9 Million Workers Return To The Labor Force In September: What Happens To Wages Then

While Goldman has been largely dismissive of inflation so far, the bank recently highlighted three key inflation risks that it would take seriously if they emerged, namely, more aggressive increases in wage growth, shelter inflation, and inflation expectations than the bank has already assumed in our forecasts. These risks, Goldman notes, rather than temporary reopening effects on prices, “are the ones that would matter beyond this year and will ultimately be most relevant for monetary policy.”

In a note published overnight by Goldman’s chief economist Jan Hatzius, he points to Goldman’s forward-looking wage survey leading indicator, which measures business and household expectations of future wage growth, which has picked up to 3.5% and notes that while “these are firmer numbers than usually seen when the economy is just emerging from a recession, but they are still consistent with trend unit labor cost growth of 2% or less.”

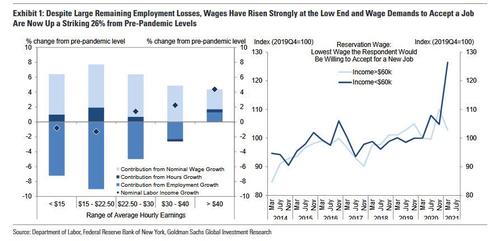

However, in a potential red-light, Hatzius concedes that wages for lower-paid workers have risen more sharply, especially in recent months, amidst widespread reports of worker shortages: specifically, wages for lower-wage groups have grown 6% since the pandemic began, despite large remaining employment losses and in contrast to tepid wage pressures at the top

On one hand, this is to be expected: Goldman explains that low-end wages are always the most responsive to labor market conditions, and that staggered state and local minimum wage hikes across the US have provided a strong boost to wage grow that the bottom over the last few years. On the other hand, even Hatzius admits that “the latest signs of strength at the low end are striking: production and non-supervisory wages in the leisure and hospitality sector are already up 8.25% this year, research from the Atlanta Fed shows that wage increases have been particularly strong for newly hired workers in low-wage services jobs, and a New York Fed survey reports that workers with usual earnings below $60,000 per year say they would need a wage 26% higher than they required before the pandemic to accept a job.”

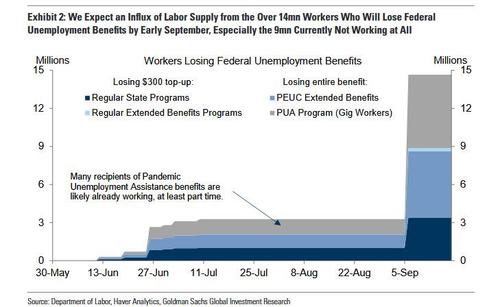

Of course, it has long been argued that many of these lower wages (and expectations) will resent sharply in September when extended unemployment insurance benefit expire, and Goldman predictably expects said expiration and further normalization of post-pandemic life to substantially increase effective labor supply incoming months (i.e., lower pay), to wit:

By early September, we expect roughly 3.5 million workers to lose their $300 weekly federal top-up, over 5 million workers to lose their Pandemic Emergency Unemployment Compensation (PEUC) extended duration benefits entirely, and nearly 6 million to lose their Pandemic Unemployment Assistance (PUA) program benefits.

While many recipients of PUA benefits are likely already working to some degree – which is permitted by program rules – most of the other 9 million will probably need to find jobs.

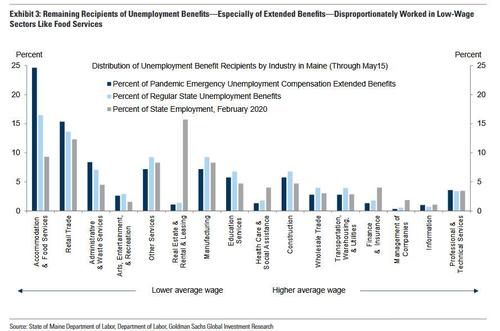

Drilling down further into claimants data shows that a disproportionate share of remaining benefit recipients previously worked in lower-wage sectors. These sectors, especially accommodation and food services, account for an even larger share of PEUC recipients in Maine, the one state for which sector-level PEUC data are available.

This is intuitive, both because those lower-wage service sectors remain more depressed on average, and because unemployment benefits represent a larger share of normal wages for low-paid workers, who therefore have had less incentive to look for a job. We But come September, Goldman expects renewed job search by this pool of workers to throw cold water on the hotter low-paid end of the labor market and dampen current wage pressures there.

And yet… what if the strong wage growth at the low end seen in the last few months persists for longer than conventional wisdom (and Goldman) expect? As noted above, this would be one of the red-lines Goldman listed as catalyzed non-transitory inflation.

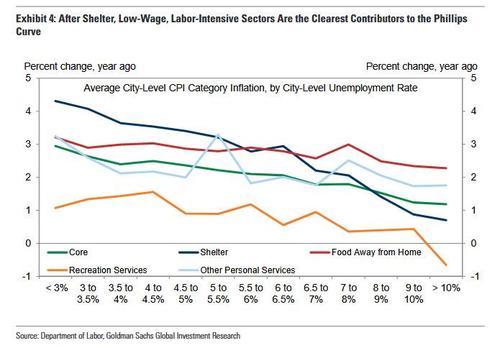

To answer this question, Goldman notes that academic studies of the impact of minimum wage hikes have found that sectors that use low-wage labor intensively pass roughly all of their labor costs—which are about30-50% of total costs at restaurants and other businesses that disproportionately employ low-wage workers—on to prices. That finding is roughly consistent with Goldman’s own rule of thumb that a 1% increase in overall wage growth flows through to a 0.25% increase in inflation the same year and a 0.15% increase the next year.

These low-wage sectors are especially interesting also because they are the second clearest contributors to the Phillips curve after shelter where as noted yesterday, there is already a dramatic acceleration.

In that context, price categories like food services are the canary in the coal mine of wage-push inflation and the key cyclical wild card in Goldman’s inflation forecast.

The bottom line: the inflation impact of stronger low-end wage growth depends on how widespread it is. So when using an estimate of the impact on food services inflation as a lower bound, and an estimate based on earnings of all workers in the bottom third from the Occupational Employment Statistics as the upper bound, Goldman estimates that 1% of outperformance in low-end wage growth boosts core inflation by 5-15 bps, a moderate effect that reflects the lower weight of low-paid workers in total costs.

Tyler Durden

Thu, 07/01/2021 – 15:24

via ZeroHedge News https://ift.tt/3qDv9Lu Tyler Durden