Futures Soar, Yields Plunge After RBA Panics And Buys Double The Amount Of Bonds In Daily QE

On Thursday we reported that just three weeks after Australia’s central bank announced on Feb 1 an extension to its QE program by a further A$100 billion (when it also said it doesn’t expect to increase interest rates until 2024) in the pursuit of the central bank’s yield curve control (as a reminder Governor Philip Lowe had previously set the three-year yield target at 0.10%) that same day the RBA purchased a whopping (for Australia) A$3BN in three-year government bonds in the secondary market on Thursday – triple the amount it bought on Monday and the most since the bond market turbulence during the COVID-19 panic last March.

Unfortunately, the RBA’s scramble to preserve both the Yield Curve Control target of 0.10% on the 3Y, and its credibility, fell short as “only” A$3BN proved insufficient and 3Y Australian bond rose to 0.13%, 3bps above the maximum YCC barrier (and the highest since December) which is why we said “Australia’s Yield Curve Control Is On The Verge Of Collapse.“

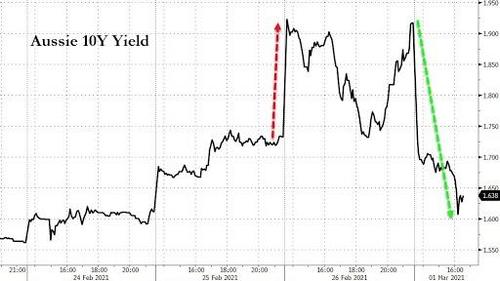

So fast forward to Monday morning when after the latest round of fireworks, the Aussie 10Y had blown out to 1.92% and threatened to unravel the local bond market.That’s when the RBA officially panicked, and took emergency steps to show markets who’s boss, by announcing an even bigger increase in bond purchases, aimed at the longer-term debt and in hopes of keeping the YCC dream alive.

Specifically, the RBA said it is buying A$4BN of longer-dated bonds, twice the usual amount. This was the first time since officials introduced the debt purchase program Nov. 3 that they bought more than the planned amount outlined by Governor Lowe, and follows the bank’s unscheduled A$3 billion bond purchase operation Friday to defend its three-year yield target, which however also failed to stabilize the rout.

In kneejerk response, 10Y Aussie yields – which we already down for the day – tumbled much as 32bps.

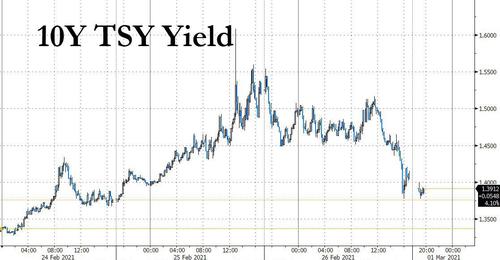

At the same time, amid expectations of even more coordinated central bank intervention, treasury futures were rising, with the 10Y yield down to 1.38% after hitting 1.61% on Thursday…

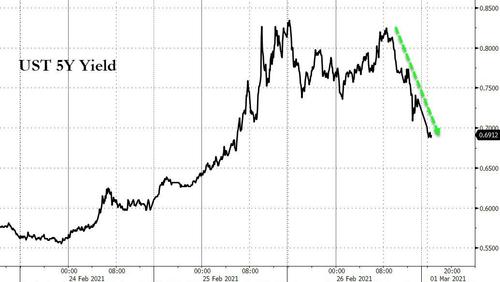

… and the closely watched 5Y yield tumbling…

… along with sliding yields in New Zealand and Japan.

And with the rout in bonds now seemingly under control, risk assets were heavily bid with Nasdaq futures up 1% in early trading…

… and with stocks seemingly set for a sharp reversal to Friday’s rout and preparing to blast off in Monday’s session.

Or, as BofA CIO Michael Hartnett is so fond of saying, “markets stop panicking when policy makers panic.” As a reminder, Fed Chair Powell and several other U.S. central bankers are scheduled to speak this week, while the RBA has its monthly meeting tomorrow. And with BofA expecting the Fed to address markets “as soon as this week“, there is no telling how high stocks can soar in the coming days as central bank panic goes to 11…

Tyler Durden

Sun, 02/28/2021 – 19:55

via ZeroHedge News https://ift.tt/2ZXBULA Tyler Durden