“It’s Coming!”

Authored by Sven Henrich via NorthmanTrader.com,

Bored by the benign chop in markets drifting ever closer to all time highs again? With almost programmed certainty new highs are coming every month after all. New highs Fed balance sheet, new highs $SPX. Every month since November. Tit for tat.

While volatility is found in the chase of meme stocks from $CME, to $AMC to now Clover Health the broader market is barely moving intra-day and the occasional dips are ferociously saved and bought followed by hours of tight range chop action:

With most market gains entirely driven by overnight gap ups:

No, it’s all rather mundane action ahead of this week’s closely watched CPI print and next week’s quad witch OPEX and the Fed meeting.

New highs are very possible and consistent with the backtest scenario described in The Trap and even with the emergent divergence in Transports.

However, new highs or not, one of our favorite charts to track is again warning of the coming end to the calm. The $VIX has again compressed into a tightening pattern that is foreboding a coming end to the low volatility regime:

This chart suggests remaining risk lower into filling the open gap from April still, but the pattern is tightening and looks to come to a resolution at any moment between now and in the next week.

This smaller pattern suggests room for a $VIX breakout into the low to high 20s.

The longer term structures continue building for a much larger move still to come in the future:

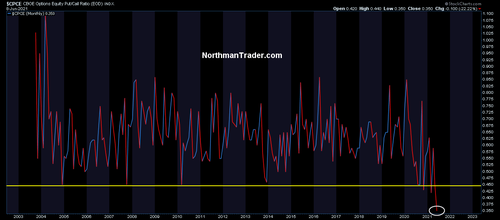

It’s all part and parcel for a market that continues to live off excessive liquidity and extreme complacency:

The main message: New highs or not, volatility, it’s coming. At least for a while.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Tyler Durden

Wed, 06/09/2021 – 12:45

via ZeroHedge News https://ift.tt/2RHoq6q Tyler Durden