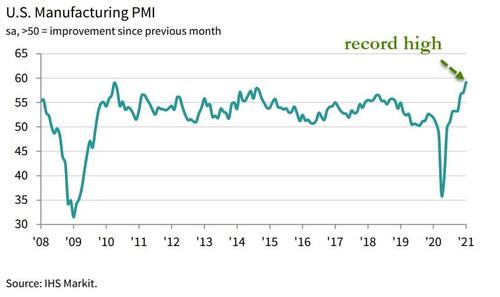

US Manufacturing Survey Hits Record High Amid Soaring Inflation, Supply-Chain Disruptions

Amid declining ‘hard’ economic data, ‘soft’ survey data on US manufacturing surged to a record high in January, according to Markit. But, according to ISM, Manufacturing in the US slowed in January too?

-

Markit Manufacturing 59.2, up from 59.1, and above 59.1 expectations to a record high.

-

ISM Manufacturing 58.7, down from 60.5, and below 60.0 expectations.

So take your pick!?

Source: Bloomberg

However, the surge in Markit’s PMI was driven by intensifying cost pressures amid raw material shortages (with near-record supply chain disruption).

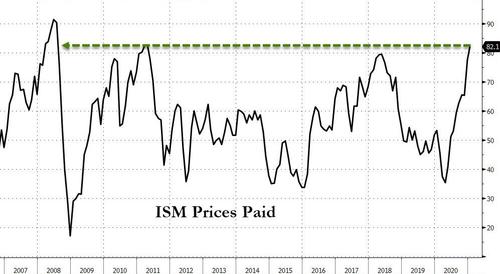

Firms were able to partially pass on higher costs, however, with selling prices rising at the fastest pace since July 2008.

The last time Prices Paid was here, Oil was trading at $140!

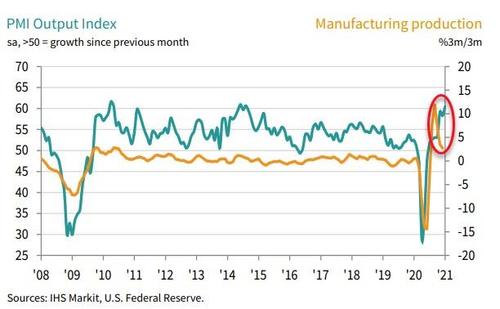

The Manufacturing survey’s surge is not matched by output…

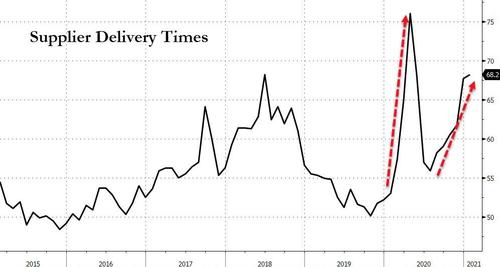

Supplier delays persisted. Excluding December’s record low, vendor performance deteriorated to the greatest extent since data collection began in May 2007. Supply chain disruption reportedly stemmed from raw material and transportation shortages, notably trucking.

This surge is modeled within ISM/Markit as a ‘positive’ sign of demand but clearly this is anything but in a COVID-locked-down world of supply chain disruptions.

The less optimistic ISM report showed respondents split into two cohorts:

Soaring business

-

“Supplier factory capacity is well utilized. Increased demand, labor constraints and upstream supply delays are pushing lead times. This is more prevalent with international than U.S.-based suppliers.” (Computer & Electronic Products)

-

“Business remains strong. Manufacturing running at full capacity.” (Chemical Products)

-

“Very strong demand with limitations in supply to meet increased demand.” (Transportation Equipment)

-

“Our current business demand is going way past pre-COVID-19 [levels].” (Fabricated Metal Products)

and lack of workers

-

“We have had an increase in employees testing positive for COVID-19, negatively impacting manufacturing.” (Miscellaneous Manufacturing)

-

“Labor continues to be one of our largest challenges.” (Food, Beverage & Tobacco Products)

-

“Business is improving, but we are still struggling with a shortage of available labor.” (Primary Metals)

Chris Williamson, Chief Business Economist at IHS Markit said:

“US manufacturing started 2021 on an encouragingly strong footing, with production and order books growing at the fastest rates for over six years.

“Demand from both domestic and export customers picked up sharply in January, buoyed by several driving forces. Consumer demand has improved while businesses are investing in more equipment and restocking warehouses, preparing for better times ahead as vaccine roll outs allow life to increasingly return to normal over the course of 2021.

“Manufacturers are encountering major supply problems, however, especially in relation to sourcing inputs from overseas due to a lack of shipping capacity. Lead times are lengthening to an extent not previously seen in the survey’s history, meaning costs are rising as firms struggle to source sufficient quantities of inputs to meet production needs. These higher costs are being passed on to customers in the form of higher prices, which rose in January at the fastest rate since 2008. These price pressures should ease assuming supply conditions start to improve soon, but could result in some near-term uplift to consumer goods price inflation.”

With inflation soaring, optimistic investors should be careful what they wish for as The Fed’s dovish hand may be forced sooner than they think.

Tyler Durden

Mon, 02/01/2021 – 10:07

via ZeroHedge News https://ift.tt/3j7sBSn Tyler Durden