This Is The Stunning Way Some Desperate Funds Covered Their Gamestop Shorts

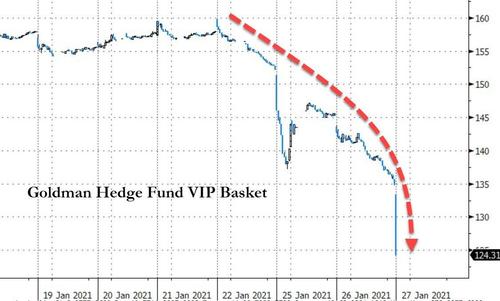

On Friday we reported that while every hedge fund bro and TikTok-ing Millennial has been glued to the meltup in heavily-shorted stocks like GME (and the meltdown in the hedge funds who were heavily-short), there has been significant impacts under the covers of the rest of the financial markets that few have (for now) noticed. One place where the unintended consequences of the short squeeze hit hard was FANG stocks in particular, and the most popular and liquid names held by hedgies (i.e., the Goldman Hedge Fund VIP basket) which have seen liquidations to meet margin calls, as well as due to VaR shocked-induced gross leverage drawdowns. In other words the highest the most shorted names rose, the more the selling in the “most popular” longs as shown below.

But it’s not just pair trades that have gotten hammered – and incidentally, according to several desks, GME was the most popular short pair-trade offset to the ubiquitous AMZN long, which is why we asked earlier if the WSB army isn’t coming after Jeff Bezos next…

GME is the most frequent participant in AMZN pair trades: Goldman prime

Is the WSB train about to come for Bezos

— zerohedge (@zerohedge) January 31, 2021

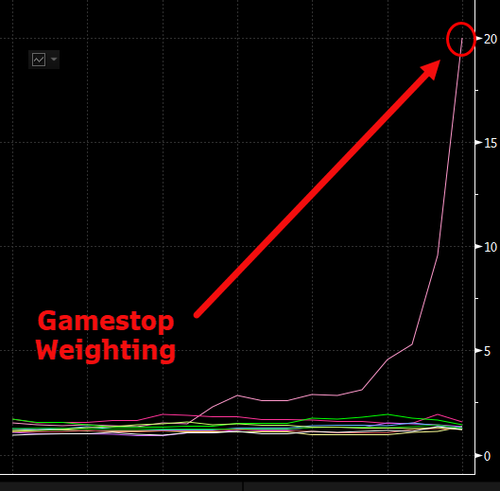

… as we noted on Friday, the outsized influence from the booming video-game retailer has altered some ETF compositions and is forcing what Citi analysts called “ad-hoc rebalances and strategy adjustments.” In one of the most stunning developments, roughly $700 million in assets was pulled from the SPDR S&P Retail ETF (XRT) this week…

… with a record $506 million pulled on Wednesday alone, draining total assets to just $164 million.

The outflows come after GameStop’s surge swelled its weighting in XRT to an insane 20%, which is unprecedented given that the fund tracks an equal-weighted index, the video game retailer’s weighting should be closer to 1% according to Bloomberg’s James Seyffart.

While we didn’t know what specifically caused this record plunge in XRT assets, we speculated that “one possibility is that because XRT redemptions are delivered in-kind – meaning that its shares are exchanged for the underlying stocks in the fund – investors are ditching the ETF to get their hands on hard-to-borrow GameStop shares.“

As it turns out that’s precisely what happened. As Bloomberg’s Seyffart and Balchunas explain, “the $506 million outflow on Jan. 27 cut XRT’s assets to less than $240 million and offered further evidence of the stability of the ETF structure. Despite the plunge in assets, XRT’s price was unaffected, closing at a 6-bp discount…. The Jan. 27 outflow amounted to 5.55 million XRT shares, lowering the total to 2.6 million.”

Yes a huge move that barely impacted the price: that’s good – it means that the market is still liquid enough for historic asset reallocations in ETFs. But that’s not the punchline:

And the punchline: “The in-kind redemption was likely an attempt by investors to get their hands on scarce GameStop shares. Based on XRT’s weightings, those who took delivery of the underlying holdings received about 292,000 GameStop shares, alongside 94 other stocks.”

Unprecedented? Well, yes. Because as Bloomberg itself concludes “by allowing investors to redeem GameStop and other shares from its own holdings, XRT effectively acted as a dealer, akin to the role we see many liquid fixed-income ETFs playing in the bond market.“

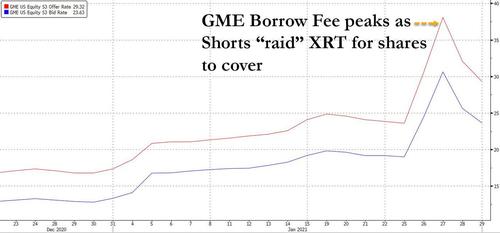

Why is this important? Because as a look at GME borrow rates (courtesy of S3 Blacklight) shows, Jan 27 is precisely the day when the carry cost to hold GME shorts peaked (and at some dealers it soared as high as a suicidal 200% according to S3 Partners).

In the Thursday overnight session, the price of GME also peaked and has been drifting lower since.

Here is the bottom line: one (or more funds) perhaps facing a terminal margin call, was so desperate to close out their GME short in a market where the cost to borrow the stock had exploded as high as 200% (a death sentence for any hedge fund who plans to keep the GME short on for a long period of time), that they stripped XRT (which as Bloomberg notes “acted as a dealer”) of 292K shares of GSE to quickly plug the shortfall (no pun intended) and to emerge alive. As a result of this furious scramble, not only did the cost to borrow GME slide, but so did the stock price.

So what does that mean: is the panic squeeze over now that the cost to borrow GME has dropped? Well… maybe not and here’s why: with XRT effectively raided out of a paltry 300K shares, there are no more hiding places for GME stock to be raided. In other words, any shorts left are on their own. Meanwhile as S3 Partners’ Ihor Dusaniwsky wrote on Friday, some 113.3% of the GME float is still short (synthetically, including rehypothecated shorts). What’s worse, while the cost to borrow GME stock has dropped, it still remains around 30% which means that no hedge fund can remain short the stock indefinitely without suffering massive losses and yet still more than all of the float is short.

Whether this means the GME squeeze will resume tomorrow, or whether with the “help” of Robinhood’s effective shutdown and Citadel’s friends in high places, the short raid will finally end on Monday, we leave it up to readers to decide.

Tyler Durden

Sun, 01/31/2021 – 14:55

via ZeroHedge News https://ift.tt/3aifB8l Tyler Durden