Bill Gross: The Fed Can’t Keep Its “Pedal To The Metal” Much Longer

Longtime ‘bond king’ Bill Gross has kept a low profile since his “retirement” from Janus Henderson, where he worked after leaving PIMCO abruptly in 2014 in a high-profile dispute with colleagues. While he emerged earlier this year to share the results of a recent Gamestop short, Gross has been making more appearances in the tabloids than in the business press recently thanks to a legal dispute with one of his neighbors.

But in today’s FT, Gross returns with an editorial warning that the Federal Reserve and Treasury are injecting money into the economy so quickly that as the economy recovers from COVID-19, they’re risking a dangerous snap-back in markets as investors reckon with the withdrawal of all the post-COVID stimulus.

For those who still have faith in the Fed, Gross asks: do you think the booms in cryptocurrencies and SPACs represents “the product of financial innovation”…”or the product of cheap and plentiful credit…”

Even enthusiasts of the Fed’s policy must wonder whether hundreds of cryptocurrencies or a boom in special purpose acquisition vehicles are the result of continuing financial innovation or the product of cheap and plentiful credit demanded by deficit spending and an accommodating Fed chair.

Gross also wondered how long the Fed could continue with “near-costless Fed financing for “$2 trillion, $3 trillion, $4 trillion deficits” without sinking the dollar? The greenback has certainly weakened in response to all this stimulus, but just how much more can the market absorb before things start to break?

Many observers wonder how Treasuries and other global sovereigns can trade at yields that are so low, and in some cases negative. Five-year US Treasuries currently yield just 0.80 per cent, not much in a world where inflation expectations over the same period are above 2.5 per cent. That is reflected in the negative real yields, which have the effects of inflation stripped out.

Five-year US inflation protected bonds now trade at a yield close to minus 2 per cent. Part of the explanation lies with the less attractive yield on local sovereign debt for foreign institutions (minus 0.5 per cent in Germany, for instance). Even US investors, however, believe that a 10-year Treasury yielding 1.65 per cent can earn a total return of 2.40 per cent or more by capturing the rising price of the bond as it approaches its maturity date. And then there’s the Fed buying more than $1tn Treasuries a year.

No wonder the 10-year Treasury rests illegitimately at 1.65 per cent. Such speculations, however, are dependent upon the stability of the dollar and the consistency of Powell’s vow to keep short rates unchanged for the foreseeable future. At some point in the next few months, hopes for this will probably be disappointed as inflationary pressures pose increasing price risks to Treasuries and stocks too.

Gross also wondered how the Fed will determine essential policy benchmarks like Nairu, since the central bank’s historical models likely won’t be much use in the post-pandemic era.

Powell will not even acknowledge asking the question about asking the question until Covid is more under control and employment returns to historical norms. Yet unemployment may never return to 4 per cent, given the radical changes in working from home and Zoom-like technological shifts.

What is Powell’s new Nairu? The Fed’s historical model for the “non-accelerating inflation rate of unemployment” cannot be a reliable guide for future policy rate changes. And how long can the Treasury continue to require near-costless Fed financing for $2tn, $3tn and $4tn deficits without sinking the dollar? In a historical gold-standard world, Fort Knox would have been emptied long ago, implying the bankruptcy of the world’s reserve currency.

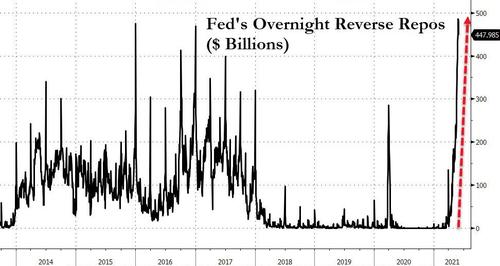

Here’s an example of what the Fed’s stimulus is doing to the plumbing of the global dollar-based financial system: banks are quickly running out of places to stash all their cash reserves amid a shortage of good collateral, much of which has been hoovered up already by the central bank.

Thanks to the Fed, Gross argues that Treasuries valuations have become so stretched that they’re essentially “risk” assets now. Financial journalists scoffed last month when Bridgewater’s Ray Dalio once again warned that “cash is trash”, a warning that he has made repeatedly in the past, often before big market selloffs. As Gross sees it, cash might soon be the only real haven for investors as markets are forced to reckon with the possibility that rate hikes and tapering might arrive sooner than investors might like.

The Fed cannot for long continue to maintain current policy rates and expand its own balance sheet and therefore private bank reserves at a $120bn monthly pace.

Ten-year Treasuries morphed into the “risk” asset category several years ago. Stocks with valuations supported by low yields have entered the same category now, no matter the growth potential for 2021 and 2022.

Cash has been trash for years but soon it may be the only haven for investors sated beyond reasonable expectations of perpetually low yields and supportive bond kings and queens.

Regardless of what happens next, few would argue with Gross’s conclusion that Chairman Jerome Powell and the Fed’s other top officials are the true “kings and queens” of the bond market.

Tyler Durden

Tue, 06/01/2021 – 19:00

via ZeroHedge News https://ift.tt/3pcXt6E Tyler Durden