Key Events This Week: ISM, FOMC Minutes And Jobless Claims

The week after payrolls is relatively quiet for newsflow but given the first Friday of the month was so early we have PMIs/ISM from the service sector to look forward to today and tomorrow, ahead of next week’s start of Q2 earnings season. Outside of that, DB’s Jim Reid notes that the main event of the week will be the release of the last FOMC minutes (Wednesday) given the surprise move at the meeting. Elsewhere a gathering of G20 finance ministers and central bank governors (Friday) will be interesting, especially after the news that 130 countries had signed up to the minimum tax agreement last week. Finally the development of the delta variant is never going to be too far from the top of the headlines. It has certainly put a dampener on the reopening trade for now. The U.K. is at the top of the global charts for new cases again, yet it seems to be powering ahead towards a full reopening two weeks today. So this is going to be an enormous test case as to whether heavily vaccinated countries can live with the virus.

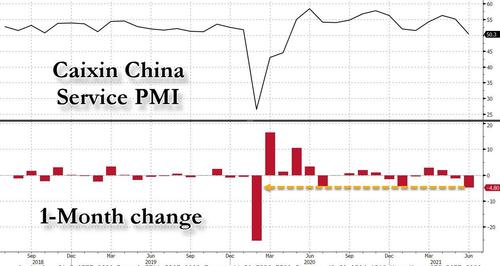

Going through some of the week’s main event highlights, first we have the release of the global services and composite PMIs today and tomorrow. The flash readings we’ve already had were pretty strong, with the Euro Area composite PMI at a 15-year high of 59.2, while the US number came in at 63.9. Overnight, as discussed earlier, China’s Caixin June services PMI came in at 50.3 (vs. 54.9 expected and 55.1 last month), the lowest level since April 2020 and on the verge of contraction.

On prices, the statement along with the release added that “Prices in the service sector were stable, as inflationary pressure eased. High commodity and labor prices continued to push up costs for services companies, but the growth of input prices slowed.” Japan’s final services PMI came in at 48.0 vs. 47.2 in flash.

Also in focus will be the ISM Services index from the US, after the ISM manufacturing reading last Thursday saw the employment index move below 50 for the first time since November. And on top of that, the prices paid measure hit its highest since 1979, so we can expect there to be continued focus on signs of inflationary pressures. On employment, it’ll be worth looking out for the latest US JOLTS data for May on Wednesday will also be closely watched as this has shown a much healthier labor market than payrolls of late.

The main highlight outside of data will be the release of the FOMC minutes from their June meeting on Wednesday. That has the potential to shed further light on the hawkish shift that saw the median dot move to project two rate hikes in 2023, up from zero back in March. All signs of how the committee felt about the taper will also be devoured but we have heard from several members on this topic since the FOMC. Otherwise, there’ll be a few speakers to look forward to, including ECB President Lagarde and Bank of England Governor Bailey. In terms of monetary policy decisions however, the only G20 decision scheduled for this week is from the Reserve Bank of Australia (Tuesday), where the consensus expectation is that they’ll keep their cash rate target unchanged at 0.10%.

The G20 finance ministers and central bank governors meeting on Friday, which is taking place in Venice, will be interesting to see if there’s any discussion on the ongoing OECD negotiations on reforming the global corporate tax system, which, it was announced, 130 countries and jurisdictions have now signed on to. The main changes would see companies pay more taxes in the jurisdictions they operate in, including digital companies, and also a global minimum corporate tax rate.

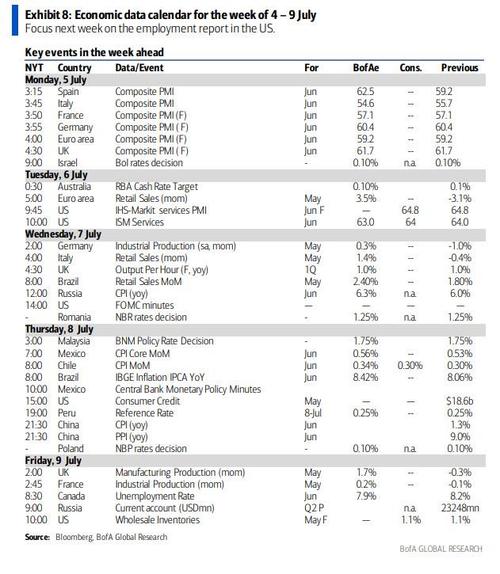

Below is a visual summary of the week’s key global events:

Courtesy of DB, here is a day-by-day calendar of events

Monday July 5

- Data: June services and composite PMIs from Australia, Japan, China, India, Italy, France, Germany, Euro Area, UK and Brazil, UK June new car registrations

- Central Banks: ECB’s Vice President de Guindos speaks

- Other: US markets closed for Independence Day holiday

Tuesday July 6

- Data: Germany May factory orders, July ZEW survey, UK and Germany June construction PMI, Euro Area May retail sales, US June services and composite PMI, ISM services index

- Central Banks: Reserve Bank of Australia monetary policy decision, ECB’s Hernandez de Cos speaks

Wednesday July 7

- Data: Japan preliminary May leading index, Germany May industrial production, Italy May retail sales, US June JOLTS job openings

- Central Banks: Federal Reserve release June FOMC minutes, Fed’s Bostic speaks

- Other: European Commission publishes latest economic forecasts

Thursday July 8

- Data: Japan May current account balance, Germany May trade balance, US weekly initial jobless claims, May consumer credit

Friday July 9

- Data: China June CPI, PPI, UK May GDP, France May industrial production, Italy May industrial production, US final May wholesale inventories

- Central Banks: ECB President Lagarde and BoE Governor Bailey speak

- Other: G20 finance ministers and central bank governors meet in Venice

Finally, looking at just the US, Goldma notes that the key economic data releases this week are the ISM services report on Tuesday and the jobless claims report on Thursday. There are no speaking engagements from Fed officials this week.

Monday, July 5

- US Independence Day holiday observed. There are no major economic data releases scheduled. NYSE will be closed. SIFMA recommends bond markets also close.

Tuesday, July 6

- 09:45 AM Markit services PMI, June final (consensus 64.8, last 64.8)

- 10:00 AM ISM services index, June (GS 62.5, consensus 63.5, last 64.0): We estimate that the ISM services index retrenched 1.5pt to 62.5 in June, reflecting normalization from an elevated level and a waning sequential boost from the spring stimulus checks. Our services tracker rose 0.6pt to 62.8.

Wednesday, July 7

- 10:00 AM JOLTS Job Openings, May (consensus 9,313k, last 9,286k)

- 02:00 PM Minutes from the June 15–16 FOMC meeting: At its June meeting, the FOMC left the funds rate target range unchanged at 0–0.25%, as widely expected. The June FOMC statement noted that the economy had strengthened due to progress on vaccinations, strong policy support, and improvement in the sectors most adversely affected by the pandemic. In the Summary of Economic Projections, the median participant projected two rate hikes and a 3.5% unemployment rate and 2.1% core PCE inflation for the end of 2023.

Thursday, July 8

- 08:30 AM Initial jobless claims, week ended July 3 (GS 360k, consensus 350k, last 364k); Continuing jobless claims, week ended June 26 (consensus 3,325k, last 3,469k): We estimate initial jobless claims decreased to 360k in the week ended July 3.

Friday, July 9

- 10:00 AM Wholesale inventories, May final (consensus +1.1%, last +1.1%)

Source: DB, BofA, Goldman

Tyler Durden

Mon, 07/05/2021 – 10:35

via ZeroHedge News https://ift.tt/3yp2xbM Tyler Durden