Only One Number Mattered To Global Markets In 2020

Authored by Robert Burgess, op-ed via BloombergQuint.com,

When it came to financial markets in 2020, the most frequently asked question was why. Why, in the midst of a global pandemic that has killed some 1.7 million people worldwide and plunged the economy into the worst crisis since the Great Depression, did equity markets stage a historic rebound to reach new highs and become completely disconnected from reality? And it wasn’t just stocks, as anything smacking of carrying any semblance of risk, from junk bonds to Bitcoin, had epic rallies.

Everyone has an explanation for how markets performed. They range from the cerebral (markets are “forward-looking” and investors are anticipating a roaring economy once Covid-19 has been eradicated) to the cynical (just buy the dip). True, the market is always about what will happen rather than what has happened, and it’s been highly profitable in recent years to buy whenever the market pulls back. Still, neither adequately explains the jaw-dropping 66% surge in the MSCI All-Country World Index of stocks from its low in late March, the record-low yields in junk bonds, the more than five-fold increase in the price of Bitcoin or any of the other seemingly inexplicable market moves.

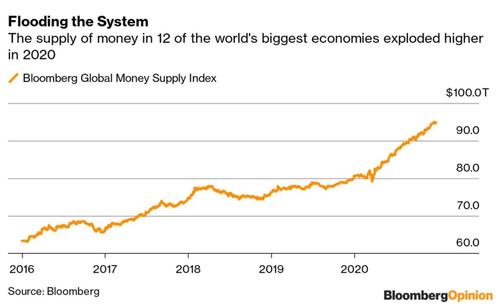

The answer is much simpler and comes down to one number: $14 trillion. That’s the amount by which the aggregate money supply has increased this year in the U.S., China, euro zone, Japan and eight other developed economies.

To put the surge in perspective, the jump to $94.8 trillion exceeds all other years in data going back to 2003 and blows away the previous record increase of $8.38 trillion in 2017, according to data compiled by Bloomberg (how did equities do back then? The MSCI All-Country World Index soared 21.6%, the result of a steady climb all year. Although the MSCI is up a smaller 12.4% this year, it has surged 65% from its low in late March).

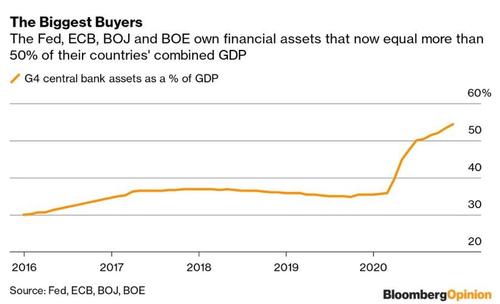

Knowing what was behind the performance of markets is only part of the story; it’s also important to understand the mechanics. The place to start is with the central banks, which were instrumental in printing the money they needed to inject directly into the financial markets by purchasing bonds and other assets on a scale never seen before. As of Nov. 30, the collective balance sheet assets of the Federal Reserve, the European Central Bank, the Bank of Japan and the Bank of England stood at 54.3% of their countries’ total gross domestic product, up from about 36% at the end of 2019 and about 10% in 2008, data compiled by Bloomberg show. The Fed alone is pumping at least $120 billion a month into the financial markets through its purchases of fixed-income assets.

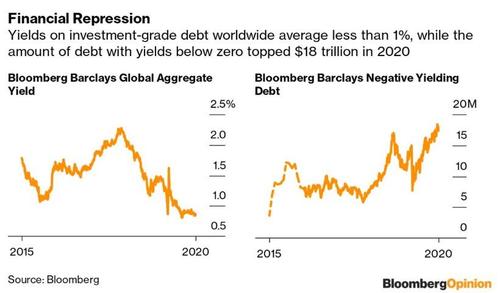

The purchases by central banks helped to suppress bonds yields globally, with the average tumbling to below 1% this year, as measured by the Bloomberg Barclays Global Aggregate Index. Not only that, but the amount of bonds with yields below zero surged above $18 trillion, adding to the financial repression suffered by savers since the financial crisis.

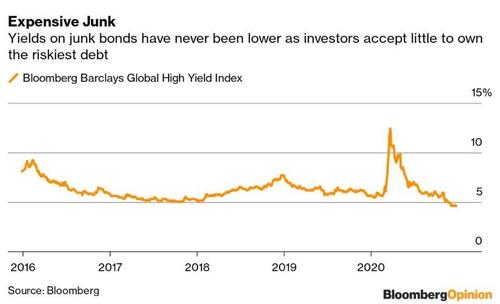

Of course, nobody wants to own bonds that pay next to nothing, or even negative rates, unless they have to for regulatory or other reasons. The result has been a scramble for yield, primarily for the debt obligations of companies and others with below-investment-grade credit ratings. Rising demand pushed yields on bonds issued by these companies to a record low 4.59% worldwide on average. Even so-called frontier nations such as Ghana, Senegal and Belarus are benefiting.

Many realize that these low yields don’t offer a lot of compensation in return for lending money to borrowers at higher risk of default. After all, they’re not called “junk bonds” for nothing. Which is why much of the money that landed in the laps of investors this year found its way into the stock market, pushing the global value of stocks to more than $100 trillion for the first time and the average stock price for a member of the MSCI All-Country World Index to a stratospheric 31 times earnings.

All the money created by governments and central banks also raised some hard questions about the true value of currencies. There’s no small number of people who believe foreign-exchange regimes are on the verge of collapsing because of all of the money-printing — not just this year, but since the financial crisis more than a decade ago. This explains much of the stunning rally in Bitcoin and other cryptocurrencies, as well as gold.

While many governments deserve criticism for their response to the pandemic from a social-welfare context, the swift action they took – in conjunction with their central banks – to support their economies warrants praise despite the worries about permanent “moral hazard,” never-ending central bank support of financial markets and the wealth inequality it exacerbated. It will be years, perhaps a generation, before we know whether too much (or perhaps too little?) money was created to support the economy through the pandemic, nurturing the biggest bubble of all time and uncontrollable inflation.

But imagine the alternative if nothing was done.

Tyler Durden

Mon, 12/28/2020 – 16:20

via ZeroHedge News https://ift.tt/2L6pmh6 Tyler Durden