Siry, Journal of the Society of Architectural Historians (2018) 77 (4): 448–472. https://doi.org/10.1525/jsah.2018.77.4.448

via ZeroHedge News https://ift.tt/3cWZBK1 Tyler Durden