Global Stocks Soar To Best Month Ever As Bitcoin Hits Record High

Tyler Durden

Mon, 11/30/2020 – 16:00

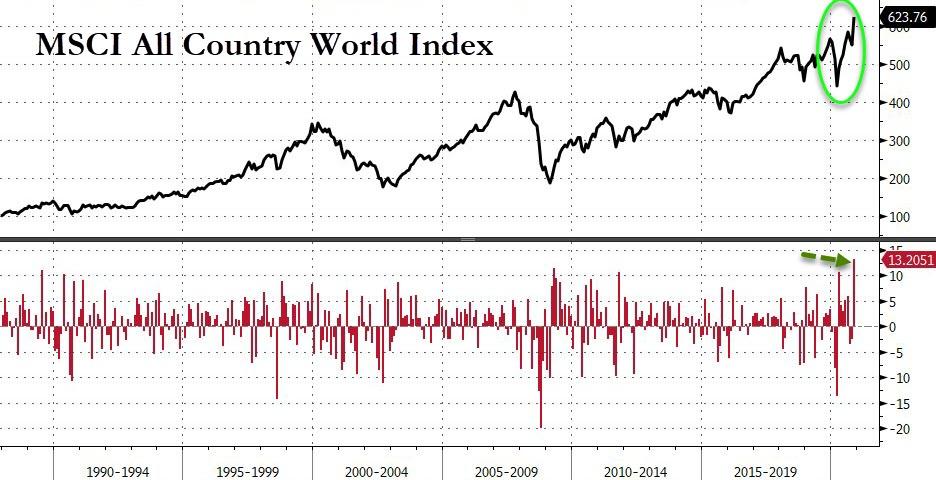

Global stocks soared over 13% in November – the greatest monthly gain in its history – apparently on the heels of vaccine news…

Source: Bloomberg

“What’s really taken most people by surprise is that if anybody said to you in March, ‘Hey we’re going to have a year where really most businesses are working at not-full capacity, most restaurants may not even be open, people aren’t going to the office, and oh yeah, by the way, we’ll hit all-time highs,’ people would have thought you were nuts,” said JJ Kinahan, chief market strategist at TD Ameritrade.

“It’s been amazing.”

A $15 trillion rise in global liquidity helped to lift global stocks off those March lows, and continue to inflate asset prices everywhere…

Source: Bloomberg

Which sent “Extreme” greed to “Extremer” greed…

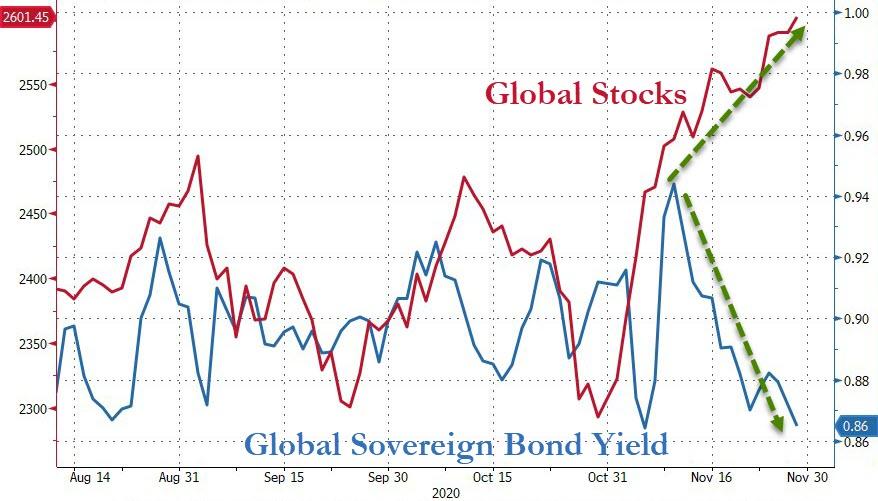

Critically, if one really believes that stocks soared on fundamentals in November, then why did global bond yields tumble?! (NOTE – that is the lowest bond yield since August)

Source: Bloomberg

And as global stocks and bonds rallied, the dollar was battered to its 2nd worst month in almost 3 years (and down 7 of the last 8 months) to its weakest against its fiat peers since April 2018 (and unchanged since Jan 2015)…

Source: Bloomberg

This was also European stocks best month on record…

Source: Bloomberg

In the US, Small Caps were the best performers in November and Nasdaq and the S&P 500 were the laggards (but even so they rose over 10%)…

Source: Bloomberg

This was Small Caps’ best month ever, soaring to a new record high…

Source: Bloomberg

And The Dow’s best month since Jan 1987…

Source: Bloomberg

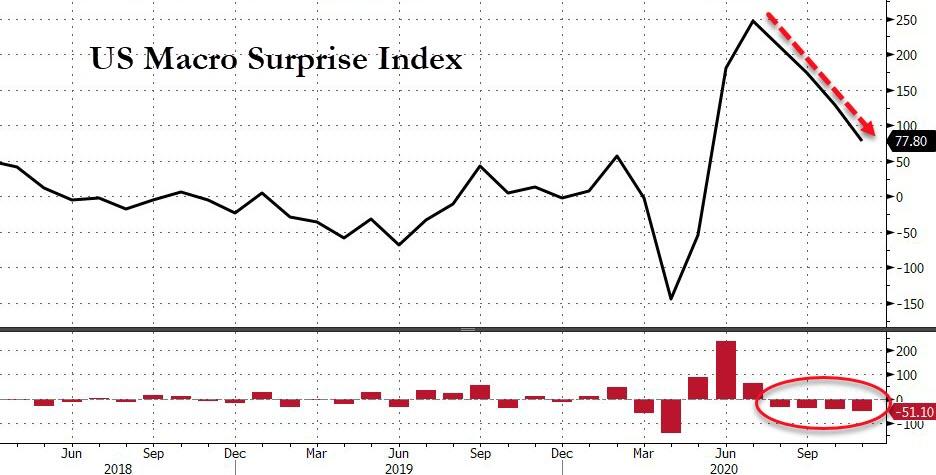

And that happened as US macro dats plunged (for the 4th straight month) by the most since April…

Source: Bloomberg

So – a quick summary – COVID cases, deaths, and ICU hospitalizations are (according to the media) exploding higher, Xmas is cancelled, US macro data is rolling over fast, bonds know this vaccine malarkey ain’t coming anytime soon, there’s no big stimulus anytime soon, and damn-it-Janet can only do so much with gridlock… all of which explains why stocks are at record highs…

Small Caps have outperformed Big-Tech for 3 straight months (the biggest 3mo outperformance since 2002), but we note the last couple of days have seen that Russell/Nasdaq rise stall at what looks like recent resistance…

Source: Bloomberg

Momentum collapsed in November…

Source: Bloomberg

… underperforming value by the most since April 2009…

Source: Bloomberg

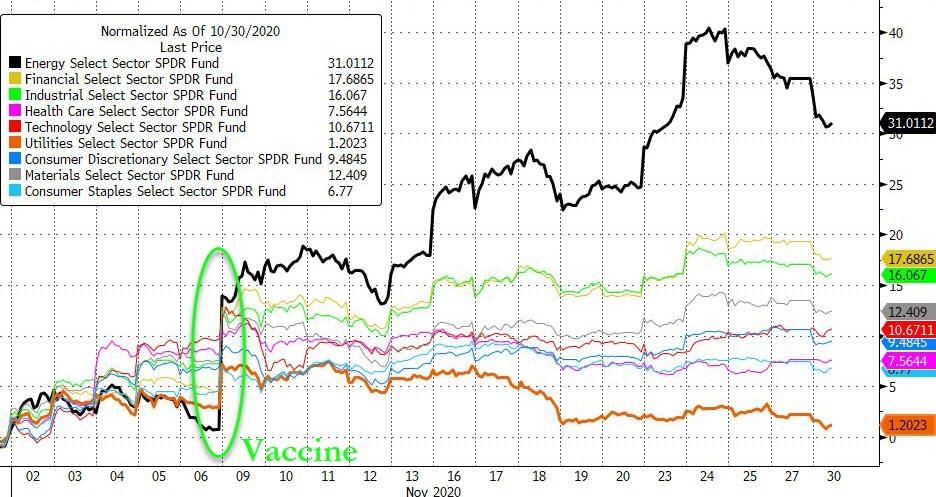

Cyclicals significantly outperformed defensives post-vaccine…

Source: Bloomberg

Energy stocks were November’s massive outperformer, soaring over 31% (slightly higher than April’s surge) – for the greatest monthly performance for Energy stocks ever…

Source: Bloomberg

VIX collapsed by almost 17 vols in November, its second biggest monthly compression in history…

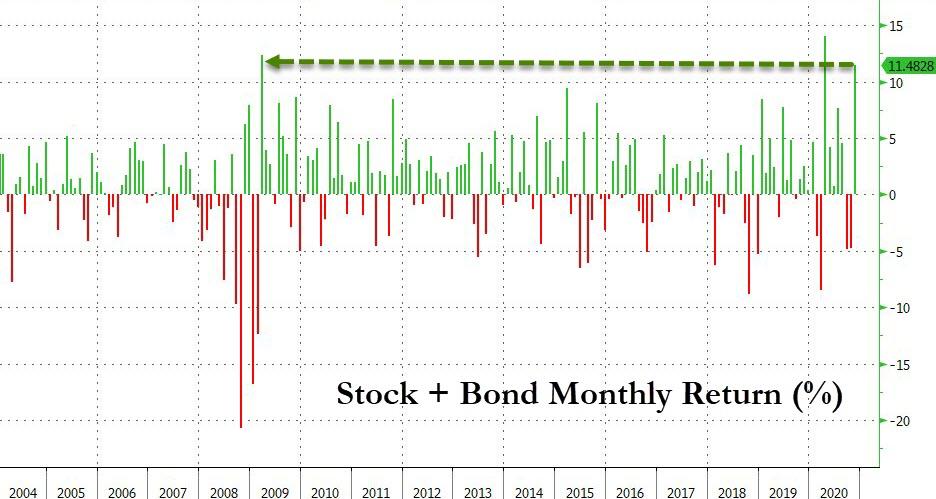

November saw a combined bond/stock portfolio’s second-best monthly gain since March 2009…

Source: Bloomberg

As stocks soared, US Treasury yields ended November significantly lower (30Y -9bps)…

Source: Bloomberg

Notably, 30Y Yields stalled their “rout” higher at 1.75% once again…

Source: Bloomberg

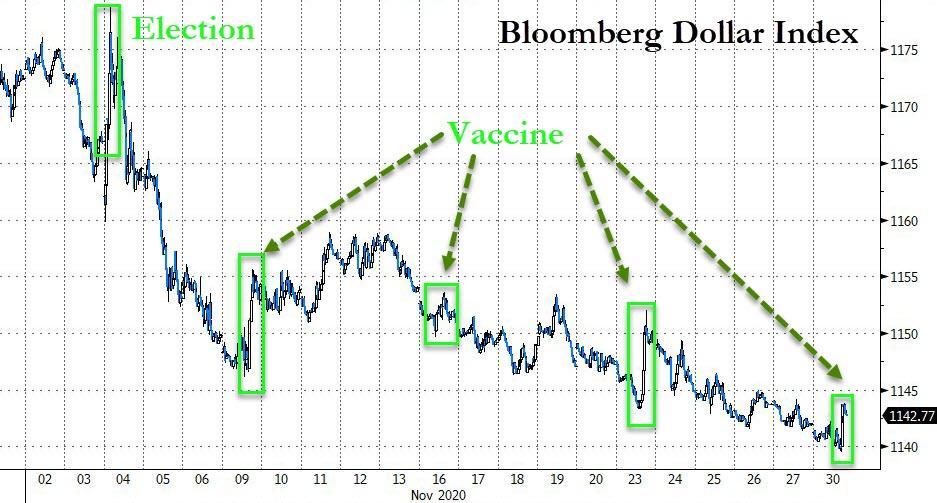

The Dollar had an ugly month despite spikes on the election and 4 Monday vaccine ramps…

Source: Bloomberg

As the dollar dived, the Columbian Peso, Norwegian Krone, Brazilian Real, and Turkish Lira all soared with only the Argentine Peso weaker against the dollar on the month…

Source: Bloomberg

Cryptos had a massive month with Bitcoin up around 40% – its best month since May 2019 – and Ethereum outperforming that…

Source: Bloomberg

Sending Bitcoin to a new all-time record high…

Source: Bloomberg

Bitcoin’s last week or so has been an impressive roller-coaster to say the least…

Source: Bloomberg

Crude and copper soared as PMs sank in November…

Source: Bloomberg

This was WTI’s best month since May 2020…

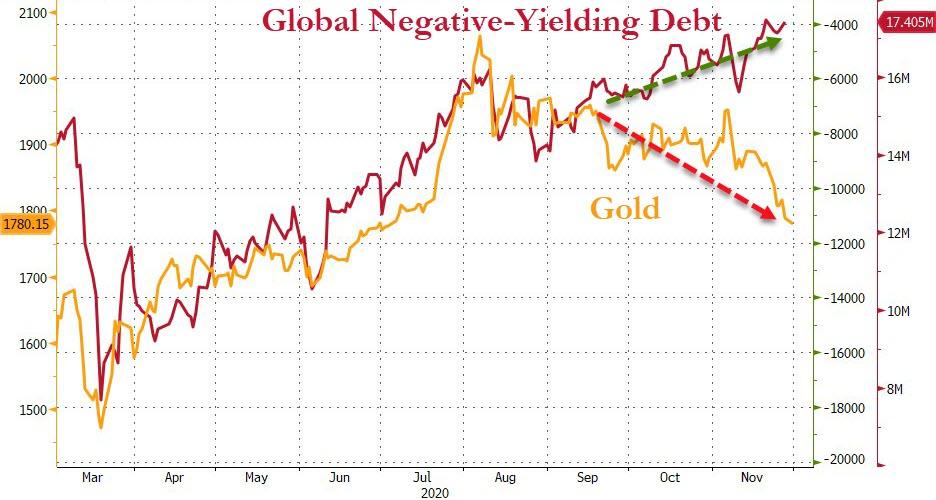

This was Gold’s worst month since Nov 2016 (and is down for 3 straight months)… despite the dollar’s drop…

Interestingly, gold has dropped as the volume of global negative-yielding debt soared to a new record high over $17.4 trillion…

Source: Bloomberg

Gold’s move is most notable given the drop in the USD. Combined, this is the worst USD-adjusted month for gold since June 2013 (-5.2% Gold, -2.5% USD)…

Source: Bloomberg

And finally, the $15 trillion in additional global liquidity has sent the S&P 500 to its most expensive valuation in history…

Source: Bloomberg

via ZeroHedge News https://ift.tt/2HWGJQ8 Tyler Durden