PBOC Holds Unexpected Meeting On FX, Says Soaring Yuan Not Used To Offset Soaring Commodity Inflation

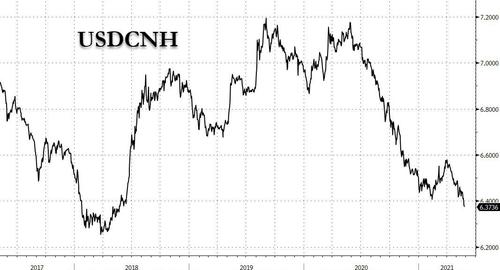

With the Chinese yuan on a rampage in recent weeks, hitting the highest since March 2016 against a basket of trading partners’ currencies as the USDCNH rose above the critical resistance level of 6.40 on Wednesday…

… some were waiting for the PBOC to address this relentless ascent, especially after Chinese state-owned banks entered the market on Tuesday to buy dollars and push the yuan lower amid speculation that the currency had gotten so strong it was hitting Chinese exports or that, inversely, it was hoping for an even stronger yuan to offset soaring domestic inflation.

That’s precisely what happened this morning when after an ad hoc meeting organized by the central bank and other government bodies with major forex market players Thursday, the PBOC said in a statement that exchange rate can’t be used as a tool to stimulate exports via depreciation nor to offset impact of rising commodity prices via appreciation.

The PBOC also said that the meeting concluded the current forex market is balanced overall, while many market and policy factors are in play and that two-way fluctuations in the Yuan exchange rate are normal while warning that Beijing will firmly crack down on malicious manipulation of forex markets and malicious behaviors for creating one-way expectations.

The Chinese central bank also said that it continues to guide firms and financial institutions to establish the “risk-neutral” mentality, while enterprises and financial institutions should actively adjust to two-way fluctuations of CNY rate; firms should not bet on Yuan rate appreciation or depreciation.

With increasingly more attention falling on the Yuan, which many speculate can’t rise further and thus will serve as a natural break to further dollar weakness and equity strength, on Monday PBoC Deputy Governor Liu stated that fluctuations in either direction for the CNY will become the norm and that the future trend of the CNY exchange rate will remain dependent on market supply and demand, as well as changes in the international market. Furthermore, Liu added that the PBoC will guide expectations to keep the CNY basically stable on a reasonable and balanced level.

Separately, Newsquawk notes that China’s Securities Journal overnight noted that the PBoC has largely ceased regular interventions, so the future rise & fall of the Yuan should be determined by the market, even though China has been aggressively cracking down on commodities (citing inflation fears) and cryptos (due to the digital Yuan and environment). It also notes of the more punchy language from the central bank as opposed to the usual bland commentary i.e. keeping the Yuan rate “basically stable”

It is worth noting that some have attributing the recent Yuan appreciation to positive vibes emanating from US-Sino talks. That was the take of Bloomberg’s Simon Flint who penned the following:

- Yuan appreciation should continue — partly due to China’s growing concern with domestic prices pressure. That said, the confirmed first-round of trade discussions probably influenced the timing of Wednesday’s yuan move. Likewise, front-page commentary in the official Securities Times to the effect that the laissez-faire attitude can continue can also be read in light of the trade talks. Given the surprising ease with which the 6.40-level was broken, what could go wrong?:

- There is a long precedent of allowing yuan appreciation ahead of key discussions, and currency matters surely featured in U.S. talking points. It’s certainly possible that China front-loaded their move ahead of these talks

- Indeed, U.S.-China relations remain fraught — despite the positive tone from today’s phone call. The comments from Kurt Campbell being the latest in a long-line of discouraging statements. That said, Campbell’s statements can be partly viewed as addressed to a U.S. domestic audience, and as a pressuring tactic towards China ahead of talks.

- While the overall trend on the domestic economy has been improving — showing a 0.9% m/m s.a. improvement in retail sales since 2H 2020 (versus a 2018-19 trend of 0.4%) — the April retail sales number registered a nasty-looking -4.5% drop. However, high-frequency data for May suggest that this decline may have been somewhat reversed.

- All in all, although the seeming ease by the authorities for a stronger local currency was likely a sweetener for the trade talks, yuan appreciation should continue.

What makes today’s message all the more confusing is that just earlier this week there were confirmed reports that state banks were defending the 6.400 mark in USD/CNY and USD/CNH.

Bottom line: this is likely a trading ploy by Beijing, seeing how much higher it can push the yuan to gain concessions out of Biden before slamming the currency lower again.

Tyler Durden

Thu, 05/27/2021 – 08:28

via ZeroHedge News https://ift.tt/3yHPWS0 Tyler Durden