Trump’s Tax Cut Turned Out To Be Progressive… A Few Lessons For Illinois And Beyond

Authored by Mark Glennon and John Klingner via Wirepoints.org,

To countless politicians and critics nationally and locally, it was perhaps the most vile thing Congress ever produced.

The “worst bill in the history of the United States Congress,” said House Speaker Nancy Pelosi.

“The American plutocracy gets its immoral tax bill,” wrote Jesse Jackson in the Chicago Sun-Times.

“Sheer greed, an effort by the…. ‘malefactors of great wealth’ to escape more of their obligations to the society,” wrote the St. Louis Post-Dispatch.

It was TCJA, the 2017 Tax Cuts and Jobs Act, and its alleged sin was a massive give-away to the rich at the expense of the poor and middle class.

When the bill was passed in 2017 we said to hold off on that judgement.

“One thing for sure,” we wrote, “is that wildly hysterical opponents have convinced the middle class they’ll be getting a tax increase, and that’s nonsense.”

It turns out that may have been understatement.

For the first time, we have the actual results instead of estimates and assertions.

In 2018, the first year for which we have hard numbers on TCJA’s effect, the wealthiest Americans paid a greater portion of the burden than they did before.

There’s more. TCJA, according to separate research, lopped a full trillion dollars off the value of high-end homes, not middle-class homes, which was part of a trade-off that accrued to the benefit of the country as a whole.

Here are the details:

The IRS publishes data on which income groups paid how much about two years after each year’s filing deadline. Those numbers for 2018 recently came out and were analyzed by the NTPU, the National Taxpayers Union Foundation. Their conclusions:

As a result of the TCJA, the share of federal income taxes paid increased for the top 1 percent from 38.5 percent in 2017 to 40.1 percent in 2018…

On top of this, the share of income taxes paid by the top 5 percent, top 10 percent, top 25 percent, and top 50 percent all increased.

The bottom 50 percent of taxpayers saw their share of federal individual income taxes drop from 3.1 percent to 2.9 percent.

Their full report is here.

How can that be? TCJA cut rates for high earners and some supposed experts said at the time that the result would be a windfall for the rich.

The answer is due in part to lower rates for everybody, a higher standard deduction and additional provisions designed to ease burdens low-income earners such as the increased child tax credit, all of which were in TCJA.

But there’s clearly another reason why higher earners didn’t get a windfall, one that became immediately obvious to anybody paying high property taxes in states like Illinois. For high earners, TCJA slashed the SALT deduction – deductions for state and local income tax, sales tax, and property taxes, essentially capping them at $10,000. With a higher standard deduction protecting low and moderate incomes, that cap only hit big earners.

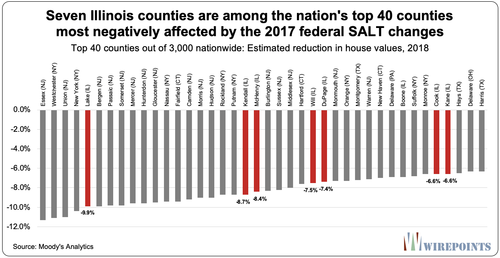

And it’s for that reason that the impact of TCJA goes far beyond NTPU’s study. High property taxes and reduced deductibility depress home prices. Moody’s Analytics quantified that effect in research last year.

Specifically, Moody’s estimates that TCJA’s reduction in SALT deductions means home prices are $1 trillion lower than they would be otherwise.

That loss is almost entirely concentrated on big earners and those with expensive homes in high tax states. The middle class gets the standard deduction, which TCJA increased, or if they itemize, they don’t hit the $10,000 cap. So, the tax code changes hurt home values most in the wealthiest areas in the highest property tax states – Illinois, Connecticut, New York and New Jersey, according to Moody’s.

You can see it in Moody’s data below of the 40 hardest-hit counties below. They are all in high property tax states with relatively high incomes.

Notice that Cook County and all Chicago’s collar counties are on that list:

The point is that the savings for the general public that resulted from reduced SALT deductions were paid for heavily by the wealthy through reduced home values. TCJA was indeed progressive.

The bigger lesson is to beware of claims about what’s progressive and what isn’t. Politicians often don’t know or truly care about the difference.

Supposedly progressive Senators like Senators Chuck Schumer and Nancy Pelosi, for example, want to double down on the hostility to TCJA by eliminating the cap on SALT deductions. That means they are directly supporting a tax cut for the rich. Schumer said, “I want to tell you this: If I become majority leader, one of the first things I will do is we will eliminate [the cap] forever…. It will be dead, gone and buried.” Pelosi has tried to remove the cap as part of various pandemic relief proposals.

Here in Illinois, the supposed regressivity of TCJA was sometimes used to support the case for a counterbalance through the failed Fair Tax proposal, which would have allowed for progressive tax hikes at the state level. That rationale was wrong, and the Fair Tax would have been a mistake for separate reasons that we often wrote about – Illinois already has an uncompetitively high tax burden. Trying to address inequality through state tax increases where the tax base is already fleeing because of high taxes is folly.

Photo by Thomas de LUZE on Unsplash

TCJA had other pros and cons not discussed here. Personally, I thought at the time it went too far too fast because, among other reasons, the economy was red hot, so some of the economic stimulus it provided would have been better to preserve for tougher times (like now).

But it’s good to see that the hysteria about it being regressive turned out wrong, at least so far.

In the coming year, we hope to write more about how to address income and wealth inequality focusing on what truly works and what doesn’t. That’s an extraordinarily complex matter in which sorting facts from political hyperbole isn’t easy, as TCJA has shown.

Tyler Durden

Tue, 12/29/2020 – 16:45

via ZeroHedge News https://ift.tt/3aVpivg Tyler Durden