Crypto Carnage Continues Amid Kuroda, Korea, & Cathie Wood Comments

Despite the announcement of a $6 trillion budget by the Biden admin, crypto markets resumed their carnage overnight with various catalysts cited as a driver though none particularly new or convincing.

Bitcoin tested $40,000 for the 4th time in the last 4 days… and failed again, tumbling to $35,000 this morning before a small BTFD bid appeared…

Source: Bloomberg

“Volatility has eased this week, but that probably won’t last entering a long weekend,” Edward Moya, senior market analyst at Oanda Corp., wrote in a note.

“Bitcoin’s consolidation phase should continue, but if the $37,000 level breached momentum, it could get ugly fast.”

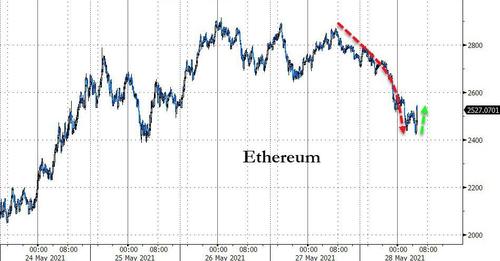

Ethereum is also getting spanked, failing to hold above $2800 and falling back to $2400 this morning before it also saw a bid…

Source: Bloomberg

Save for a few anomalies, Decrypt notes that all of the top 100 coins by market cap are down by around 10% in the past 24 hours. Data from CoinMarketCap shows that the decline started at 5 am UTC and steepened at 10 am.

The fourth-largest cryptocurrency, Binance Coin, is down 11% since yesterday, now trading for $329. Its price has plummeted almost 15% over the past week.

Cardano is down by 11.36%, even though the blockchain just launched the testnet for its long-awaited smart contract platform, which will eventually turn the network into a direct competitor to Ethereum.

XRP fell 12% in price and became the seventh-largest cryptocurrency by market cap; the coin was supplanted by Dogecoin, now the sixth-largest with a market cap of $41 billion.

“Looking at the unrest across the crypto market, there is a chance that we see another hectic weekend trading in Bitcoin and other cryptocurrencies,” said Ipek Ozkardeskaya, a senior analyst at Swissquote.

Some have suggested this is ‘Reddit’ traders rotating from crypto back to the meme stocks, though that seems a stretch since the moves have not been correlated (until today’s surge in AMC etc relative to Bitcoin’s battering).

Some have suggested that Bank of Japan’s Kuroda sparked some selling overnight after citing its volatility, he dismissed Bitcoin as “barely used as a means of settlement.”

…adding that the vast majority of Bitcoin trading is “speculative and volatility is extraordinarily high.”

Clarification from Korean regulators on their roles in cracking down on crypto also spooked some overnight:

“No one can guarantee its value, and there is a risk of massive losses due to the volatile exchange environment at home and abroad.”

Additionally, headlines that Burger Swap, the Binance Smart Chain-based decentralized exchange, was hacked for $7.2 million did not help.

Others have pointed out Bitcoin’s inability to reclaim its 200DMA as a driver of more weakness here…

Source: Bloomberg

On the bright side, CoinTelegraph reports that Ark Investment CEO Cathie Wood attempted to calm down fears regarding stricter scrutiny over Bitcoin entities.

Speaking at the Consensus 2021 conference earlier this week, the celebrated tech investor said it is impossible to shut down cryptocurrencies, reiterating her views that regulators would eventually need to wrap their minds around blockchain assets.

“I think the competitive dynamic in the rest of the world is helping us in the United States. I think it’s been good,” Wood said in an interview last week.

On declining institutional investments in the cryptocurrency space, Wood noted that investors had paused their capital flow into Bitcoin and other rival assets over their questionable environmental profile. Elon Musk raised the same issue when his benchmark undertaking Tesla decided to stop taking Bitcoin payments for its electric vehicles.

However, the billionaire entrepreneur later backed an alliance of North American crypto miners to track and reduce crypto-related carbon emissions.

“Half of the solution is: understanding the problem,” Wood said during her Consensus conference address.

“This auditing of what miners, certainly in North America, are willing to do around how much of their electricity usage is generated by renewables is going to bring that topic into stark relief and will encourage an acceleration in the adoption of renewables beyond which otherwise would have taken the place.”

She added that institutional buying in the Bitcoin market would resume on the cryptocurrency’s improving green profile.

Tyler Durden

Fri, 05/28/2021 – 08:51

via ZeroHedge News https://ift.tt/3uwQKpn Tyler Durden