Crypto Carnages Wipes $1 Trillion In Wealth As Transactions Tumble To 3-Year Lows

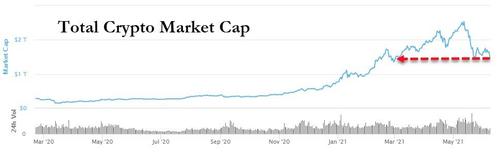

The total market capitalization of Cryptocurrencies has collapsed from over $2.5 trillion in mid-May to below $1.5 trillion this morning as losses re-accelerate overnight…

That is the lowest level since March with Bitcoin’s dominance having fallen back to around 40%, as Ethereum’s share of the space up to just below 20%…

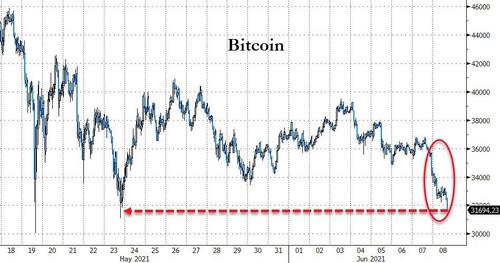

Bitcoin is back to a $31k handle…

Source: Bloomberg

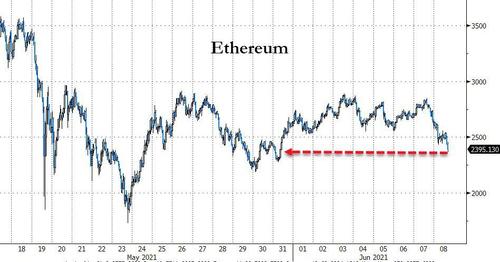

Ethereum is also lower, back below $2400…

Source: Bloomberg

The recent slump also coincides with a marked decline in the number of transactions flowing through the Bitcoin blockchain. On May 30, the number of daily Bitcoin transactions dipped as low as 175,000 — a near three-year low that stretches back to September 2018, according to data from BitInfoCharts.

The catalyst for the latest leg lower are likely manifold as the mainstream media grab hold of government-delivered narratives on the risks/fraud involved, and as Decrypto.co’s Liam Kelly writes, reports that The Department of Justice (DoJ) announced that they had recouped $2.3 million of said funds after “following the money,” has sparked widespread fears the network had been hacked.

Though it was initially reported that attackers’ Bitcoin wallet had been “hacked,” this was likely not the case.

Instead, an affidavit from the Federal Bureau of Investigation (FBI) suggests that authorities were able to trace the ransomed Bitcoin using a block explorer to a specific address containing 63.7 Bitcoin.

They then seized control of the private key linked to this address, thus accessing the ransomed Bitcoin.

Users need both the private and the public keys for a Bitcoin address to access the funds. Both keys are a string of words and numbers. Matching the correct private key with the corresponding public key allows users to take control over that Bitcoin.

Without these keys, it is near impossible to access funds due to the level of encryption used.

It is far more likely that authorities could either match the address in question with a specific identity, or the address was linked to a U.S.-based crypto service, such as an exchange or other custodian.

An assistant special agent who participated in the case, Elvis Chen, said, however, that he didn’t “want to give up our tradecraft in case we want to use this [method] again for future endeavors.”

Still, it would appear that the market is trading as if the Bitcoin network has indeed been hacked, with the top cryptocurrency’s price tumbling.

Tyler Durden

Tue, 06/08/2021 – 10:37

via ZeroHedge News https://ift.tt/3wXClEm Tyler Durden