And Now A Liquidity Crunch: Credit Suisse Halts Redemptions From Renaissance Feeder Fund

Once upon a time, we couldn’t go an hour without some dire news involving Deutsche Bank (and its tens of trillions of gross notional derivatives). Now, it’s Credit Suisse’s turn.

In what was at least the third flashing-red headline for the day referencing the scandal-plagued Swiss Bank, moments ago Bloomberg reported that Credit Suisse, still humiliated from the billions it lost on Archegos and Greensill and countless subsequent banker terminations and defections, has temporarily barred clients from pulling their cash from a feeder fund that that was sold as an investment option for rich clients at the bank’s wealth arm, and which invests with Renaissance Technologies “after the strategy tanked and investors rushed to exit.”

To be sure, Credit Suisse has every right to impose this gate: according to Bloomberg, the Swiss bank invoked a hold back clause, after assets in the CS Renaissance Alternative Access Fund slumped to about $250 million this month from approximately $700 million at the start of 2020. While investors are expected to receive 95% of their redemption requests after two months, the remaining 5% is expected to be paid out in January, after the fund’s year-end audit, the people said. Hold back clauses are a standard part of offer documents at some U.S. based hedge funds.

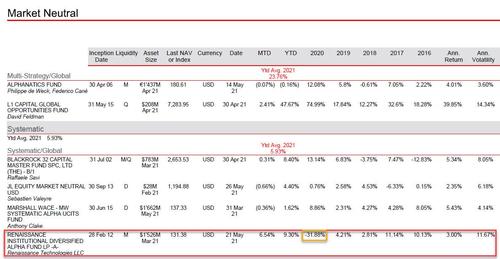

The Credit Suisse feeder fund lost about 32% last year, identical to the decline in the Renaissance Institutional Diversified Alpha Fund International fund that it invests into, as the latest HSBC hedge fund report notes.

The troubles at the Renaissance market-neutral fund have been well publicized: while it is regarded as one of the most successful quant investing firms in the world – mostly thanks to the stellar performance of its “friends and employees only” Medallion fund, the RIDA fund which is open to external investors was rocked by billion of dollars in redemptions earlier this year after unprecedented losses in 2020. Three of its funds open to external investors fell by double digits last year.

As Bloomberg notes, like Credit Suisse, the Renaissance fund – which allows investors to take out money every month – also has the ability to hold back but unlike Credit Suisse – RenTec is not invoking the clause and hasn’t ever done so. As shown in the table above, the fund is up 6.54% this year through May 28 after last year’s losses.

This suggests that in addition to the massive reputational damage that it has suffered after the implosion of the bank’s supply-chain finance funds linked to Greensill Capital and the collapse of family office Archegos Capital Management where the Credit Suisse prime brokerage lost around $5 billion, the Swiss bank is starting to experience a liquidity crunch too as that would be the only justification for gating its feeder fund clients.

The question is whether this latest troubling development sparks a broader liquidity run on the troubled Swiss bank, one which could make all of its existing troubles pale by comparison.

Tyler Durden

Fri, 05/28/2021 – 14:20

via ZeroHedge News https://ift.tt/3vs9NlY Tyler Durden