“It’s Been Nuts”: Silver Surges Most Since Lehman Bankruptcy; Hits 7-Year High Over $30

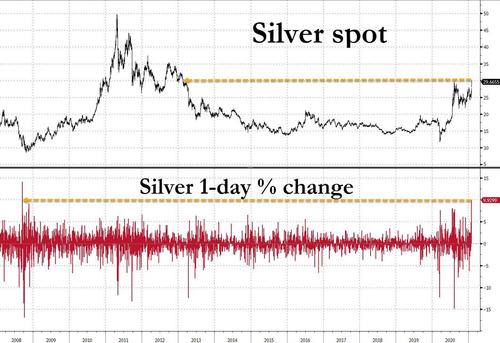

It’s been a long time coming, but for precious metal fans the day of joy has finally arrived: following a coordinated campaign to buy both silver ETFs in the paper realm and precious metals in the physical, which over the weekend which left virtually US precious metals retailer with little to no physical inventory, silver has finally exploded higher following in the footsteps of other “most-shorted” names, and it was last trading just around $30/ounce, soaring by 11.5% – its biggest one-day jump since Sept 16, 2008 – the day Lehman filed for bankruptcy. And, if silver closes here, it would be the highest price since early 2013.

The euphoria in the metal spilled over to various silver minter, with U.S.-listed peers soaring in the pre-market trading:

- First Majestic +33%,

- McEwen Mining +25%,

- Hecla Mining +23%,

- Coeur Mining +21%,

- Pan American Silver +16%,

- Wheaton Precious +12%

European silver miners also soared on Monday led by Fresnillo, which rose as much as 17%, most since March; other exposed miners rise: Polymetal +6%, Hochschild Mining +17%. Elsewhere, China Silver Group Ltd. rose as much as 63% in Hong Kong, while Australia’s Silver Mines Ltd. gained as much as 49%.

Trying to pour cold water on the second biggest one-day move in silver this century – because let’s face it, getting silver to move up by 10% is far more difficult than getting a low float, super squeezed stock like GME to soar by 1600% – Ipek Ozkardeskaya, Senior Analyst at Swissquote Bank said that “so far, it is not exactly the GameStop anomaly, but it is a hint that the retail traders who just discovered the strength of their unity are out there, looking for new targets – and apparently bigger ones.”

As we reported extensively over the weekend, silver’s advance can be traced to r/WallStreetBets forum, where one post last week declared the metal “THE BIGGEST SHORT IN THE WORLD” and encouraged traders to pile into the iShares trust as a way to stick it to big banks.

The calls to buy silver began appearing on WallStreetBets as early as Wednesday, when the mania surrounding GameStop reached a fever pitch. Some of the posts touched on a similar David-vs-Goliath theme that has inspired individual investors to take on short-selling hedge funds: “Any short squeeze in silver paper shorts would be EPIC. We know billion (sic) banks are manipulating gold and silver to cover real inflation.”

“Last week’s events have shown it to be unwise to doubt the purchasing power of retail investors, and this has been sufficiently demonstrated again on the silver market,” said Howie Lee, an economist at Oversea-Chinese Banking Corp.

Yet as Bloomberg correctly notes, silver differs in important ways from stocks like GameStop. For one, the scope for a short squeeze in silver is far less obvious: money managers have had a net-long position on the metal since mid-2019, futures and options data from the Commodity Futures Trading Commission show. More importantly, the market for silver is also by some measures much deeper than those for smaller stocks like GameStop. The bricks-and-mortar video game retailer had a market capitalization of about $1.4 billion in mid-January, before the Reddit frenzy sent the company’s value soaring more than 16-fold. By contrast, London vaults held 1.08 billion ounces of silver at the end of November, according to LBMA data. That’s worth almost $32 billion at current prices.

“They may find it a bit harder to squeeze the silver market than they did with GameStop — the former is much bigger and more liquid — but the momentum looks like it rests with them at the moment” said Lee. Which is why the fact that a bunch of rag-tag forum participants managed to spark the momentum to send silver higher by a near record, is in many ways far more remarkable than their achievements in GME and other most-shorted stocks.

What happens next? Don’t expect a reversal of the surge any time soon: short-term forward rates on the London silver market flattened on Monday, indicating strong demand for the metal in coming weeks.

“I can envisage a scenario where maybe a hedge fund has purchased maybe a short-term tactical long position, so the upside could be a combination of several factors now,” said Philip Newman, managing director at consultancy Metals Focus.

* * *

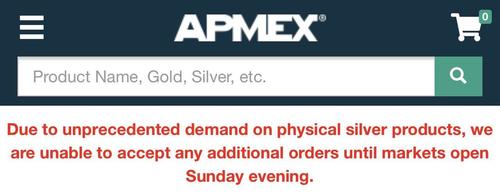

Finally, there is the physical aspect: As we first reported, amid expectations for a surge in silver prices, sellers of physical silver including Apmex – called the Walmart of precious metals products in North America – said they were unable to process orders until Asian markets opened because of record demand.

Ken Lewis, Apmex’s chief executive officer, said the decision to temporarily suspend silver sales was unprecedented in the company’s history and that it may take longer then usual to fill orders going forward.

“As we evaluate the markets, it is difficult to know where silver’s price and demand will go in the coming day and weeks,” Lewis said, adding that his firm is “locking up any metal we can find in the marketplace.”

“It’s been nuts,” said John Feeney, business development manager at Guardian Vaults in Sydney.

Tyler Durden

Mon, 02/01/2021 – 07:51

via ZeroHedge News https://ift.tt/3oCgsFW Tyler Durden