The Stock Market, Fatally Wounded By The Truth, Will Stumble And Crash

Authored by Charles Hugh Smith via OfTwoMinds blog,

It didn’t have to be this way, but this is the reality we must now face: truth is fatal to fraud, and our entire financial-political system is a fraud.

The stock market has just been punctured by the thin blades of truth. It is fatally wounded but nobody dares notice. The wounds are barely visible, but the internal damage is mortal. The stock market is already stumbling and will soon crash.

The banquet’s participants ignore the faltering market because the rules are we never reveal the truth, or acknowledge it, or discuss it, no matter how obvious, because truth is fatal to fraud. So the stock market’s vital signs are in freefall but the conversation remains upbeat and light: stimulus, rapid growth in the second half, etc., all the patter of a carefully constructed illusion that fraud is forever as long as the truth never comes out.

Alas, the truth has emerged from the shadows, despite the silence of the insiders and the financial media. Here are the truths that have emerged like karmic genies:

1. The stock market is nothing but one giant fraud. The entire market is corrupt and rigged from the ground up. The fraud is systemic, designed into every tendril of the market. It was a useful deception to blame it all on “bad players,” but now the truth has been revealed: the market is nothing but a rigged game enriching insiders.

2. The Fed is a fraud. All the Federal Reserve has accomplished in 13 years of goosing the stock market is unprecedented wealth and income inequality as the fraud of the Fed has boosted the fraud of the market, which has fatally undermined America’s social and economic orders. Please read this short paragraph and let it sink in. Monopoly Versus Democracy (Foreign Affairs):

Ten percent of Americans now control 97 percent of all capital income in the country. Nearly half of the new income generated since the global financial crisis of 2008 has gone to the wealthiest one percent of U.S. citizens. The richest three Americans collectively have more wealth than the poorest 160 million Americans.

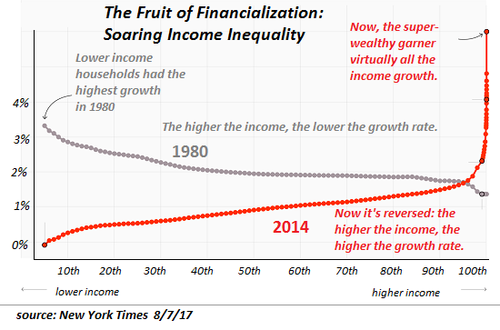

Thanks to the tightly bound frauds of the Fed and markets, the bottom 90% of Americans own essentially zero capital that produces income and the vast majority of all income gains since 2008 has been siphoned off by the top 0.1% (see chart below from the New York Times.) Three monopolists own more wealth than half the nation’s citizens.

Yet the fraudsters in the Fed laughably insist their policies haven’t created inequality on such a vast scale that is has destabilized the nation. The Fed’s credibility is zero, yet the financial media tiptoes around, proclaiming the glory of the Emperor’s illusory clothing.

3. America’s system of governance is a fraud. What can we say when powerful politicians are worth over $100 million and are active participants in the most speculative excesses of the stock market, Buying More Than $1 Million In Tesla, Disney And Apple Calls In December? Do we even need to ask where their interests lie?

What can we say about a regulatory system that immediately bails out the most corrupt and destructive financiers / speculators but stands aside when the public loses trillions of dollars? The financial regulatory system is a complete fraud, devoted to bailing out the biggest insiders while ignoring the losses of the bottom 99.9%. America’s financial regulations protect the corrupt, not the citizenry.

4. The wealth effect is a fraud. The Fed’s entire fraudulent policy holds that if the stock market is goosed higher by Fed rigging, the phantom wealth handed to the top 0.1% will magically trickle down and benefit the bottom 90% who own no productive capital.

There is no magic; the wealth effect is a fraud. If one $5 stock (GameStop) can be pushed up to $400 in a week, why not push every $5 stock to $400? This is the essence of the wealth effect: all capital is phantom capital, a fraud balloon awaiting a pin.

The wealth effect failed, the Fed failed, regulations failed, politics failed. But thanks to the Fed and the self-serving political class, the entire U.S. economy is now utterly dependent on this completely corrupt and destabilizing fraud–the stock market. If the stock market stumbles and collapses, the economy–now totally dependent on phantom capital –also stumbles and collapses.

It didn’t have to be this way, but this is the reality we must now face: truth is fatal to fraud, and our entire financial-political system is a fraud. The stock market is pale, and blood is seeping through the tuxedo, but the insiders, politicos and their toadies and apologists are nervously averting their gaze.

The market’s bleeding but it can’t possibly die, can it? Yes it can, and yes it will: truth is fatal to fraud, and the truth has escaped and is now free. We can’t unsee what’s behind the curtain.

* * *

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

* * *

My recent books:

A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World (Kindle $5, print $10, audiobook) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($5 (Kindle), $10 (print), ( audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Read the first section for free (PDF).

Tyler Durden

Sun, 01/31/2021 – 11:35

via ZeroHedge News https://ift.tt/2Yt0dQY Tyler Durden