Chaotic Crude Holds Gains After Mixed Inventory Data

Oil prices have rollercoastered in the last 12 hours or so with a surprisingly large crude draw reported by API sparking a bid for WTI overnight which was then monkeyhammered at around 8amET for no good reason, tumbling back below $48 before dip-buyers panic-bought it back up.

Now that the stops have been run, we’ll see what the official inventory data does for the algos.

API

-

Crude -4.875mm (-3.1mm exp)

-

Cushing +131k

-

Gasoline -718k

-

Distillates -1.877mm

DOE

-

Crude -6.065mm (-3.1mm exp)

-

Cushing +27k

-

Gasoline -1.192mm

-

Distillates +3.095mm

A bigger than expected crude draw was offset by a bigger than expected surprise build in distillates last week…

Source: Bloomberg

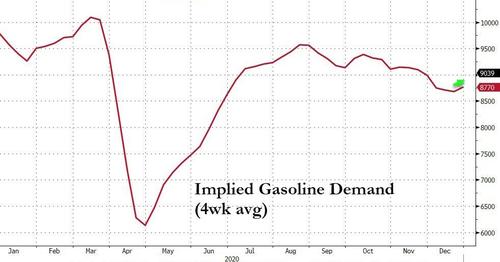

Implied Gasoline Demand (4wk average) saw a small uptick last week…

Source: Bloomberg

US Crude Production remained flat at 11mm b/d…

Source: Bloomberg

WTI traded around $48.30 ahead of the official print and chopped lower, then higher after the data…

As Bloomberg notes, the resurgent coronavirus has kept price gains in check in recent days. In the U.S., the governor of Colorado said the Covid-19 strain discovered in the U.K. has been found in the state. Meanwhile, a second cluster of infections emerged in Sydney and cases rose in China, India and South Korea.

The outbreaks come ahead of an OPEC+ meeting early next week, where the group will decide whether to add an extra 500,000 barrels a day of supply to the market.

Tyler Durden

Wed, 12/30/2020 – 10:36

via ZeroHedge News https://ift.tt/3rB5tQ1 Tyler Durden