It Reeks Of Deflation After Second Stellar Treasury Auction In A Row

After yesterday’s blockbuster 2Y auction which pushed bond yields sharply lower and which we said was an indication that the inflationary storm has passed with bond traders no longer expecting any rate hikes for the foreseeable future, moments ago the stench of deflation was positively rancid after today’s $61BN 5-Year auction was just as almost as solid as Tuesday’s auction.

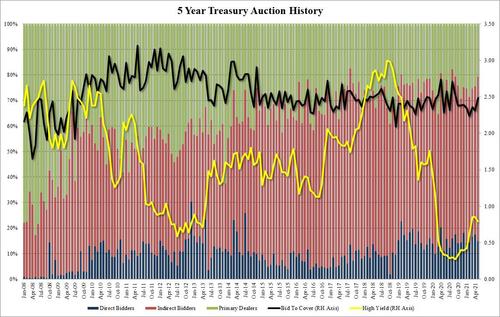

Printing at a high yield of 0.788%, the 2Y auction stopped 5.5bps below April’s auction and also stopped through the When Issued 0.794% by 0.6bps, the first stop through for the tenor since Jan 2021.

Meanwhile, and like yesterday, the Bid to Cover jumped, rising from 2.31 last month to 2.49 today, the highest since Sept 2020 and obviously well above the six-auction average of 2.34.

The internals were also stellar with Indirects taking down a whopping 64.4%, the highest foreign award since August 2020 and far above the 57.9% recent average. And with Directs taking down a lower than average 14.9%, Dealers were left holding 20.8% of the auction, the lowest since August.

Overall, a stellar bond auction, and one which together with yesterday’s 2Y auction suggests that demand for tomorrow’s 7Y issuance will be vastly greater compared to the dismal 7Y bond sale in late February when the bellybuster auction was nearly a flop and sparked a major bond and stock market selloff.

Tyler Durden

Wed, 05/26/2021 – 13:16

via ZeroHedge News https://ift.tt/34gUGjs Tyler Durden