Suddenly The Market No Longer Sees Jackson Hole As Taper D-Day

Just a few weeks ago, the market was rife with speculation that amid galloping inflation, the Fed would almost certainly breach the topic of the infamous taper during its June 16 FOMC meeting, and if not then, then no later than the September 22 meeting, which takes place just after the late-August Jackson Hole central banker outing in which most of the Fed’s “radical” ideas in the past decade have been introduced.

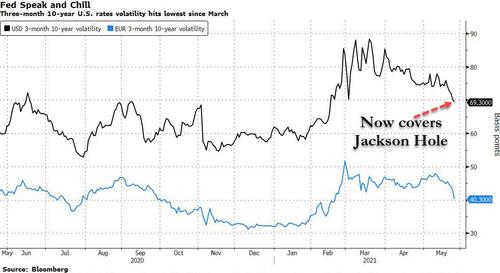

Not any more. As Bloomberg’s Stephen Spratt points out, 3-month 10-year implied swaption vol – a closely-watched metric of how much TSY prices may move over the period – has been steadily declining, and hit the lowest levels since early March, amid a non-stop barrage of central bankers repeating in the past 48 hours that inflation will be transitory. Among these were Fed vice chair Richard Clarida who downplayed the effects of higher price pressures, voicing faith in the central bank’s ability to engineer a “soft landing” if prices continue to escalate beyond what is expected. He was joined on Wednesday by Bank of France Governor Francois Villeroy de Galhau talked down stimulus adjustments anytime soon, while European Central Bank Executive Board member Fabio Panetta who said he sees no signs of sustained inflation that would allow for a reduction in bond purchases.

The three-month swaption in the U.S. implies a breakeven range of around 30 bps, suggesting benchmark 10-year yields may trade between 1.25% and 1.85%, versus about 1.56% currently. The same gauge for Europe has a range of 17 basis points either side of the current 10-year swap rate at 0.14%.

What is remarkable is that the drop has come even as the three-month contract now cover the likely start dates for the Jackson Hole Economic Symposium, which has traditionally started in the last week of August, and where as noted above, is where central banks have traditionally telegraphed material changes in central bank policies. As Spratt notes, large bets for a hawkish shake-up at Jackson Hole were seen earlier this month, with option positions targeting a more aggressive rate outlook for both the Federal Reserve and European Central Bank.

If the market is right and there is no taper announcement at Jackson Hole, it is unclear when the Fed’s next window of opportunity will be.

In the U.S., “volatility is low because the Fed has crushed it,” James Athey, investment director at Aberdeen Asset Management, told Bloomberg even though he disapproves of selling it here, and instead owns vol in five-year Treasuries and swaps. “I don’t think selling vol is attractive at all. It’s like picking up pennies in front of a steam roller.”

To be sure, even without a J-Hole surprise, there are a series of factors that could inject fresh volatility into markets. Federal Open Market Committee minutes show a number of participants signaling openness to discussing tapering of bond buying at “upcoming meetings” if the economy evolves as expected. This position was echoed by Fed Vice Chair Richard Clarida on Tuesday.

Tyler Durden

Wed, 05/26/2021 – 15:09

via ZeroHedge News https://ift.tt/3bT9lFO Tyler Durden