“Transitory” Retail Buying Frenzy: Money Market Funds See Massive Inflows As Investors Turn Defensive

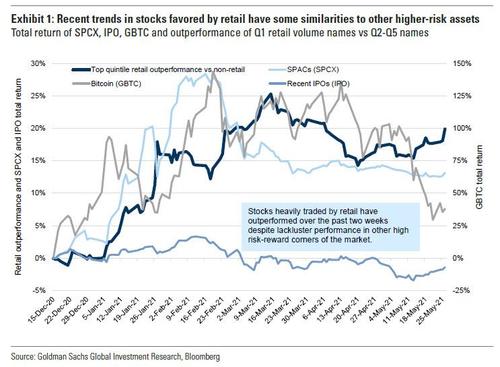

The recent surge in retail trading, which has seen the WallStreetBets army flood back into meme stocks for the second time since the epic February short squeeze sending names like AMC and GME soaring even as other high risk-reward corners of the market have remained stagnant…

… may prove to be – in the Fed’s favorite parlance – “transitory.”

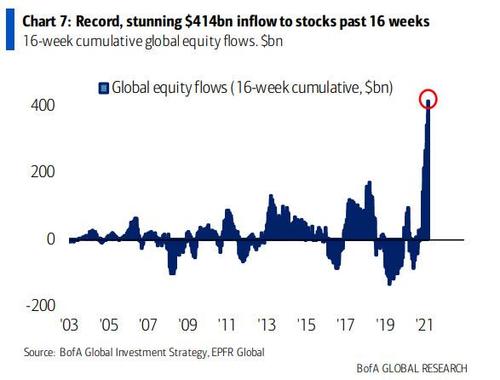

The reason fort his is that unlike the first quarter when we saw a record flood of new capital entering equity funds and validating the retail buying…

… this time the flow of funds is in the opposite direction.

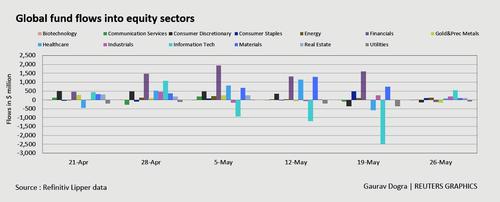

According to BofA’s latest Flows Show, this week’s EPFR data revealed a broad defensive retrenchment, culminating with the largest inflow to cash since Apr’20 & largest inflow to gold in 16 weeks ($2.6bn); and while broad inflows to equities continue ($512bn YTD) & largest inflow to Europe since Feb’18 ($2.8bn); we just experienced the largest 3-week outflow from tech since Mar’19 ($1.5bn) as well as the largest outflow from banks since Jun’20 ($0.6bn).

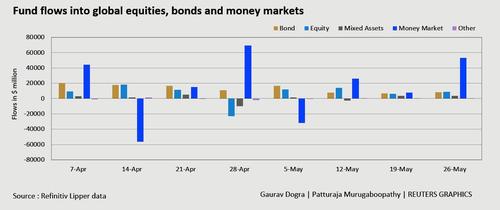

Refinitiv confirms this, reporting this morning that “global money market funds saw huge inflows” amounting to no less than $53.2 billion, the highest in four weeks, in the week ended May 26 amid caution that quickening inflation could alter the direction of U.S. monetary policy and shake up asset markets.

Despite the massive flows into the safety of money market, Refinitiv also finds that global equity funds attracted solid inflows of $8.84 billion, a 46% increase over the previous week, as stocks rallied somewhat after U.S. Federal Reserve officials reaffirmed a dovish monetary policy stance: U.S. equity funds received $2.87 billion, while European equity funds and Asian equity funds obtained $2.47 billion and $1 billion, respectively.

Where the EPFR and Refinitiv data diverge is when it comes to tech. Contrary to the EPFR observation, Refinitiv reports that tech funds attracted inflows worth $546 million after three straight weeks of outflows, while financial sector funds faced their first outflow in 16 weeks, hit by a decline in bond yields.

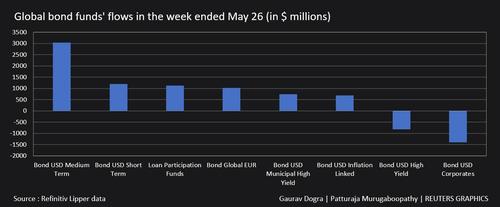

Still, the defensive bias prevailed with global bond funds receiving inflows worth $8.25 billion, a 26% increase over previous week, while precious metal funds saw net purchases worth $1.37 billion, the biggest in 16 weeks, as gold prices surged to a 4-1/2-month high this week.

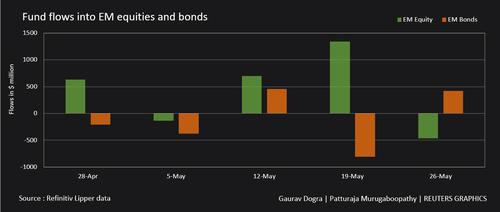

Finally, the reflation narrative appears to be running on fumes according to the latest reversal in emerging market flows: Refinitiv’s analysis of 23,865 emerging-market funds showed equity funds had net outflows worth $463 million, while bond funds had inflows worth $420 million after outflows in the previous week.

Tyler Durden

Fri, 05/28/2021 – 15:23

via ZeroHedge News https://ift.tt/2R6MOy4 Tyler Durden