Melvin Capital Lost A Stunning $5.3 Billion In January, 53% Of Its Capital; Here’s How Everyone Else Did

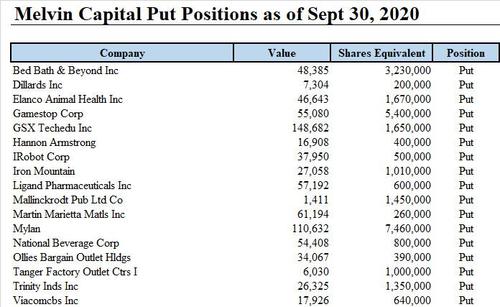

We already knew that last’s weeks epic squeeze of the most shorted stocks was a disaster for Melvin Capital, which emerged as the first casualty of the reddit squeeze because, as we showed last Monday, it was heavily short precisely the stocks that exploded higher (mostly as pair trade offset to its retail longs such as Amazon and others) with its puts losing all value, even as the fund suffered further pain on its outright shorts.

And while we didn’t know just how much pain Melvin had suffered – especially after Ken Griffin’s Citadel (which is Robinhood’s top client and orderflow purchaser) and Steve Cohen organized a $2.75 billion bailout financing, we do now, because as the WSJ reported this morning, Melvin Capital lost 53% in January, as Gabe Plotkin (a former SAC Portfolio Manager), lost over $5.3 billion in one month.

In dollar terms, it means that Melvin lost a stunning $5.3 billion in just a few weeks thanks to r/wallstreetbets:

It started the year with about $12.5 billion and now runs more than $8 billion. The current figure includes $2.75 billion in emergency funds Citadel LLC, its partners and Mr. Cohen’s Point72 Asset Management injected into the hedge fund last Monday.

What is even more stunning is that it took just days for Citadel and Point72 to be underwater on their $2.75 billion rescue financing: “So far, Citadel, its partners and Point72 have lost money on the deal, though the precise scope of the loss was unclear Sunday.”

This also means that as the squeeze of GME and other companies continues, it is leading to billions in losses for the two funds and may explain why Robinhood – whose biggest customer is Citadel (as the WSJ separately reports 29% of Gamestop trading volume on Thursday was handled by Citadel, which means that Citadel is caught in an unprecedented conflict of interest) – was so quick to halt trading on Thursday and limit it to just one share on Friday.

With the fund now existing only on daily life support and the continued goodwill of Griffin and Cohen, it is hardly a surprise that it had to massively degross (i.e., sell all potentially problematic positions):

Melvin has massively de-risked its portfolio, said a client. People familiar with the hedge fund said its leverage ratio—the value of its assets compared with its capital from investors—was the lowest it has been since Melvin’s 2014 start. They also said the firm’s position-level liquidity, or its ability to exit securities in its portfolio easily, had increased significantly.

Alas, none of that matters. As we noted earlier today, the massive damage that some hedge funds sustained last week (and while some hedge funds indeed profited from the short squeeze, most lost money as Goldman noted last night “The typical US equity long/short fund returned -7% this week and has returned -6% YTD”) will now spark a massive redemption wave:

Here’s the problem: the short squeeze led to massive losses for some funds. It may or may not be over. But now come the redemption requests and funds will see billions cash out, forcing them to liquidate top longs (GS VIP basket)

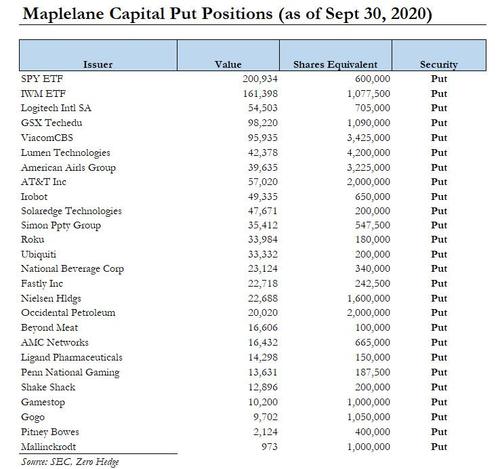

Confirming this, the WSJ also wrote that Maplelane Capital – the hedge fund which we first said last week could be the next Melvin – ended January with a roughly 45% loss. It managed about $3.5 billion at the start of the year.

D1, which incidentally last August invested $200 million in Robinhood, ended the month down about 20%, was short AMC and GameStop, said people familiar with the fund. One of the people said D1 had exited both positions by Wednesday morning but that those were small drivers of losses. A more significant factor was shares of travel-related companies declining.

And while mounting redemptions are a clear problem, an even bigger problem is what happens to the short squeeze, because if it continues there is now a risk of a broader market selloff as Goldman cautioned last night, noting that “Unsustainable excess in one small part of the market has the potential to tip a row of dominoes and create broader turmoil.“

So what happens next? Well, as the WSJ correctly notes, as part of an aggressive overhaul to the hedge fund industry, “Fewer hedge funds are likely to highlight their bearish positions by disclosing put options… Instead, funds may use Securities and Exchange Commission rules to keep confidential those positions, a tool activist investors have long used to build positions in companies quietly. More funds also may institute rules about avoiding thinly traded, heavily shorted stocks.”

Good luck with getting the SEC to agree to confidential “short only” idea dinners especially now that shorting hedge funds have emerged as public enemy #1.

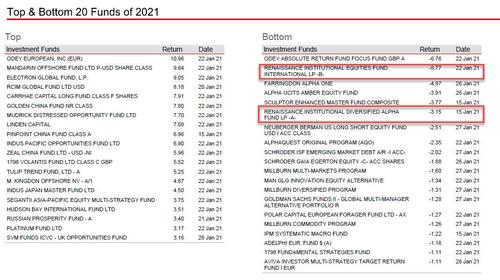

Finally, for those wondering how the rest of the industry is going, here is the Top and Bottom 20 funds summary from the latest HSBC hedge fund report. We the strikingly bad performance by Renaissance – the most profitable and secretive hedge fund in the history of the world – especially notable although we are confident that the loss in the public-facing funds is more than offset by gains for the employee-only Medallion.

Tyler Durden

Sun, 01/31/2021 – 10:43

via ZeroHedge News https://ift.tt/3pAHS0k Tyler Durden