Speculators Boost Bullish Bets On Corn Amid Hot, Dry Conditions

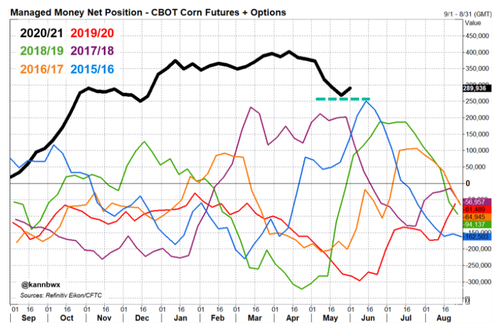

Reuters reports money managers boosted their net long position in Chicago Board of Trade (CBOT) corn futures and options last week after slumping to a five-month low. New weather models forecast hot and dry conditions in the Corn Belt to persist through mid-month.

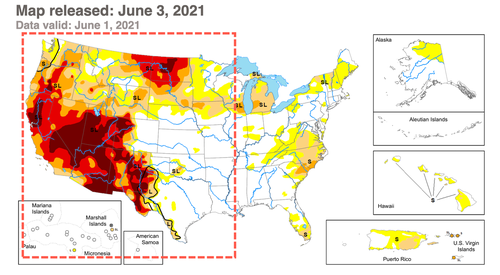

The western half of the US is facing a megadrought while a heat wave last week swept across the West Coast to East Coast by the weekend.

Weather conditions across the Corn Belt, a region of the Midwestern US, are forecasted to remain hot and dry through next week.

As a result, money managers increased their net long position in CBOT corn futures and options in the week ended June 1 to 289,936 contracts. The increase comes as bullish bets on grain slumped since early April after a meteoric rise since last summer.

Last week was money managers’ first net buying week in corn in seven weeks. Most-active July futures rose 11%, and December contracts rose increased by 12%. The surge was somewhat hampered by rumors China’s purchases of US farm goods would lapse. However, on Monday morning, corn futures are up more than 2%.

Money managers are also betting on the ethanol industry as the Biden administration’s climate plan calls for renewable fuels to play a much more significant role in reducing emissions. The industry has produced over 1 million barrels per day of corn-based biofuel in the last three weeks, nearing levels not seen since pre-pandemic days.

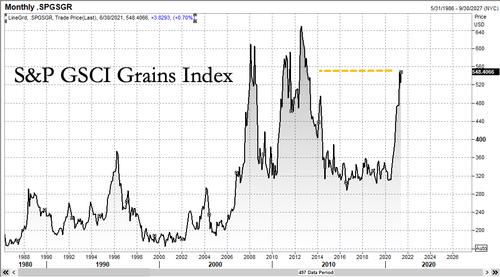

S&P GSCI Grains Index has been on a tear since last summer, hitting levels last month not seen since 2013 on increasing China demand for corn.

The bad news is that food inflation is rising to a decade high.

Back in December, SocGen’s resident market skeptic Albert Edwards shared with the world why he is starting to panic about soaring food prices. And since that was before food prices erupted amid broken supply chains, trillions in fiscal stimulus, and exploding commodity costs, all we can imagine today is more and more disposable income by working-poor is being used to feed their families. Somehow, the Federal Reserve doesn’t see a problem here…

A United Nations index of world food costs climbed for a 12th straight month in May, its longest stretch in a decade, rising to the highest in almost a decade, heightening concerns over bulging grocery bills.

With speculators boosting bullish bets on corn amid arid weather conditions in the Corn Belt, prices may continue to trend higher, worsening the food inflation crisis.

Tyler Durden

Mon, 06/07/2021 – 12:16

via ZeroHedge News https://ift.tt/3gea7yk Tyler Durden