Chaos In Steel Market As Manufacturers Battered By Shortages, Soaring Prices

The virus pandemic has upended global supply chains and produced shortages of certain commodities, sending spot prices sky-high. The latest shortage is steel, where many US manufacturers are having difficulty procuring cold-rolled and hot-rolled steel from mills, reported Reuters.

At the moment, steel shortages are sending spot prices through the roof. The latest round of disruptions in the steel industry is impacting America’s manufacturing heartland, where aerospace parts maker in California struggles to find cold-rolled steel, while auto and appliance parts manufacturers in Indiana are having trouble securing hot-rolled steel.

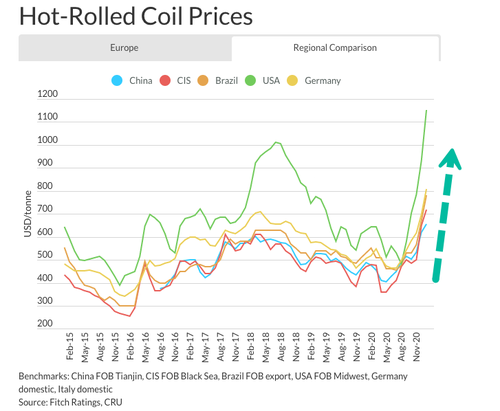

“Unfilled orders for steel in the last quarter were at the highest level in five years, while inventories were near a 3-1/2-year low,” Reuters said. Spot prices for hot-rolled steel hit $1,176/ton this month, the highest in 13 years.

US hot-rolled steel prices are rising the most versus the rest of the world.

S&P GSCI Industrial Metals is exhibiting a multi-decade symmetrical triangle.

One of the main reasons for the undersupply of steel in the first quarter is the slow restarts of mills, which were halted during the virus pandemic. Steel producers may not meet demand this quarter or next.

Soaring steel prices have pinched margins of steel-consuming manufacturers. New calls from within the manufacturing industry want the Biden administration to end former President Trump’s steel tariffs.

Paul Nathanson, executive director at Coalition of American Metal Manufacturers and Users, said the current conditions are bad.

“Our members have been reporting that they have never seen such chaos in the steel market,” Nathanson said.

He requested the Biden administration to terminate Trump’s metal tariffs to increase supply.

Capacity utilization rates at steel mills are slowly increasing and have moved up to 75% after plunging to 56% in the second quarter of 2020 but is still under 82% observed right before the pandemic.

“However, the recovery in automotive production and white goods manufacturing was quicker than expected when the strictest lockdown measures were lifted. The construction sector was less affected, as it was supported by government stimulus schemes in many regions. The restarting of steel plants was not sufficiently quick to meet growing demand, while inventory levels reduced to historical lows, with restocking across the steel value chain in Europe and the US creating additional demand. Steel prices rallied in all regions in late 2020 as a result,” Fitch Ratings explained in a recent report.

Steel-consuming manufacturers are voicing their frustration with the extremely tight market.

“It is very frustrating,” said Hale Foote, president of California-based aerospace parts maker Scandic Springs. “I am looking at great business…but I don’t have any material supply.”

Since last August, domestic steel prices have surged 160%, leaving steel consumers in a massive predicament – whether to absorb or pass along additional costs.

“We’ll be lucky if we break even at this price,” said Stuart Speyer, president at Tennessee-based Tennsco. He said steel costs of lockers, bookcases, and cabinets up nearly 100% in six months.

Whirlpool warned last month that rising steel costs would reduce profit this year by at least 150 basis points. Farm equipment maker AGCO and crane maker Terex have increased prices to offset rising steel prices.

Besides steel, the pandemic has also caused supply woes in the lumber and semiconductor industries. Political and geopolitical developments have also upended global supply chains.

Given the short-term nature of the steel chaos rippling through America’s heartland – the mismatch in supply and demand could continue through the first half of the year.

Are surging commodity prices the first leg in the next commodity supercycle?

Tyler Durden

Mon, 03/01/2021 – 04:15

via ZeroHedge News https://ift.tt/2ZZKABd Tyler Durden