US Pending Home Sales Unexpectedly Plunged In April “Due To Lack Of Affordable Homes”

With existing– and new-home sales both taking an unexpected tumble in April, despite soaring homebuilder sentiment, analysts expected pending home sales to buck the trend and rise 0.4% MoM. They didn’t!

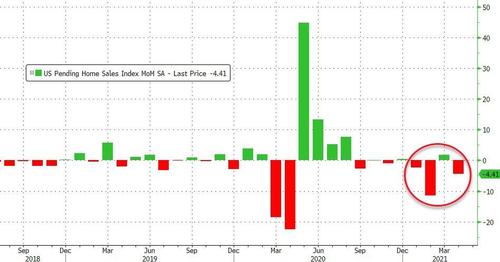

Completing the trifecta of terrible housing data, pending home sales tumbled 4.4% MoM in April…

Source: Bloomberg

That is the 3rd drop for pending home sales in the last 4 months.

That shifts the NAR index to its lowest since May 2020…

Source: Bloomberg

Of course, NAR is careful to point out that its lack of inventory (of affordable homes) that is the problem…

“Contract signings are approaching pre-pandemic levels after the big surge due to the lack of sufficient supply of affordable homes,” said Lawrence Yun, NAR’s chief economist.

“The upper-end market is still moving sharply as inventory is more plentiful there.”

Pending home sales by region:

-

Northeast declined 12.9% to 85.3

-

Midwest increased 3.5% to 101.1

-

South fell 6.1% to an index of 128.9

-

West decreased 2.6% in April to 92.0

“The Midwest region, which has the most affordable homes, was the only region to notch a gain in the latest month,” Yun noted.

“Some buyers from the expensive cities in the West and Northeast, who have the flexibility to move and work from anywhere, could be opting for a larger-sized home at a lower price in the Midwest.”

And, as we have noted recently, the enthusiasm of homebuilders (near record highs) is mirrored almost perfectly by the total disdain of homebuyers (near record lows) as rates rising alongside home prices removes all but the wealthiest from the American Dream pipeline…

Source: Bloomberg

So, Mr. Powell, keep pumping (and face even bigger crises), or pull the rip cord now and deal with the carnage?

Earlier this week, JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon said during a congressional hearing that “there is a little bit of a bubble” in housing.

Tyler Durden

Thu, 05/27/2021 – 10:07

via ZeroHedge News https://ift.tt/3hVWwhw Tyler Durden