China, Yields, And The Coming Deflationary Impulse

Authored by Lance Roberts via RealInvestmentAdvice.com,

Market Review & Update

Finally, after a week of false starts, the “buy signals” kicked in, and the markets mustered a rally. As we stated last week:

“With markets deeply oversold on a short-term basis and with signals at levels that generally precede short-term rallies, the rally on Thursday and Friday was not unexpected. Notably, the S&P 500 held support at the 50-dma and rallied back into the previous trading range.

On Wednesday, the Nasdaq triggered its short-term “buy signal,” which will likely provide some relative outperformance over the S&P 500. It will be important for the Nasdaq to hold above the 50-dma into next week“

The good news is that we did indeed get the rally we were expecting. The not-so-good news is that the rally already consumed a majority of the “buy signal.” Such does not mean the market is about to correct; it does suggest that upside remains limited near term.

However, the S&P 500 buy signal has a bit more room to run. Such suggests we may see some relative performance pickup between the S&P 500 and the Nasdaq over the next week or so.

Our more significant concern remains the weekly “sell signal.” Historically, these weekly signals typically denote periods of more significant volatility swings or corrections. The biggest correction risk comes when the daily and weekly signals align.

Importantly, these weekly sell signals do not always resolve into a correction. However, by the time you realize a correction has started, it is often too late to do much about it. Therefore, we tend to take these weekly signals at face value and adjust our risk exposures accordingly.

Still Expecting A Bigger Correction

As discussed over the last few weeks, we still expect a more extensive correction this summer. Currently, the markets are in an exceptionally long stretch in the market without a 5% pullback, so the odds are rising.

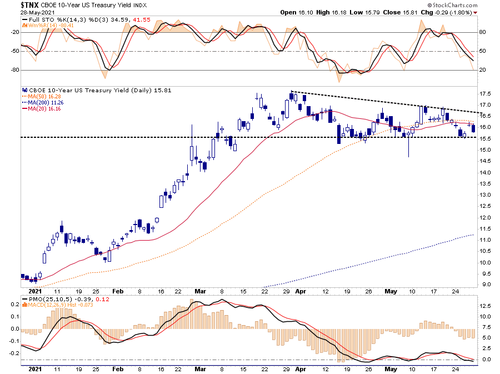

Importantly, as noted in this week’s “3-Minutes” video below, the one thing we continue to watch very closely is interest rates.

Wall Street analysts continue to ratchet up earnings at one of the fastest paces on record. For earnings to meet these rather lofty expectations, economic growth must sustain a very high growth rate into 2022. However, interest rates peaked a couple of months ago suggesting economic growth will weaken in the months ahead.

If rates are sniffing out slower economic growth as stimulus fades from the system, the earnings are at risk of fairly significant downward revisions. In the market figures this out, a repricing of assets is likely.

Such is why we continue to suspect a 5-10% correction is a higher probability than most think.

Inflation Is Likely Transient

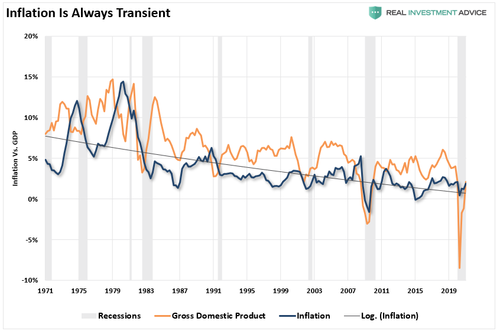

We previously discussed that inflation might indeed be more transitory given the impacts creating increased prices were artificial. (i.e., stimulus, semi-conductor shortages, and pandemic-related shutdowns.) To wit:

“Inflation is and remains an always ‘transient’ factor in the economy. As shown, there is a high correlation between economic growth and inflation. As such, given the economy will quickly return to sub-2% growth over the next 24-months, inflation pressures will also subside.”

“Significantly, given the economy is roughly comprised of 70% consumption, sharp spikes in inflation slows consumption (higher prices lead to less quantity), thereby slowing economic growth. Such is particularly when inflation impacts things the bottom 80% of the population, which live paycheck-to-paycheck primarily, consume the most.”

However, another important factor behind inflationary pressures is an individual’s own actions. As noted last week by Société Générale’s Albert Edwards:

“Surveys suggest that inflation fears have become investors’ number one concern. But why look at it that way? We could equally say it is investors’ own bullishness on the strength of this economic cycle that is driving prices sharply higher in the most cyclically exposed equity sectors and industrial commodities.”

Bloomberg’s John Authers discussed the same, noting a “reflexivity” to investors’ belief in rising inflation.

“In inflation, as in many other areas of economic life, perceptions can form reality, and that is certainly true of inflation. The University of Michigan monthly survey of consumers’ expectations perennially shows shoppers foreseeing more inflation than will in fact arrive. The important factor here is the direction of travel. If they are more worried about inflation, they will do more to guard against it, which will tend to push up prices.”

China Drives Inflation

Such is an important point, as Albert notes:

“When investors pile into commodities as an investment vehicle to benefit from rising inflation, they create substantial upstream cost pressures. Beyond the cascading effect of upstream commodity price pressures, headline CPIs are also quickly impacted as food and energy prices rip higher.”

In other words, investors cause inflation by their actions. However, this is where Albert keys in on another critical driver of inflation.

“In addition to this, the observation by investors that industrial commodity prices are rising only serves to reaffirm their belief about cyclical strength and rising inflation, most especially ‘Dr. Copper.” Many investors see copper as extremely sensitive to economic conditions.

The circular, or as George Soros terms it, ‘reflexive’ nature of financial markets makes them extremely vulnerable to being whipsawed. Yet because of the current extreme momentum, it would take a very heavy weight of evidence to convince this market to reverse direction.

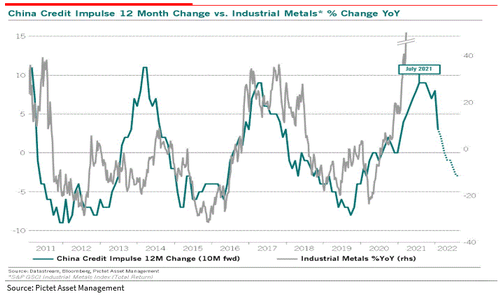

We continue to highlight that commodity prices are at high risk of a major reversal because of the steep downturn in the Chinese Credit Impulse. We have highlighted this before and we are not alone. Julien Bittel of Pictet Asset Management posted the following chart.”

“When commodity prices do start to fall, expect a major reversal in inflation sentiment. Furthermore, expect momentum to become as self-reinforcing and reflexive on the way down just as it was on the way up.”

As we discussed previously, this is what the bond market is already pricing in.

Yields Need A New Narrative

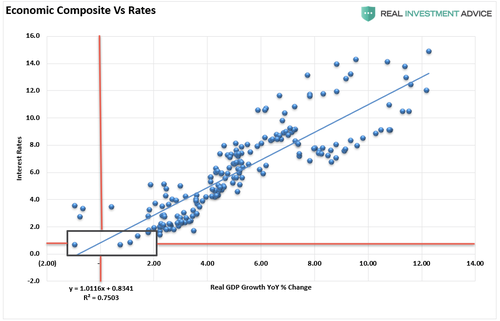

While investors expect surging inflation, the bond market continues to price in weaker future economic growth. As noted in “No, Bonds Aren’t Over-Valued.”

“The correlation between rates and the economic composite suggests that current expectations of sustained economic expansion and rising inflation are overly optimistic. At current rates, economic growth will likely very quickly return to sub-2% growth by 2022.”

Note: The “economic composite” is a compilation of inflation (CPI), economic growth (GDP), and wages.

Currently, as shown in our opening commentary, yields have remained range-bound between 1.5-1.6%. Such suggests that expectations for price pressures have moderated.

While the markets wonder when the Fed will start to talk more about tapering the bond purchases, yields are currently suggesting inflation may not be the real “risk.”

The most considerable risk is a divergence among Fed policymakers which possibly leads to a policy mistake of tapering too quickly or even hiking rates.

The majority of the inflation and economic growth pressures are artificial, stemming from the stimulus injections over the last year. However, with those inputs fading as year-over-year comparisons become more challenging, the “deflationary” impact could be more significant than expected.

There is also one other point about the Fed tapering the purchases. As shown in the chart below, rates rise during phases of QE as money rotates from bonds to stocks for the “risk-on” trade. The opposite occurs when they start to taper, suggesting a decline in rates if “taper talk” increases.

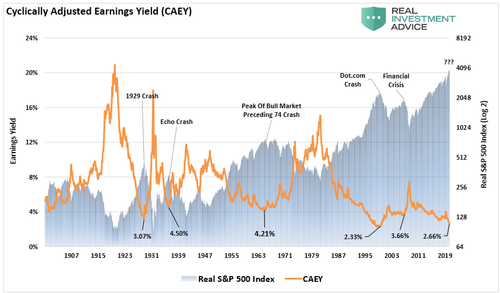

Earnings Yields Are A Problem

Switching from economics to equities, the recent spike in inflation has caused a drop in the “earnings yield” into negative territory.

Let’s start with what is “earnings yield.”

“Earnings yield has been the cornerstone of the ‘Fed Model’ since the early ’80s. The Fed Model states that when the earnings yield on stocks (earnings divided by price) is higher than the Treasury yield, you should invest in stocks and vice-versa.”

The problem here is two-fold.

-

You receive the income from owning a Treasury bond, whereas there is no tangible return from an earnings yield. For example, if we purchase a Treasury bond with a 5% yield and stock with an 8% earnings yield, if the price of both assets remains stable for one year, the net return on the bond is 5% while the return on the stock is 0%.

-

Unlike stocks, bonds have a finite value. At maturity, the principal gets returned to the holder along with the final interest payment. However, stocks have price risk, no maturity, and no repayment of the principal feature. The risk of owning a stock is exponentially more significant than holding a “risk-free” bond.

If we look at periods of exceptionally low earnings yields compared to the market, we find a better correlation to corrections and outright bear markets.

As shown, there is a reasonable correlation between low earnings yields and low forward returns. Historically speaking, with an earnings yield of 2.66%, forward returns over the next decade should somewhere between +2% and -5%.

But what about the NEGATIVE yield?

Negative Real Yields Are A Bigger Problem

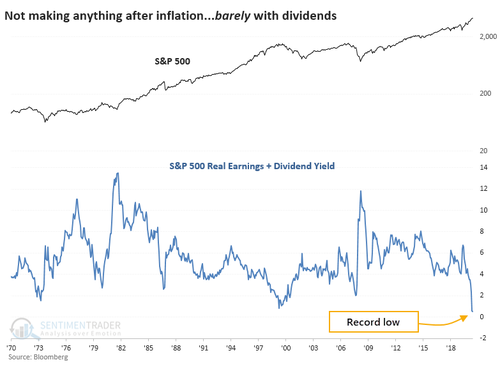

An interesting note this past week from Sentiment Trader discussed the outcomes for markets when inflation-adjusted earnings yields are negative.

“Until recently, one of the main arguments for stocks was that even though they weren’t yielding much, at least they were earning more than Treasuries, even after accounting for inflation. Now that there has been a spike in inflation gauges, the earnings yield on the S&P 500 has turned negative. This is not a condition that investors have had to tackle much over the past 70 years.

When an investor in the S&P adds up her dividend check and share of earnings, then subtracts the loss of purchasing power from inflation, she’s barely coming out even. This is a record low, dating back to 1970, just eclipsing the prior low from March 2000.”

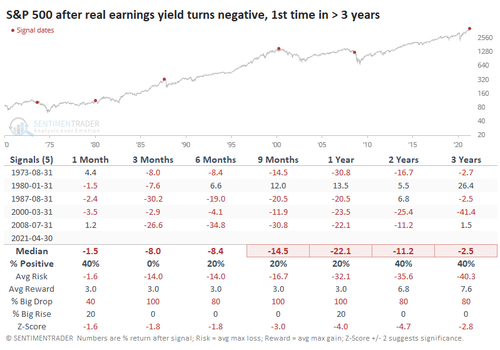

“If we ignore dividends, then there have been five other times when the S&P 500’s inflation-adjusted earnings yield turned negative. You may want to close one eye and use the other to look askance at the table because it’s not pretty.”

The issue of negative earnings yield tells you three things:

-

The market is hugely overvalued relative to the strength of underlying earnings.

-

Expectations for future earnings growth are unlikely to match current expectations leading to a future repricing of risk.

-

Bond yields are confirming that both economic and earnings growth has likely peaked.

Tyler Durden

Sun, 05/30/2021 – 10:00

via ZeroHedge News https://ift.tt/3i5zqFo Tyler Durden