Yellen & The Big Push To Offshore US Labor

Authored by Lance Roberts via RealInvestmentAdvice.com,

Janet Yellen’s latest commitment to support the Biden progressive agenda from higher taxes to unionization, will not lead to increased economic prosperity. Instead, it will lead to more outsourcing and offshoring of U.S. Labor. Such was evident in two recent comments.

“With corporate taxes at a historical low of one percent of GDP, we believe the corporate sector can contribute to this effort by bearing its fair share: we propose simply to return the corporate tax toward historical norms.”

And;

“Workers, particularly lower-wage earners, have seen wage growth stagnate over several decades, despite overall rising productivity and national income. There are several contributors to this troubling trend, but one important factor is an erosion in labor’s bargaining power.”

In theory, there is nothing wrong with either of these two statements. Why not have corporations pay more in tax and push companies to unionize.

In reality, however, if Janet Yellen and Joe Biden get their wish, it would lead to a sharp increase in the offshoring of manufacturing and employment.

Let’s dig into both of these issues.

Increase Corporate Tax Rates

Increasing corporate tax rates certainly seems like an easy task. However, the negative impacts of increasing taxes on the primary suppliers of employment will likely outweigh the revenue increase.

Let’s start by understanding some of the most basic facts.

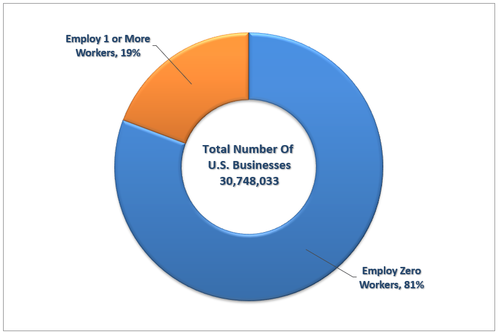

In the U.S. there are roughly 30.7 million businesses. Of those, 81% have ZERO employees. Such is important to understand because many of these “businesses” are set up for tax shelters and estate planning purposes.

The remaining 19% employee 100% of all non-governmental workers.

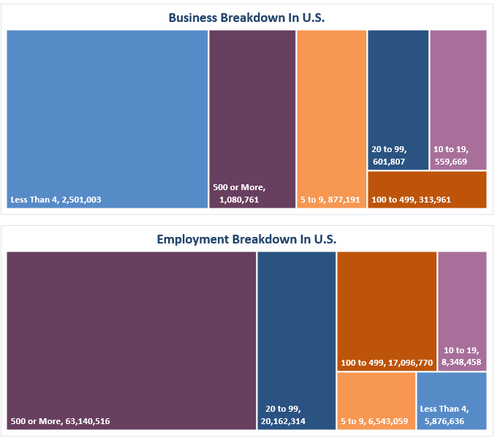

Importantly, when Yellen suggests we raise taxes on corporations, she is primarily talking about the roughly 10,000 major corporations in the U.S. However, 50% of all jobs are created by firms with fewer than 500 employees, and almost 90% by firms with less than 1000.

While Yellen is suggesting we go after those “evil corporations,” she is only talking about a fraction of the businesses that employ workers. However, the impact of higher taxes, unionization, etc., impact all businesses and hurts the small business owners that employ the most workers the most.

Such was a point made by the Chamber of Commerce in response to Janet Yellen’s statement:

“The data and the evidence are clear: the proposed tax increases would greatly disadvantage U.S. businesses and harm American workers, and now is certainly not the time to erect new barriers to economic recovery.” – Suzanne Clark, CEO/President US Chamber of Commerce

Unionization Is A Barrier To Employment

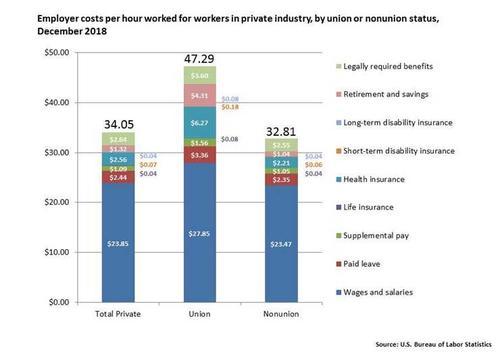

As we discussed recently, the cost of operating a business is increasing. For small businesses which already struggle to remain profitable, increasing the cost of “labor” is problematic. The cost of a “union shop” costs nearly 1/3rd more to operate than a “non-union” shop.

“Research indicates that the cost of running a unionized operation is 25% to 35% greater than for a non-unionized one, and this figure does not reflect any negotiated changes in unionized employee wages or benefits.

The administrative budgets of the unionized plants were 30% higher. In addition to obvious increased costs, there are those that affect morale, creativity, and resiliency. Ultimately, an organization’s profit margin can decline. Productivity appears to be lower in unionized environments.” – Adams, Nash, Haskell & Sheridan

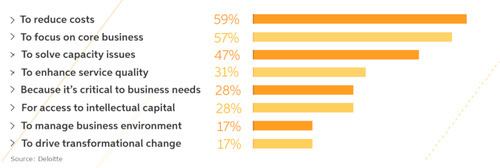

Increased costs of labor are the primary reason why companies look to “offshore.” To wit:

“The two main reasons that organizations decide to outsource are to reduce costs and to have the ability to focus on core business goals and planning. But the research shows a shift in industry thinking. Outsourcing is not just about saving money anymore. It’s seen as a critical tool in innovation.” – Deloitte

Of course, the companies that are outsourcing labor are the industries with the highest wage-paying jobs.

“The primary industries for outsourcing are Consumer & Industrial Products, Financial Services, Life Sciences & Healthcare, and Technology, Media & Telecomm. There has also been a growing increase in outsourcing from industries such as Real Estate, Facilities Management and Procurement.”

That leaves the lower-wage paying jobs in the U.S. which are being automated to further save costs.

The Carrier Reality

A great example of trying to “onshore” jobs came during the early days of the Trump administration.

Pay attention to the details.

The deal made with Carrier Industries, which makes heating, air conditioning, and refrigerator parts, meant roughly 1,000 workers would keep their jobs in Indiana. However, in exchange for keeping those jobs in Indiana, Carrier received $7 million in tax credits and other incentives which fell to the taxpayers of Indiana. Carrier also invested $16 million in its Indianapolis plant.

According to Carrier, they would have saved $65 million a year by moving operations to Mexico.

So, how do tax credits and company investment of $16 million equalize the disparity of costs?

For that answer let’s go to an interview with Greg Hayes, the CEO of Carrier: (Transcript courtesy of Business Insider)

JIM CRAMER: What’s good about Mexico? What’s good about going there? And obviously what’s good about staying here?

GREG HAYES: So what’s good about Mexico? We have a very talented workforce in Mexico. Wages are obviously significantly lower. About 80% lower on average. But absenteeism runs about 1%. Turnover runs about 2%. Very, very dedicated workforce.

JIM CRAMER: Versus America? Much higher.

GREG HAYES: Much higher. And I think that’s just part of these — the jobs, again, are not jobs on an assembly line that people really find all that attractive over the long term. Now I’ve got some very long service employees who do a wonderful job for us. And we like the fact that they’re dedicated to UTC, but I would tell you the key here, Jim, is not to be trained for the job today. Our focus is how do you train people for the jobs of tomorrow?

Entitlement Is A Problem

While foreign countries have cheaper labor (not demanding $15/hr) they also have a more dedicated workforce. To wit:

GREG HAYES: The assembly lines in Indiana — I mean, great people, great people. But the skill set to do those jobs is very different than what it takes to assemble a jet engine.

There are several problems that should be readily evident with American workers:

-

We believe we are entitled to higher wages, benefits, time off, support, bonuses, health care, etc.

-

Our skill set, and dedication to the job, lags that of other countries.

-

We now believe “blue-collar” work is degrading.

As we discussed in “The Adverse Consequences Of $15/min Wage:”

“Increasing the cost of employing low-wage workers generally leads employers to reduce the size of their workforce. The effects on employment cause changes in prices and different labor and capital types.

By boosting the income of low-wage workers who keep their jobs, a higher minimum wage raises their families’ real income, lifting some families out of poverty. However, real income falls for some families because other workers lose their jobs, business owners lose income, and prices increase for consumers.

Higher wages increase the cost to employers of producing goods and services. The employers pass some of those increased costs on to consumers in the form of higher prices. Those higher prices, in turn, lead consumers to purchase fewer goods and services. The employers consequently produce fewer goods and services, reducing their employment of low-wage and higher-wage workers.”

Here is the most important point:

“When the cost of employing low-wage workers goes up, the relative cost of hiring higher-wage workers or investing in machines and technology goes down.”

While U.S. workers believe they are entitled to higher wages, employment is ultimately driven by competition, costs, and relative skills.

Yellen’s Prescription Won’t Work

So, as I asked earlier, how do you equalize the cost of saving $65 million annually by moving a plant to Mexico in exchange for $7 million in one-time tax credit and incentives?

That is where the $16 million investment came in.

In order to justify keeping the Indiana plant open, the company injected $16 million to drive down the cost of production and reduce the operating gap between the US and Mexico.

GREG HAYES: Right. Well, and again, if you think about what we talked about last week, we’re going to make a $16 million investment in that factory in Indianapolis to automate to drive the cost down so that we can continue to be competitive. Now is it as cheap as moving to Mexico with a lower cost of labor? No. But we will make that plant competitive just because we’ll make the capital investments there.

JIM CRAMER: Right.

GREG HAYES: But what that ultimately means is there will be fewer jobs.

While the idea of higher corporate taxes and unionization sounds great in theory, businesses operate from a position of profitability.

However, Yellen’s prescription of unionization and taxes won’t reduce the employment, wage, or wealth gap. Instead, those policies will only create incentives for businesses to fight back by passing on costs, reducing labor, increasing automation, and offshoring labor.

Tyler Durden

Fri, 06/04/2021 – 09:51

via ZeroHedge News https://ift.tt/3yZYcwB Tyler Durden