May Payrolls Preview: A 1 Million “Whisper”

Up until this morning, the big risk heading into tomorrow’s payrolls report was for yet another subpar print (as a reminder last month’s jobs report showed a paltry 266K jobs were added, a huge miss to expectations), but then today’s blockbuster ADP report, which showed 978K private jobs far above the highest forecast, changed everything (even if the ADP report has a reputation of being chronically incorrect, with zero predictive power).

Still, as Newsquawk notes, labor market indicators have generally been encouraging in May (if maybe not to the same degree as April and we know how that ended): ADP’s gauge of payroll growth surprised to the upside, initial jobless claims declined to a fresh pandemic low in the corresponding survey week, while continuing claims fell near to the post-pandemic low (both continued to make progress in the subsequent reports too). Business surveys like the ISM reports as well as the Fed’s own Beige Book allude to tight labor market conditions where firms are struggling to fill vacancies, and are having to offer financial incentives like signing-on fees and higher wages to attract staff. However, the Conference Board’s measure of consumer confidence was more mixed: although consumers’ view of the labour market improved, their views on wage growth are not quite as bullish as business surveys are signalling.

Traders have suggested that the May jobs data is more important than other recent reports, since it will be influential in the market’s perceptions about the timing of the Fed’s taper of asset purchases; for what it is worth, even if the report comes in on the strong side, officials will likely highlight the great deal of slack that remains, while there are still multiple-millions that remain out of work vs pre-pandemic levels. Furthermore, to catch up to the pre-covid trendline by mid/late-2022, the economy will need to add roughly 1 million jobs every month (which isn’t very likely).

In his preview of tomorrow’s jobs number, JPM Chief Economist Mike Feroli has a sub-consensus forecast of +550k jobs while Economist Jesse Edgerton’s alternative data suggests +476k jobs. Both numbers are below the current consensus of +656k. If either Mike or Jesse is correct this would be a disappointment, which would fail to push yields higher. A weak jobs print combined with higher commodity prices likely pushes real yields more negative. This would be positive for both gold and Tech stocks.

Goldman’s economists are more optimistic, and estimate that nonfarm payrolls rose by an above consensus 750k in May. Following the surprisingly weak April report, Goldman believes the further easing of business restrictions more than offset a moderate drag from labor supply factors and seasonality. While Big Data measures were mixed between the April and May survey weeks, the signals Goldman tracks generally indicate sharply higher employment levels relative to March. Goldman’s optimistic goalseek narrative aside, the bank sees uncertainty ahead of tomorrow’s report to be higher than usual, and Goldman notes the possibility that the establishment survey undercounts job gains from reopening establishments, which other things equal would result in a relatively stronger household survey.

These two banks aside, here is what consensus expects:

- JOB GROWTH: Non-farm Payrolls (exp. 650k, prev. 266k); Private Payrolls (prev. 600k, prev. 218k); Government Payrolls (prev. 48k); Manufacturing Payrolls (exp. 24k, prev. -18k).

- JOBLESSNESS: Unemployment Rate (exp. 5.9%, prev. 6.1%); Participation Rate (prev. 61.7%, vs 63.3% in Feb 2020); U6 Underemployment (prev. 10.4%, vs 7.0% in Feb 2020); Employment-Population Ratio (prev. 57.9%, vs 61.1% in Feb 2020).

- WAGES: Average Earnings M/M (exp. +0.2%, prev. +0.7%); Average Earnings Y/Y (exp. +1.6%, prev. +0.3%); Average Workweek Hours (exp. 35.0hrs, prev. 35.0hrs)

Job Gains

- Initial jobless claims data that coincides with the BLS employment situation report survey period showed weekly claims falling to a post-pandemic low at 444k, and the data series continued to show progress the next week too; continuing claims also declined in the corresponding survey window to 3.64mln, although that was not a fresh pandemic low.

- The ADP measure of nonfarm payrolls surprised to the upside, seeing 978k private payrolls added to the economy in May, above the forecast range, where the most optimistic forecast saw gains of 900k. ADP’s chief economist said that private payrolls had shown a marked improvement from recent months, and the strongest monthly gain since the early days of the recovery; “While goods producers grew at a steady pace, it is service providers that accounted for the lion’s share of the gains, far outpacing the monthly average in the last six months,” she added, “companies of all sizes experienced an uptick in job growth, reflecting the improving nature of the pandemic and economy.”

- ISM’s manufacturing PMI saw the employment sub-component fall by 4.2ppts to 50.9, still in expansion for the sixth straight month, but with momentum cooling (a manufacturing employment index above 50.6, over time, is generally consistent with an increase in the BLS data on manufacturing employment). ISM said that continued strong new-order levels, low customer inventories and expanding backlogs continue to indicate employment strength, but panellists are struggling to meet labor-management plans, and the commentary indicates that an overwhelming majority of companies are hiring or attempting to hire, though more than 50% of manufacturing firms have expressed difficulty in doing so. Similarly, the employment sub-component within the Services ISM declined too, by 3.5 points to 55.3; respondents said that “competition for labor continues to intensify due to lack of available talent pool” and “working to fill vacant positions; difficulty in finding qualified candidates.”

Slack

- The Conference Board’s gauge of consumer confidence was mixed regarding the labour market; consumers’ assessment of current labour market conditions improved – with the number saying jobs are plentiful rising while those claiming that jobs are hard to get declining, which in aggregate bodes well for the May jobs report. However, optimism in the short-term outlook waned, CB said, with the number expecting business conditions to improve over the next six months falling, while the number expecting business conditions to worsen rose. CB also said that consumers were less upbeat about the job market ahead, with the proportion expecting more jobs in the months ahead falling, while those anticipating fewer jobs rose.

- But even if the data surprises to the upside (range is 400k to 1mln), some desks expect Fed commentary to remain cautious, and continue to note that there remain a significant number of Americans out of work. Indeed, the aggregate nonfarm payroll additions since March last year still leaves a deficit of 8.2mln who remain out of work vs pre-pandemic levels, if you judge the amount purely based on the totals of the nonfarm payrolls figures, and potentially even more when accounting for underemployment.

- Fed officials are looking beyond the headline unemployment rate to try and gauge the levels of slack that remains; accordingly, the U6 Underemployment metric, Participation Rate, as well as the Employment-toPopulation ratio have gained in importance; last month, U6 stood at 10.4% (vs 7.0% in February 2020), Participation was at 61.7% (vs 63.3% in February 2020), and the Employment-Population Ratio was at 57.9% (vs 61.1% in February 2020), all three of these indicating that there is still some way to go, and reclaiming this lost ground is not going to happen in the immediate short-term.

Wages

- Data from Challenger, Gray & Christmas showed monthly job cut announcements picking up a touch in May, to 24.6k from around 22.9k in April, but the trend remains solid, and announced job cuts were still some 93.8% lower vs May 2020 levels. “Many employers, especially those hit hard during the pandemic, such as Retailers and Hospitality and Leisure companies, are having a difficult time finding workers, and many are offering signing bonuses or higher wages to attract workers,” Challenger said, adding that “as the labour market tightens, workers may find employers offering more attractive perks and benefits, including higher starting wages, as they look for positions.”

- However, according to Conference Board data, the number of consumers expecting incomes to rise over the next six-months pared back a touch in May (to +14.5% from +17.4%), though the number of Americans expecting incomes to decline in the next six-months also dropped back. Anecdotes leaning towards this were also noted in the Fed’s recent Beige Book (which was conducted before 25th May), which stated that while overall wage growth was moderate, a growing number of firms were offering signing bonuses and had increased starting wages to attract and retain workers.

Arguing for a better-than-expected report:

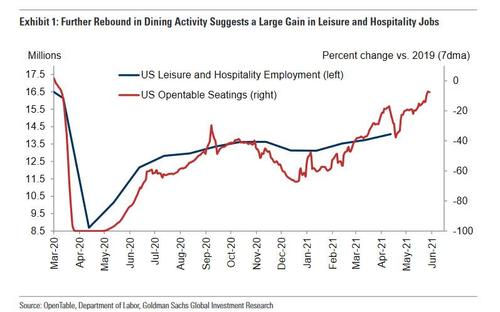

- Reopening. Sharply lower infection rates and a further easing in the severity of business restrictions likely supported job growth in virus-sensitive industries between the April and May survey period. For example, restaurant seatings on OpenTable rebounded to -17% during the May survey week, compared to -35% in that of April.

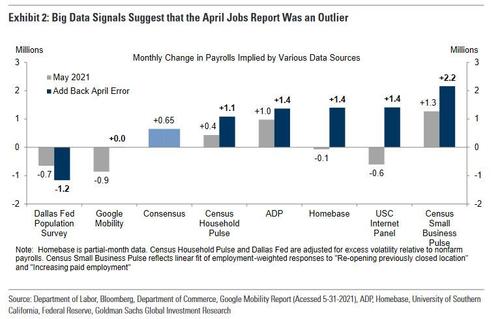

- Big Data. High-frequency data on the labor market were mixed between the April and May survey weeks, with outright declines in three of the seven measures Goldman tracks (gray bars in Exhibit 2). However, most measures nonetheless indicate sharply higher employment levels relative to March. Taking into account last month’s divergence with nonfarm payrolls, the majority of the signals would argue for an above-consensus reading, on our estimates (blue bars below). We find that Homebase (75% directionally correct vs. consensus since May 2020), Dallas Fed(75%), the USC Understanding America Survey (67%), and the Census Small Business Pulse have been among the most reliable predictors of the jobs report over the last year. Given the diverging messages from these indicators, we believe uncertainty ahead of tomorrow’s report is higher than usual.

- ADP. Private sector employment in the ADP report increased by 978k in May, well above consensus expectations for a 650k gain. We continue to believe the ADP panel methodology undercounted workers returning to their previous employers,and this would argue for a larger gain in tomorrow’s report.

- Job availability. The Conference Board labor differential—the difference between the percent of respondents saying jobs are plentiful and those saying jobs are hard to get—surged to +34.6 in May (from +21.6 in April) and is now at pre-pandemic levels.Job cuts. Announced layoffs reported by Challenger, Gray & Christmas fell by 30%nin May after declining by 23% in April (mom, SA by GS). Announced layoffs reported by Challenger, Gray & Christmas fell by 30% in May after declining by 23% in April(mom, SA by GS). Layoffs were at the lowest level since 1989.e at the lowest level since 1989. Employer surveys.

Arguing for a weaker-than-expected report:

- Labor supply constraints. Labor supply appears to be tighter than the unemployment rate suggests, likely reflecting the impact of unusually generous unemployment benefits and lingering virus-related impediments to working. We also believe that the survey period of tomorrow’s report is too early to reflect state-level changes to UI benefit availability and generosity, as benefits will be curtailed in onehalf of US states starting in June.

Neutral/mixed factors:

- Seasonality. In April, reopening effects likely overlapped with normal seasonal hiringn patterns, resulting in less-impressive job gains on a seasonally-adjusted basis. In normal times, many service industries ramp up operations in the spring ahead of peak-season demand. This year, however, firms in heavily-impacted industries may simply have been more focused on bringing back their pre-crisis permanent workforces than on expanding their businesses and adding temporary seasonal labor. If so, seasonality should weigh on the May report as well, as the May BLS adjustment factors generally anticipate at least 300k of net hiring (vs. over 800k in April).

- Employer surveys. The employment component of our manufacturing survey tracker decreased (-1.4pt to 58.5), while the employment component of our services survey tracker increased (+0.6pt to 56.6), but both remain around 2018 levels.

- Jobless claims. Initial jobless claims declined during the May payroll month, averaging 505k per week vs. 656k in April. Across all employee programs including emergency benefits, continuing claims remained roughly unchanged between the payroll survey weeks.

How will the market respond?

The yield curve has failed to move materially over the last month as we received a disappointing NFP print but Fed Mins that show the FOMC is talking about talking about tapering. According to JPM, it may be the case that the bond market needs to see multiple NFP prints that approach the 700k – 1mm jobs range and/or actual tapering talk, before we see a sustained move higher, especially since the latest JPM Treasury survey found the most shorts since 2017. In other words, there is nobody left to short rates.

Meanwhile, as Bloomberg notes, stronger data, including ADP and ISM services, sent real yields and the dollar higher. The risk of the payroll Friday is skewed favorably to the dollar. There’s a wide range of estimates for the payroll, making a clean read more difficult. The average forecast was 667k jobs. But with standard deviation of 147k, anything between 500k and 800k would be considered more or less in line with expectations.

But, as BBG’s Ye Xie notes, we know from various surveys that demand for labor isn’t an issue. It’s labor supply that is holding back job growth, because of the pandemic, child care and unemployment benefits. So, a low reading would be taken with a grain of salt. Any knee-jerk fall in yields or the dollar could be reversed soon after.

But a higher figure, say close to 1 million, would put the tapering discussion on the table more urgently.

Finally, it is worth noting that after several months of disappointment, the US economy is certainly in need of a strong jobs report and that may explain why moments ago we learned that the president, who already knows the number, is set to discuss it shortly after it is released:

- BIDEN TO GIVE REMARKS ON THE MAY JOBS REPORT AT 10:15AM ET.

That alone was enough to push the whisper number to 1 million.

Tyler Durden

Thu, 06/03/2021 – 22:40

via ZeroHedge News https://ift.tt/34MsoNS Tyler Durden