UMich Sentiment Slides As Record Number Of Americans Fear Soaring Prices

The disappointing plunge in ‘hope’ from The Conference Board’s survey of consumer sentiment was echoed in the UMich sentiment survey as the headline slipped from 88.3 to 82.9 (and slightly below the preliminary data). Both current and expectations indices also tumbled, and all are still well below pre-pandemic levels…

Source: Bloomberg

As stimmies stall (see income collapse this morning), so buying conditions have also plunged…

Source: Bloomberg

And no drop is more significant than the crash in homebuying optimism (relative to record high homebuilder optimism).

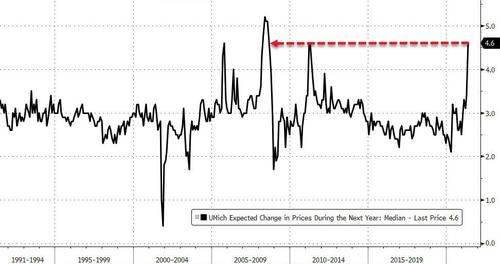

Finally, we note the final May print for inflation expectations soared to 3.6% in the next 12 months, the hottest since 2008…

Source: Bloomberg

Record proportions of consumers reported higher prices across a wide range of discretionary purchases, including homes, vehicles, and household durables – the average change in May vastly exceeds all prior monthly changes

UMich Director Richard Curtin has fully jumped on the transitory bandwagon…

While higher inflation will diminish real incomes, the gains in spending will nonetheless be substantial. The key issue is whether the timing of spending decisions will advance due to the expected price increases. At present the growth in inflationary psychology is unlikely, but it cannot be completely dismissed. Early preventative actions are much less costly, but these actions are much more difficult when policy objectives include avoiding uneven distributional impacts across population subgroups. It will require keeping the level of stimulus higher for a longer period than would have seemed prudent in the past. The primary risk of this strategy is an accelerating inflation rate, which also has uneven distributional impacts. Shifting policy language and a small rate increase could douse inflationary psychology; it would be no surprise to consumers, as two-thirds already expect higher interest rates in the year ahead.

Tyler Durden

Fri, 05/28/2021 – 10:09

via ZeroHedge News https://ift.tt/3vy1tkF Tyler Durden