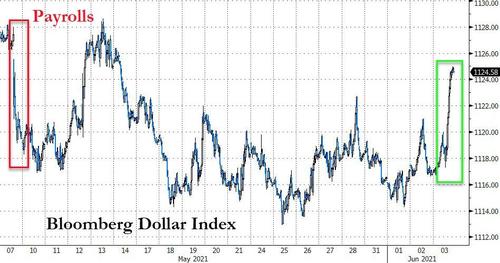

Dollar Spikes Most In 9 Months As Meme-Mania Distracts Markets

While “meme-mania” dominated the headlines today, the biggest thing that happened in global markets was a sudden, violent, and sustained bid for the dollar, which saw its biggest daily gains since September 2020…

Source: Bloomberg

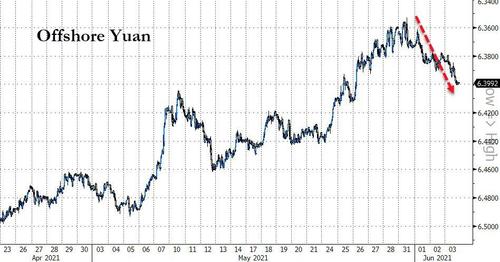

Which we’re sure will please the Chinese…

Source: Bloomberg

But anyway, that’s enough of that – we know you want to see the malarkey in meme stocks…

The good… GTT screamed higher today (admittedly with lots of vol)…

And another of our “most shorted” stocks – WKHS ripped higher…

The bad… GME gave back yesterday’s gains for a 8% tumble…

And the ugly… AMC was down over 50% at one point today after another major secondary…

And Bed, Bloodbath, & Beyond was clubbed like a baby seal with no AMC-like dip buying…

And the Musky… TSLA tumbled below $600 on the back of some ugly China sales reports, breaking below its 200DMA once again…

Overall, the major indices had a rollercoaster ride, all puking at the open on Biden budget headlines only to be panic-bid back into the European close, after which they drifted lower. Nasdaq was the biggest loser along with Small Caps as The Dow tried its best to hold on to the flatline (it closed red, breaking its recent win streak)…

“…madness? This is meme-stock-mania!!!”

Talking of madness, cryptos were bid today with Bitcoin back above $39k and Ether almost tagging $2900. From last Friday’s “close”, cryptos have staged a solid rebound this week so far…

Source: Bloomberg

While the dollar rallied and stocks were weaker, Treasuries were also sold relatively hard with yields in the belly up 4-5bps (wing yield up 1-2bps)

Source: Bloomberg

10Y Yield is back above 1.60%, seemingly testing the pre-CPI levels from last month’s spike..

Source: Bloomberg

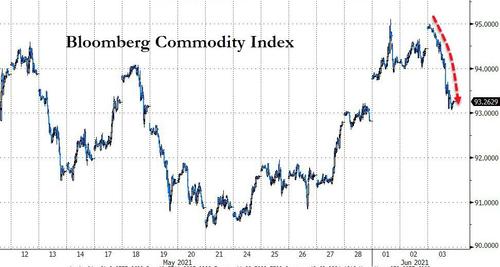

Gold was monkeyhammered back below $1900 as the dollar spiked…

But oil prices extended gains after a decent crude draw, with WTI topping $69…

Overall, commodities had an ugly day today

Source: Bloomberg

Finally, there’s no bears left… and it didn’t end well last time…

Source: Bloomberg

Tyler Durden

Thu, 06/03/2021 – 16:00

via ZeroHedge News https://ift.tt/3vQQ7Iz Tyler Durden